U.S. Fed Anticipates 0.25%: The latest inflation data from the United States places March 2025 inflation at 2.4%, higher than the Federal Reserve’s long-term target of 2% but lower than the Market expectations of 2.6%. This was a significant drop from February, which registered a rate of 3.1%. Hence, this could be a sign that inflation is slowing down. With the dawn of cooling inflation, speculation is emerging that the Fed may cut interest rates in the subsequent two meetings by 0.25% (or even 0.5%). U.S. Fed Anticipates 0.25% This potential cut would affect almost every market-the economy, the financial market, and even the crypto sector. In this article, we shall discuss:

- Why the Fed might cut rates

- How much of a reduction we can expect

- The potential impact on loans, savings, and investments

- The connection between Fed rates and inflation

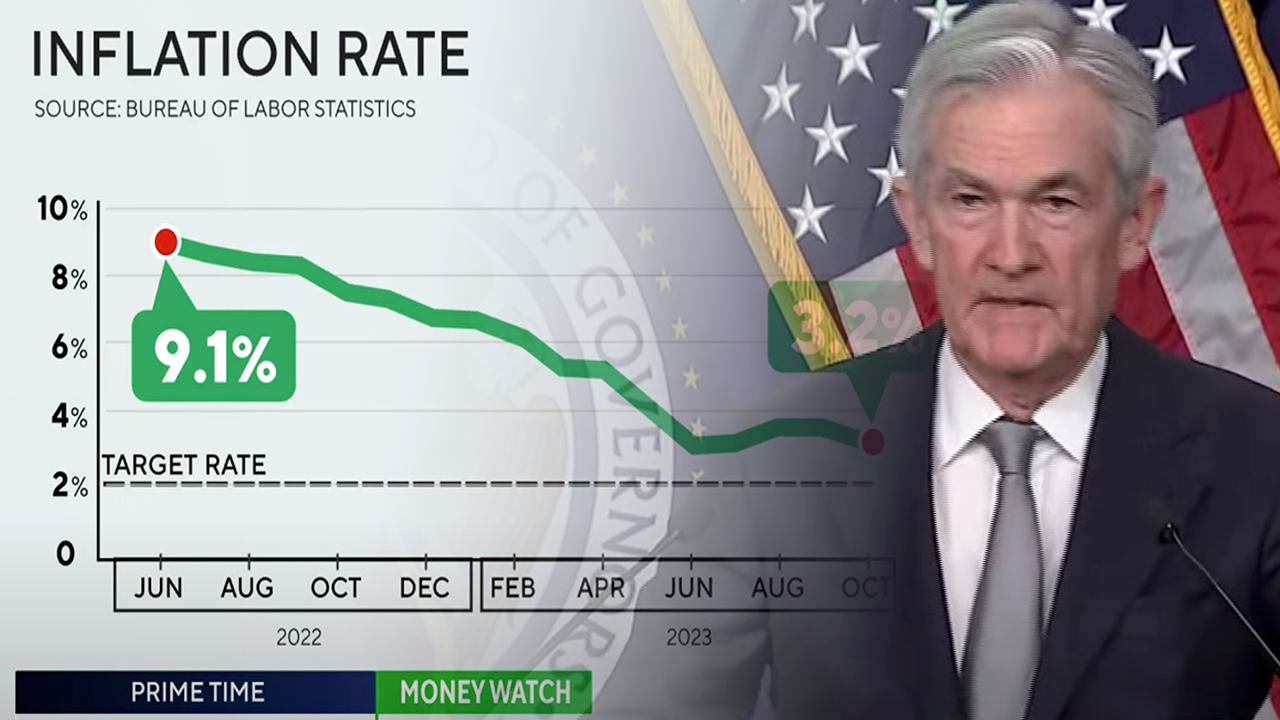

March Inflation Data: A Step Toward Rate Cuts?

The Consumer Price Index (CPI) for March 2025 has registered a year-on-year increase of 2.4%. This happened by falling from February’s rate of CPI with inflation at 3.1%. Such a decrease indicates that for the past two years, the Fed’s aggressive rate hikes have been finally successful in controlling inflation.

