The cryptocurrency market is abuzz with anticipation as investors eagerly await the latest news on XRP ETF approval from regulatory authorities. Following the successful launches of Bitcoin and Ethereum ETFs, XRP has emerged as the next potential candidate for Exchange-Traded Fund approval, promising to revolutionize institutional access to Ripple’s digital asset. Recent developments in the XRP vs. SEC lawsuit resolution and growing institutional interest have positioned XRP as a prime contender for ETF status in 2025.

The journey toward XRP ETF approval has been marked by regulatory uncertainties, legal battles, and shifting market dynamics. However, recent positive developments, including Ripple’s partial victory against the SEC and increasing institutional adoption of XRP for cross-border payments, have renewed optimism among investors and analysts. This comprehensive analysis examines the latest developments, regulatory landscape, and potential market implications of an XRP ETF approval.

Understanding the significance of XRP ETF approval latest news requires examining the broader context of cryptocurrency ETF evolution, regulatory frameworks, and XRP’s unique position in the digital asset ecosystem. As we navigate through 2025, the convergence of favorable regulatory sentiment, institutional demand, and XRP’s proven utility in financial services creates a compelling case for ETF consideration.

Current XRP ETF Approval Status and Recent Developments

Regulatory Landscape Updates

The regulatory environment surrounding XRP has experienced significant transformation following key developments in the SEC lawsuit. Recent statements from financial regulators suggest a more favorable stance toward XRP’s classification and potential ETF structures. The Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) have begun clarifying their positions on XRP’s regulatory status, creating a more straightforward pathway for ETF applications.

Bloomberg Intelligence analysts have indicated that XRP ETF applications could emerge as early as Q2 2025, contingent on final regulatory clarity. The recent precedent set by the approvals of Bitcoin and Ethereum ETFs has established operational frameworks that could be adapted for XRP ETF structures, thereby reducing regulatory barriers and approval timelines.

Financial institutions have been actively engaging with regulatory bodies to understand compliance requirements for XRP ETF products. These preliminary discussions suggest that prominent asset managers are preparing comprehensive ETF proposals that address regulatory concerns while maximizing investor accessibility.

Major Players and ETF Applications

Several prominent financial institutions have expressed interest in launching XRP ETF products. Asset management giants, including BlackRock, Fidelity, and Grayscale, have been monitoring XRP’s regulatory progress and evaluating potential ETF structures. While no formal applications have been submitted, industry sources suggest that preliminary preparations are underway.

The success of existing cryptocurrency ETFs has demonstrated significant investor demand for regulated exposure to cryptocurrencies. Bitcoin ETFs have attracted billions of dollars in assets under management, while Ethereum ETFs have shown consistent growth despite market volatility. This track record strengthens the investment thesis for XRP ETF products.

Investment banks have begun developing research frameworks for XRP ETF analysis, indicating institutional recognition of XRP’s potential as an investable asset class. These developments suggest that formal ETF applications could emerge once regulatory clarity is achieved.

XRP ETF Approval Latest News, Market Impact Analysis, Price Implications, and Investor Sentiment

