Stacks has steadily re-entered the conversation around Bitcoin scalability, and that shift is showing up in both market structure and on-chain growth. As Bitcoin layer-2 demand expands and more capital flows into applications built around Bitcoin’s security, Stacks (STX) is increasingly treated as a “Bitcoin DeFi” proxy—one that can react sharply when sentiment turns bullish. This is exactly why the current Stacks price prediction narrative is centered on a single theme: a market testing key resistance while fundamentals—particularly network usage and TVL (Total Value Locked)—continue to improve.

In crypto, price often moves ahead of fundamentals, but when fundamentals do begin to catch up, breakouts become far more convincing. Stacks is in one of those moments where traders watch technical levels closely, while long-term holders focus on ecosystem catalysts like Bitcoin-native liquidity, rising DeFi activity, and the broader wave of interest in Bitcoin scaling solutions. If Bitcoin layer-2 adoption remains the dominant storyline for the next cycle, STX could remain one of the most sensitive assets to that theme.

This article dives deep into a detailed Stacks price prediction, exploring the technical picture, the significance of resistance levels, and why climbing TVL matters so much for valuation. We’ll also look at short-term, mid-term, and long-term scenarios—without hype—so you can understand what could realistically drive the next major move.

Understanding Stacks and Why It’s Often Called Bitcoin’s Smart Contract Layer

Stacks is designed to bring smart contract functionality to Bitcoin without changing Bitcoin itself. That idea alone places it in a unique category: it isn’t competing to replace Bitcoin, but to extend what Bitcoin can do. In the same way Ethereum became the base for DeFi, Stacks aims to become the place where Bitcoin-backed DeFi, tokenized assets, and applications can live.

This matters for any serious Stacks price prediction because investors typically pay a premium for narratives tied to Bitcoin, especially when those narratives involve scaling or expanding Bitcoin’s capabilities. When the market becomes “Bitcoin season,” assets closest to Bitcoin’s growth trends can outperform quickly.

One more reason Stacks draws attention is that Bitcoin layer-2 ecosystems are still early. Unlike Ethereum, where competition is crowded, Bitcoin scaling is still in its expansion phase, and Stacks is among the most established projects in that space. As adoption increases, the upside potential becomes tied not only to price speculation, but also to measurable on-chain data like TVL.

Why TVL Growth Is a Big Deal for the STX Outlook

TVL is one of the most widely used metrics to track DeFi growth. It represents the value locked in protocols—typically lending, DEX liquidity pools, staking systems, and other DeFi applications. When TVL rises, it signals that users are not just trading a token but actively deploying capital into the ecosystem.

For the Stacks price prediction outlook, TVL growth has three major implications:

First, it improves credibility. A rising TVL suggests people trust the ecosystem enough to lock value into it. Second, it increases economic activity—more swaps, more lending, more protocol fees—which can attract additional developers and liquidity providers. Third, it strengthens the investment case because it shows the chain’s “real usage,” not just narrative hype.

When you combine TVL growth with increasing Bitcoin layer-2 demand, you get a setup where resistance levels become more meaningful: the market is not just testing a line on a chart, but potentially pricing in expanding adoption.

The Market Narrative: Bitcoin Layer-2 Demand and the Stacks Advantage

Bitcoin’s base layer is exceptionally secure, but it isn’t optimized for complex applications. That gap creates demand for layer-2 systems and adjacent networks that can provide scalability, programmability, and speed without weakening Bitcoin’s core properties.

Stacks benefits from this trend because it positions itself as part of the Bitcoin economy rather than an alternative to it. The stronger the narrative that “Bitcoin is evolving,” the stronger the narrative becomes for STX. This is why the Stacks price prediction discussion often intensifies whenever Bitcoin sentiment turns bullish or the market begins talking about Bitcoin-native DeFi.

It’s also worth noting that Bitcoin layer-2 demand can rise even when overall altcoin markets are quiet. Some investors rotate into Bitcoin ecosystem projects specifically because they want exposure to Bitcoin’s upside while still holding an asset that can produce higher percentage moves than BTC itself.

Stacks Price Prediction: Technical Structure and Why Resistance Matters Now

Technical analysis isn’t magic, but it does reveal where supply and demand clash. Right now, the Stacks price prediction focus is on key resistance because STX is at the stage where it needs to prove it can break through areas where sellers previously defended price.

What “Key Resistance” Really Means for STX Traders

Resistance is essentially a zone where the market historically sold off. It can come from prior highs, breakdown points, or heavy volume levels. When price approaches resistance, traders watch for one of two outcomes:

A rejection, where price fails and sellers regain control, or a breakout, where buyers absorb supply and price establishes a higher trading range. For STX, the breakout scenario is what traders want, but the market will demand confirmation—usually through strong volume and follow-through.

Because Stacks has historically shown volatility, resistance breaks can be sharp. If the market perceives TVL and Bitcoin layer-2 adoption as accelerating, resistance becomes less durable. But if Bitcoin stalls or risk appetite fades, resistance can hold longer than expected.

Key Support Zones That Shape the Short-Term Outlook

A realistic Stacks price prediction must also focus on support. Support zones represent areas where buyers previously stepped in. If STX loses a support level, it often triggers accelerated selling due to stop-losses and liquidation pressure.

In a typical structure, STX might form a range between support and resistance, with the price consolidating until one side wins. If the ecosystem keeps growing and TVL continues trending upward, buyers may defend support more aggressively, increasing the probability of an upside break.

