The STETHUSD pair bouncing 2.98% may look like a routine price move in a market known for volatility, but under the surface, it tells a bigger story: staking demand is rapidly reshaping Ethereum’s liquid staking market, and stETH is sitting at the center of that transformation. As the crypto ecosystem matures, investors increasingly want exposure to Ethereum’s staking rewards without sacrificing flexibility. That’s precisely the value proposition behind liquid staking and why stETH, the liquid staking token most commonly associated with Lido, remains one of the most influential assets in the DeFi landscape.

When traders monitor the STETHUSD price, they aren’t just watching speculation. They’re tracking a hybrid asset whose valuation reflects the market’s confidence in Ethereum staking yields, the health of decentralized finance liquidity, and the stability of the liquid staking mechanism itself. A 2.98% bounce isn’t simply “stETH went up.” It is often a sign that demand for staking exposure is accelerating, that liquidity conditions are improving, and that market participants are re-pricing the value of yield-bearing ETH derivatives.

The broader context is equally important. Ethereum’s shift to Proof-of-Stake turned staking into a foundational economic engine. But traditional staking locks capital, limiting investors who want to trade, hedge, or deploy their ETH into DeFi. Liquid staking solved this by turning staked ETH into a tradable token—most notably stETH, which represents staked ETH plus accrued rewards. As demand grows, so does the influence of STETHUSD on the entire Ethereum ecosystem.

In this article, we’ll explore why STETHUSD bounced 2.98%, what that means for Ethereum’s liquid staking market, and how rising staking demand could affect liquidity, yields, DeFi adoption, and price dynamics. We’ll also examine the Lido staking ecosystem, the role of stETH as a yield-bearing token, and where this market could be heading next.

Understanding STETHUSD and Why It Tracks More Than Price

The STETHUSD market refers to the trading pair between stETH and the US dollar (or USD-denominated stablecoin equivalents on exchanges). But unlike most crypto assets, stETH is not just a token with a narrative—it’s a yield-bearing representation of staked ETH. This makes the STETHUSD price a reflection of several layered factors, including Ethereum staking participation, validator rewards, and DeFi demand.

What Is stETH and How Does Liquid Staking Work?

stETH is a tokenized representation of ETH that has been staked through Lido, one of the largest liquid staking protocols. When users stake ETH via Lido, they receive stETH in return. The stETH token accrues staking rewards over time, meaning its balance grows relative to the original deposit through a rebasing mechanism. This design allows stakers to earn staking yield while still maintaining liquidity and the ability to deploy the token across DeFi applications.

Because of this, STETHUSD doesn’t behave like a simple spot market for ETH. It behaves like a market for ETH plus staking yield, influenced by staking demand, DeFi liquidity, and even investor preferences for passive income.

Why STETHUSD Can Trade at a Premium or Discount

A key element of the STETHUSD price is the relationship between stETH and ETH itself. In an ideal world, stETH would trade close to ETH because it represents staked ETH. However, depending on market conditions, stETH can trade at a slight premium or discount, influenced by liquidity constraints, redemption expectations, and risk sentiment.

When market confidence is high and staking demand is rising, traders often value stETH more strongly due to its yield component and DeFi utility. That can contribute to upside strength in STETHUSD. Conversely, during risk-off periods, stETH can experience sell pressure if investors prioritize liquidity and immediate conversion back into ETH, especially if exit paths are constrained.

That’s why a 2.98% bounce in STETHUSD is meaningful: it can indicate a shift in sentiment toward staking exposure and a renewed appetite for yield-driven assets.

Why STETHUSD Bounced 2.98%: The Staking Demand Effect

A 2.98% bounce may sound modest in crypto terms, but for STETHUSD it often signals strong underlying demand dynamics, especially when those dynamics are connected to Ethereum staking participation.

Increased Ethereum Staking Participation Drives stETH Demand

As more investors stake ETH, the demand for liquid staking derivatives rises. Traditional staking requires locking funds, which many investors avoid because it limits their ability to respond to market volatility. Liquid staking makes staking participation more attractive by removing that trade-off. This is why Ethereum staking demand has become one of the strongest structural forces supporting assets like stETH.