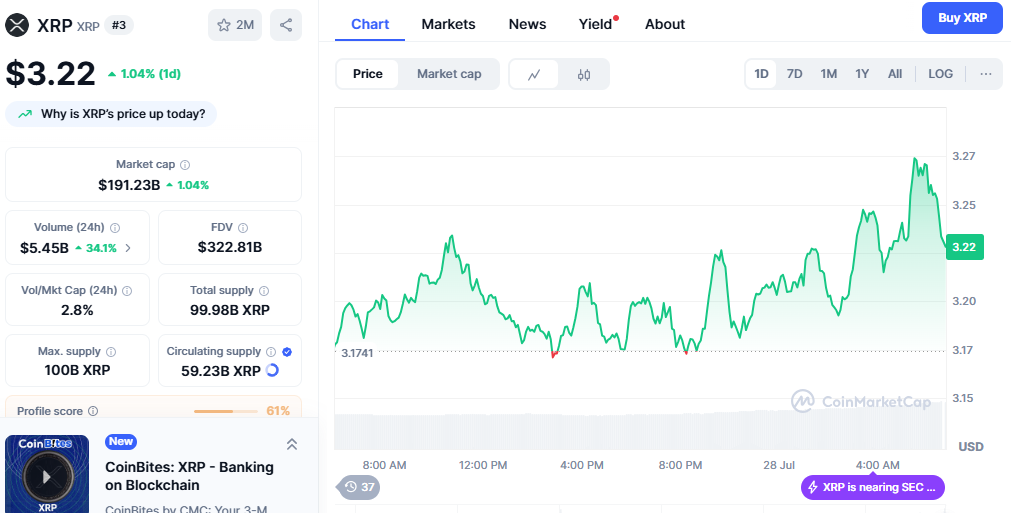

Historical analysis of cryptocurrency ETF approvals reveals significant price appreciation preceding and following regulatory approval. Bitcoin experienced substantial gains during its ETF approval process, while Ethereum demonstrated similar patterns. XRP’s price movement in anticipation of ETF approval has shown increased volatility and trading volume, indicating heightened investor interest.

Market analysts project that XRP ETF approval could drive substantial institutional capital inflows, potentially pushing XRP’s market capitalization beyond current levels. Conservative estimates suggest that ETF approval could increase XRP’s price by 50-100% within the first year of trading, based on comparable performance metrics of other cryptocurrency ETFs.

Institutional adoption through ETF vehicles could reduce XRP’s price volatility by introducing long-term investment strategies and dampening speculative trading activities. This stabilization effect has been observed in the Bitcoin and Ethereum markets following the launches of ETFs.

Institutional Investment Trends

The demand for cryptocurrency exposure through traditional investment vehicles continues to grow among institutional investors. Pension funds, endowments, and insurance companies have expressed interest in regulated cryptocurrency products that align with their fiduciary responsibilities and compliance requirements.

XRP’s utility in cross-border payments, combined with its partnerships with major financial institutions, positions it favorably for institutional adoption. Unlike purely speculative cryptocurrencies, XRP’s real-world utility provides fundamental value propositions that resonate with institutional investment committees.

Recent surveys indicate that 60% of institutional investors would consider XRP exposure through ETF products, compared to only 25% who would invest directly in XRP tokens. This preference gap highlights the importance of ETF approval for unlocking institutional capital.

Technical Requirements and ETF Structure Considerations

Custody and Security Infrastructure

XRP ETF implementation requires robust custody solutions that meet institutional-grade security standards. Primary cryptocurrency custodians, including Coinbase Custody, BitGo, and Fidelity Digital Assets, have developed infrastructure capable of supporting XRP ETF operations. These platforms provide multi-signature security, insurance coverage, and regulatory compliance frameworks necessary for ETF management.

The XRP Ledger’s native security features, including its consensus mechanism and built-in escrow functionality, provide an additional layer of security that differentiates it from other cryptocurrencies. These technical advantages could simplify ETF implementation and reduce operational risks for fund managers.

Settlement and clearing processes for XRP transactions occur significantly faster than those for traditional cryptocurrencies, with finality times of 3-5 seconds. This efficiency advantage could reduce operational complexities and costs associated with ETF management.

Liquidity and Market Making

XRP’s substantial trading volume and market depth across multiple exchanges provide sufficient liquidity to support ETF operations. Daily trading volumes exceeding $3 billion demonstrate robust market activity that can accommodate institutional-scale transactions without significant price impact.

Market makers specializing in cryptocurrency ETFs have developed sophisticated algorithms and trading strategies specifically for XRP markets. These capabilities ensure efficient creation and redemption processes that maintain ETF share prices closely aligned with underlying XRP valuations.

The global nature of XRP trading, with significant volume across Asian, European, and American markets, provides 24/7 liquidity that supports continuous ETF operations across different time zones.

Competitive Landscape and Market Positioning

Comparison with Existing Cryptocurrency ETFs

XRP ETF products would enter a competitive landscape dominated by Bitcoin and Ethereum ETFs. However, XRP’s unique value proposition as a bridge currency for cross-border payments differentiates it from purely store-of-value cryptocurrencies. This utility-focused positioning could attract investors seeking exposure to practical blockchain applications.

Fee structures for cryptocurrency ETFs typically range from 0.25% to 1.0% annually. XRP ETF sponsors will likely target competitive fee levels to attract assets while maintaining profitability. The operational efficiencies of XRP settlement could enable lower fee structures compared to other cryptocurrency ETFs.

Distribution strategies for XRP ETFs will leverage existing relationships between ETF sponsors and financial advisors, wealth management platforms, and institutional sales teams. The established infrastructure for cryptocurrency ETF distribution provides clear pathways for XRP ETF market entry.