Why This Matters for Interest Rates

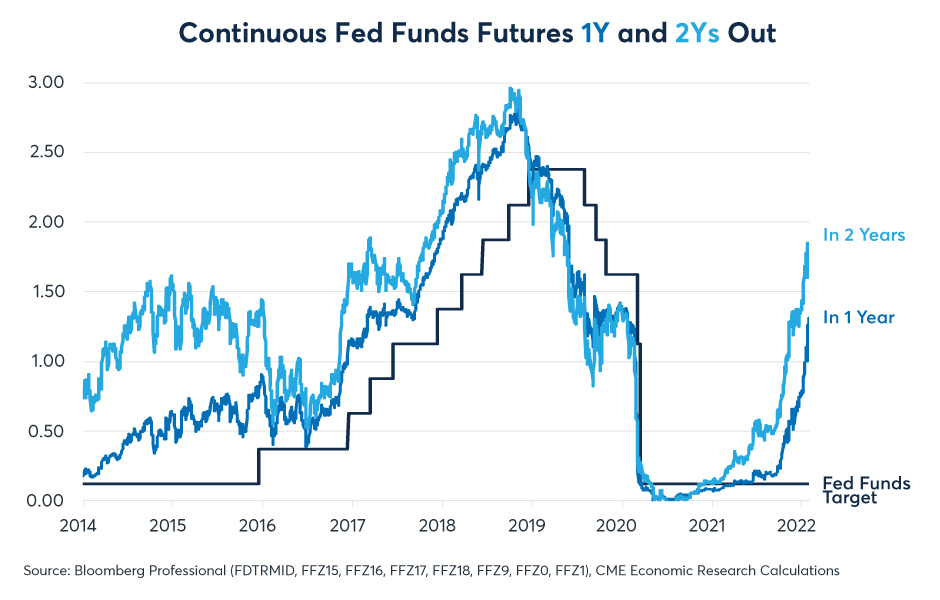

The Federal Reserve’s primary antiflationary weapon is manipulating the Federal Funds Rate. The Fed raises rates to dampen spending and borrowing when inflation is too high; conversely, it will lower rates when inflation is cool to stimulate growth. U.S. Fed Anticipates 0.25% now that inflation is closer to the 2% target, the Fed is moving into a position of influence on possible rate cuts.

Will the Fed Cut Rates in 2025?

Market Expectations

Financial markets are pricing in at least a 0.25% rate cut in the coming months, with some analysts predicting a 0.5% reduction if inflation continues to decline.

- Current Federal Funds Rate: 5.37% (range of 5.25%-5.5%)

- Expected New Rate After Cut: ~5.12% (range of 5%-5.25%)

Fed’s Quantitative Easing Hint

Another strong signal came from the Fed’s March 18-19 gathering, where policymakers indicated that QE might start in April 2025. By purchasing government bonds, QE injects money directly into the economy by the Fed and usually lowers borrowing costs while increasing liquidity. U.S. Fed Anticipates 0.25% This indicates that the Fed is preparing for the time when it will shift from fighting inflation to supporting the economy, making rate cuts very likely.

Impact of a Fed Rate Cut

1. Cheaper Loans, More Spending: U.S. Fed Anticipates 0.25%

A lower Federal Funds Rate means:

- Reduced mortgage rates (reasonable for homebuyers)

- Lower interest on car loans and credit cards

- Businesses can borrow at lower costs, boosting investments

2. Stock and Crypto Markets Could Surge: U.S. Fed Anticipates 0.25%

Historically, rate cuts lead to bullish trends in risk assets.

- Stocks: Companies benefit from lower borrowing costs, potentially driving a 10-20% market rally.

- Crypto: Bitcoin and Ethereum often rise when liquidity increases, as investors seek higher returns.

3. Weaker Savings Incentives: U.S. Fed Anticipates 0.25%

With lower interest rates:

- Savings accounts and bonds offer smaller returns

- Investors may shift to stocks, real estate, or crypto for better yields

4. Global Economic Boost Amid Trade Tensions

The U.S. is currently engaged in Trade conflicts with China and the EU. A rate cut could stimulate domestic demand, helping offset slowdowns in global trade U.S. Fed Anticipates 0.25%.

How Fed Rates Influence Inflation: U.S. Fed Anticipates 0.25%

Central banks like the Federal Reserve, ECB, and RBI use interest rates to control money supply:

Central banks like the Federal Reserve, ECB, and RBI use interest rates to control money supply:

- Rate Hikes → Less Money Circulating → Lower Inflation

- Loans become expensive, people save more, and spending slows.

- Rate Cuts → More Money in Economy → Higher Growth (But Risk of Inflation)

- Cheaper loans encourage spending and investment.

Inflation is targeted by the Fed to be at 0 to 2% for stability in the long term. The March inflation shows growth and price stability at a balance of 2.4%, making it viable for a rate decrease down the line.

Conclusion: U.S. Fed Anticipates 0.25%

The March inflation data suggests that the Fed’s tight monetary policy is working, and a 0.25% rate cut seems increasingly likely. If implemented, this could: However, the Fed will continue to tread lightly; cutting rates too soon could rekindle inflation, while tardy action may hinder recovery. Investors should look to forthcoming jobs reports, GDP growth, and inflation trends for additional signals. The information presented here is for educational purposes only and should not be misconstrued as financial advice. Always consult a financial advisor before making any investment decisions.