In practice, when staking demand increases, more ETH flows into liquid staking protocols, and more stETH is minted. This expands supply, but it also expands utility. If DeFi demand and trading appetite rise faster than supply expansion, the price can strengthen, contributing to an upward move in STETHUSD.

DeFi Liquidity Conditions Can Amplify STETHUSD Moves

The liquid staking market is deeply embedded in DeFi. stETH is widely used as collateral and a liquidity asset across lending protocols, decentralized exchanges, and yield strategies. When DeFi liquidity improves—often during broader market recoveries—demand for stETH rises because it provides both exposure to ETH and access to staking yield.

That’s why STETHUSD bounces can sometimes coincide with shifts in DeFi lending rates, liquidity incentives, and overall risk sentiment. Traders often see stETH as a “productive ETH” position, especially when yield matters again.

Yield Expectations and Risk Premiums Affect Price

Another powerful catalyst behind the STETHUSD bounce is yield expectations. If staking rewards are attractive relative to perceived risk, investors may rotate into liquid staking tokens. In a market where idle assets feel costly, the appeal of yield-bearing instruments grows.

When this happens, stETH becomes more desirable not only for long-term holders but also for DeFi participants seeking capital efficiency. That combination of demand can support upward price movement and reduce discount pressure.

How Liquid Staking Is Reshaping Ethereum’s Market Structure

Ethereum’s shift to Proof-of-Stake didn’t just change consensus—it changed market structure. Staking is now a central economic activity, and liquid staking has become one of the most important mechanisms connecting Ethereum’s base layer to DeFi.

Liquid Staking Makes ETH More Productive

One of the biggest impacts of liquid staking is that it turns ETH into a capital-efficient asset. Instead of staking ETH and leaving it idle, investors can stake ETH, receive stETH, and then use that stETH across DeFi. This creates a powerful loop: staking increases security and yields, while DeFi usage increases liquidity and innovation.

This “double utility” is why liquid staking is often viewed as a major evolution in Ethereum’s financial architecture. The STETHUSD market becomes a key indicator of how much traders value this productivity.

stETH’s Role in DeFi Collateral and Lending

In many DeFi protocols, stETH is accepted as collateral, allowing users to borrow stablecoins or other assets while continuing to earn staking yield. This is a major driver of demand, because it enables leverage and liquidity without sacrificing staking rewards.

This is where LSI keywords and related phrases matter: liquid staking derivative, staking rewards, DeFi collateral, yield-bearing token, and Ethereum staking yield all describe why stETH is widely used. As these use cases expand, the importance of STETHUSD grows too, because its price reflects the market’s confidence in this collateral system.

Competition in the Liquid Staking Market Is Increasing

While Lido’s stETH remains dominant, the broader Ethereum liquid staking market is increasingly competitive. New protocols are focusing on decentralization, alternative mechanisms, and improved redemption structures. This competition can influence stETH’s market share, liquidity dynamics, and future demand.

However, dominance is not just about share. It’s also about trust and integration. stETH’s deep DeFi integrations make it a cornerstone asset, and that established position can be a strong support factor behind price resilience such as a 2.98% bounce.

The Relationship Between STETHUSD and ETH: Correlation With a Twist

Although STETHUSD is closely tied to ETH, it behaves differently due to its staking yield and liquidity characteristics.