Target Investor Demographics

XRP ETF products will likely appeal to several distinct investor segments. Conservative institutional investors seeking cryptocurrency exposure with regulatory clarity represent the primary target market. These investors prioritize compliance, transparency, and risk management over speculative returns.

Financial advisors managing client portfolios have expressed interest in allocating to cryptocurrency through regulated vehicles. XRP’s correlation patterns with traditional assets and other cryptocurrencies could provide portfolio diversification benefits that appeal to professional investment managers.

Retail investors seeking simple cryptocurrency exposure without the complexities of wallet management and private key security represent another significant market segment. ETF structures eliminate technical barriers while providing familiar investment experiences through traditional brokerage accounts.

Regulatory Challenges and Approval Timeline

SEC Review Process

The SEC’s review process for XRP ETF applications will likely follow established precedents from Bitcoin and Ethereum ETF approvals. Key evaluation criteria include market surveillance, custody arrangements, liquidity assessment, and investor protection measures. XRP’s regulatory clarity, following the resolution of the SEC lawsuit, addresses many concerns that previously complicated ETF considerations.

Public comment periods and stakeholder feedback will play essential roles in the approval process. Industry associations, investor advocacy groups, and regulatory experts will contribute perspectives that shape final approval decisions. The precedent of successful cryptocurrency ETF launches provides a favorable context for evaluating the XRP ETF.

Approval timelines typically range from 8 to 12 months following the initial application submission. However, the established regulatory framework for cryptocurrency ETFs could expedite the review processes for XRP ETFs. Industry experts estimate potential approval dates in late 2025 or early 2026, assuming favorable regulatory developments.

International Regulatory Considerations

XRP’s global usage in financial services creates international regulatory considerations for ETF approval. Coordination between U.S. regulators and international counterparts ensures consistent treatment across jurisdictions. The Financial Action Task Force (FATF) guidelines and international cryptocurrency regulations influence domestic ETF approval decisions.

European and Asian markets have demonstrated different approaches to cryptocurrency regulation and ETF approval. Understanding these variations helps predict potential challenges and opportunities for global XRP ETF expansion following U.S. approval.

Regulatory harmonization efforts aim to establish consistent frameworks that facilitate cross-border investment in cryptocurrency products. XRP’s compliance with multiple international regulatory standards positions it favorably for global ETF expansion.

Investment Strategies and Portfolio Considerations

Risk Assessment and Management

XRP ETF investments carry unique risk profiles that differ from direct cryptocurrency ownership and traditional ETF products. Volatility remains a primary concern; however, ETF structures may offer some stabilization through institutional investment patterns and professional management.

Regulatory risks persist despite improved clarity, as future policy changes could impact XRP’s classification and the operations of ETFs. Investors must consider potential regulatory shifts when evaluating long-term XRP ETF positions.

Correlation analysis reveals XRP’s relationships with other cryptocurrencies, traditional assets, and macroeconomic factors. Understanding these correlations enables investors to make informed allocation decisions and manage their portfolio risks effectively.

Portfolio Allocation Strategies

Financial advisors typically recommend cryptocurrency allocations ranging from 1% to 5% of a total portfolio value for most investors. XRP ETF products could align with these allocation targets, providing exposure to a utility-focused cryptocurrency with real-world applications.

Dollar-cost averaging strategies may prove effective for XRP ETF investments, given the volatility characteristics of cryptocurrency markets. Regular investment schedules can reduce timing risks while building positions over extended periods.

Rebalancing considerations become important as XRP ETF values fluctuate relative to other portfolio components. Systematic rebalancing approaches help maintain target allocations while potentially enhancing long-term returns.

Conclusion

The latest news on XRP ETF approval represents a pivotal moment in the evolution of the cryptocurrency market. Recent regulatory developments, institutional interest, and XRP’s proven utility in financial services create compelling conditions for ETF consideration. While challenges remain, the precedent set by the successful launches of Bitcoin and Ethereum ETFs provides a clear pathway for XRP ETF approval.

Investors interested in XRP exposure should closely monitor regulatory developments while considering the potential benefits and risks associated with ETF investment vehicles. The convergence of institutional demand, regulatory clarity, and XRP’s fundamental utility suggests that ETF approval could unlock significant value for the broader XRP ecosystem.