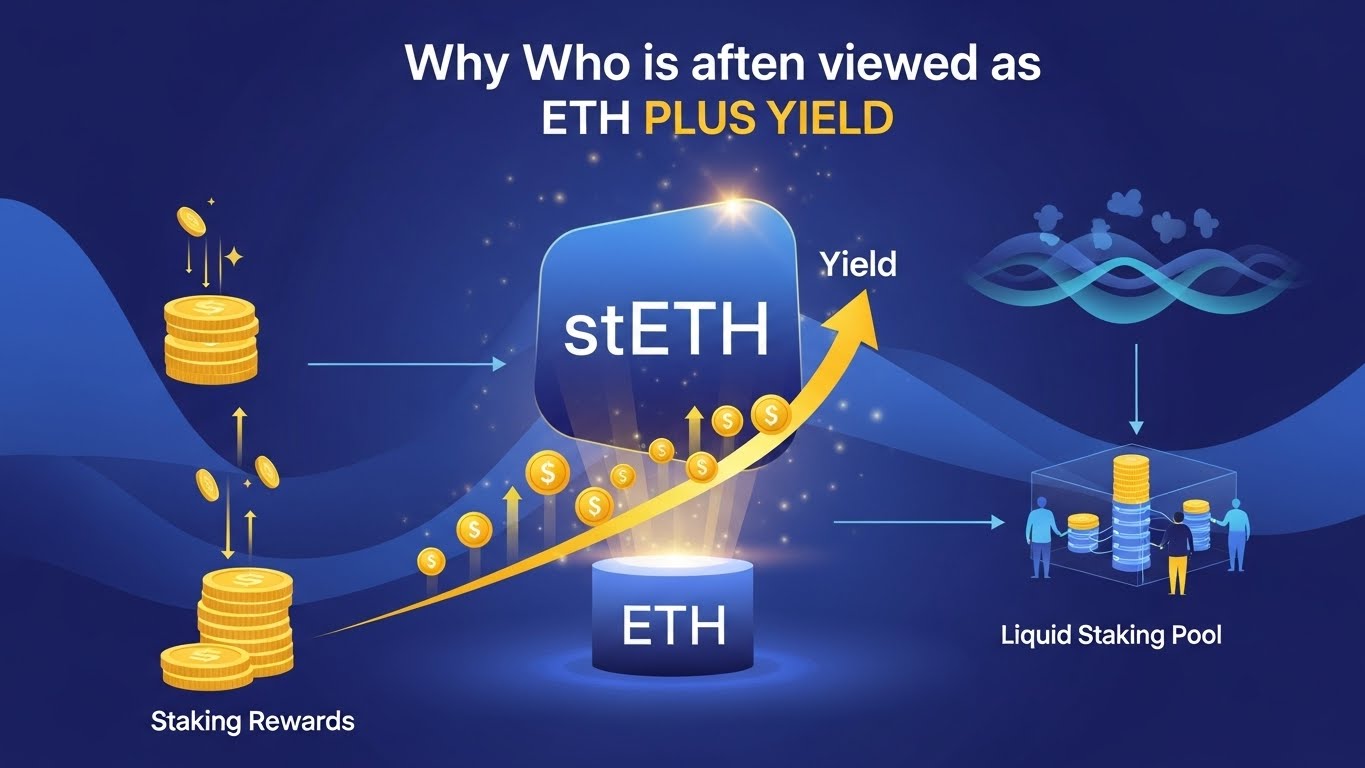

Why stETH Is Often Viewed as “ETH Plus Yield”

When traders buy stETH, they are effectively buying ETH exposure plus an ongoing yield stream. That makes stETH a unique asset class within the Ethereum ecosystem. Even if ETH is sideways, stETH’s yield component continues to add value over time. This dynamic can make STETHUSD relatively stronger during periods when yield is prioritized.

When STETHUSD Diverges From ETH

Sometimes, STETHUSD may diverge from ETH due to liquidity imbalances or market risk. If many participants try to exit stETH simultaneously, the price can drop relative to ETH. On the other hand, if staking demand surges and liquidity is strong, stETH can strengthen and trade closer to ETH or even slightly higher depending on demand for yield-bearing exposure.

A STETHUSD bounce of 2.98% may therefore reflect not only ETH moving upward but also an improvement in stETH market conditions, such as reduced discounting and stronger confidence in liquid staking stability.

What Rising Staking Demand Means for Ethereum Investors

The growing popularity of staking has created a major shift in how Ethereum investors approach portfolio strategy.

Staking Demand Encourages Long-Term Holding Behavior

As staking becomes more mainstream, it reinforces long-term holding behavior. Investors who stake ETH—especially through liquid staking—are less likely to sell quickly because they are earning rewards. This can reduce circulating supply pressure and potentially support price stability.

Liquid staking adds another dimension: investors can maintain long-term exposure while still using their tokens productively. This encourages deeper ecosystem participation and reinforces Ethereum’s role as a yield-generating asset rather than just a speculative one.

Institutional Interest and Staking Infrastructure Growth

Institutional investors increasingly evaluate staking yields as part of their crypto exposure. Liquid staking tokens like stETH provide an accessible way to gain yield exposure while maintaining tradability. As staking infrastructure improves and compliance solutions expand, institutional interest could further accelerate staking demand.

This matters for STETHUSD because increased institutional participation can improve liquidity, deepen market depth, and potentially reduce extreme discount events.

Risks and Considerations in the STETHUSD Market

Even though liquid staking is powerful, the STETHUSD ecosystem has risks that investors must understand.

Smart Contract and Protocol Risks

Liquid staking depends on smart contracts, validators, and protocol governance. Any exploit, bug, or misconfiguration can impact confidence in stETH, even if Ethereum itself remains secure. While major protocols undergo audits and security reviews, smart contract risk remains a fundamental consideration in DeFi.

DeFi Liquidation Risk and Market Volatility

Because stETH is widely used as collateral, market volatility can trigger liquidations if stETH’s value drops or if borrowing positions become undercollateralized. This can create feedback loops that amplify price movements.

When traders see a STETHUSD bounce, they should evaluate whether the rebound is supported by improved liquidity and demand—or whether it’s just a temporary reaction within a volatile environment.

Liquidity and Exit Path Constraints

The effectiveness of stETH depends on liquidity and redemption mechanics. If liquidity dries up, it can become harder to exit at fair value, leading to discounts. Market participants should monitor DeFi liquidity depth and the availability of stable exit routes.

Future Outlook: Where STETHUSD and Liquid Staking Could Go Next

The long-term trajectory of STETHUSD will likely depend on how Ethereum staking evolves, how DeFi demand grows, and how the liquid staking market responds to competition and regulatory developments.

Continued Growth in Liquid Staking Adoption

If Ethereum staking continues to expand, liquid staking adoption is likely to grow alongside it. More stakers will seek flexibility, and more DeFi protocols will integrate liquid staking derivatives. This can increase the role of STETHUSD as a major market indicator for staking sentiment and yield demand.

A More Diverse Liquid Staking Ecosystem

Competition may reduce dominance over time, but it can also strengthen the ecosystem by improving decentralization and resilience. As more liquid staking tokens emerge, investors may diversify across different protocols. Still, stETH is likely to remain influential due to its early lead and established integrations.

STETHUSD as a Staking Sentiment Barometer

Over time, STETHUSD could become one of the most watched pairs in the Ethereum ecosystem because it reflects a unique intersection: price, yield, and liquidity. The market is increasingly pricing staking demand as a structural driver, not just a temporary trend.

Conclusion

The STETHUSD bounce of 2.98% is more than a short-term movement—it’s a reflection of how staking demand is reshaping Ethereum’s liquid staking market. As more participants seek yield, flexibility, and DeFi utility, liquid staking continues to evolve into a foundational pillar of Ethereum’s financial ecosystem.

stETH remains one of the most important assets in this shift, not just because of its market share, but because it represents a new kind of crypto instrument: a yield-bearing, liquid, DeFi-ready version of ETH. As staking demand rises, STETHUSD will likely remain a critical indicator of investor sentiment toward staking yields, DeFi liquidity, and Ethereum’s broader economic structure.

For traders and long-term holders alike, understanding the forces behind STETHUSD price action is essential. It is not just about speculation; it’s about tracking a market where yield, liquidity, and network security are increasingly interconnected—and where staking demand is redefining what “holding ETH” really means.

FAQs

Q: What does STETHUSD represent?

STETHUSD is the trading pair that measures the price of stETH in US dollars. stETH represents staked ETH plus staking rewards, making it a yield-bearing Ethereum asset.

Q: Why did STETHUSD bounce 2.98%?

A 2.98% bounce often reflects rising demand for Ethereum staking exposure, improving DeFi liquidity conditions, or renewed confidence in liquid staking markets and yield expectations.

Q: Is stETH the same as ETH?

No. stETH is a liquid staking token representing staked ETH plus rewards. While it generally tracks ETH closely, it can trade at a small premium or discount due to liquidity and market demand factors.

Q: How does liquid staking benefit Ethereum investors?

Liquid staking allows investors to earn staking rewards without locking funds. They can stake ETH, receive a liquid token like stETH, and use it in DeFi for lending, trading, and yield strategies.

Q: What are the main risks of holding stETH?

Key risks include smart contract vulnerabilities, DeFi liquidation risks if stETH is used as collateral, and liquidity constraints that could cause stETH to trade at a discount relative to ETH during stressed markets.

Also Read: Ethereum and Solana Lead 2026 DeFi Reboot