This is why traders often track STX alongside Bitcoin dominance, BTC volatility, and Bitcoin ecosystem headlines. Even with strong fundamentals, price can still retrace if the market enters a risk-off phase.

The Role of Volume, Momentum, and Market Sentiment in STX Price Action

Volume is a key ingredient in any breakout. Without volume, resistance breaks are more likely to fail. Momentum indicators—like RSI or MACD—can also help assess whether buyers are gaining strength or if price is overheated.

For a balanced Stacks price prediction, it’s important to understand that STX can rally quickly on narrative-driven flows. Bitcoin layer-2 demand can create sudden waves of attention, which leads to rapid price appreciation. But when attention fades, STX can consolidate or correct just as quickly.

The healthiest trend is typically one where price climbs gradually, consolidates, and then continues higher as fundamentals improve. When TVL is rising at the same time, it adds weight to bullish continuation.

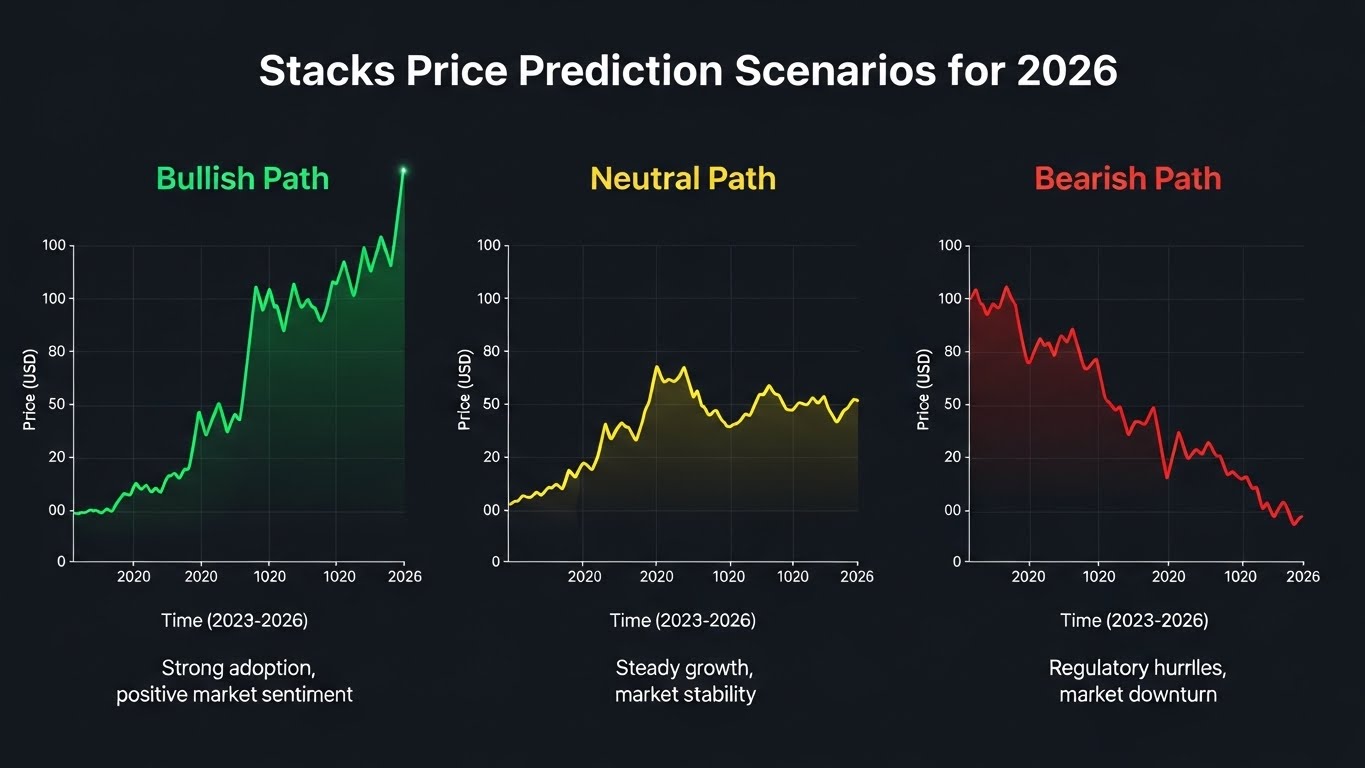

Stacks Price Prediction Scenarios for 2026: Bullish, Neutral, and Bearish Paths

No price forecast is guaranteed, especially in crypto. But scenario planning is useful because it sets realistic expectations.

Bullish Scenario: Breakout Above Resistance with Strong TVL Expansion

In the bullish case, STX breaks above key resistance and holds the level as new support. This would likely require a combination of factors: rising Bitcoin price, continued growth in Bitcoin layer-2 adoption, and sustained improvements in Stacks TVL.

In this scenario, the Stacks price prediction becomes increasingly optimistic because breakouts above major resistance zones often trigger trend-following buyers and algorithmic momentum strategies. If Stacks continues expanding its DeFi ecosystem, price could enter a higher valuation range where pullbacks are bought quickly.

Neutral Scenario: Range-Bound Trading While Ecosystem Builds

In the neutral case, STX remains stuck between support and resistance. This often happens when fundamentals improve but broader market liquidity is limited. Traders may see STX as attractive, but capital rotation might favor Bitcoin or other major assets until altcoin risk appetite returns.

A neutral Stacks price prediction doesn’t mean bearish—it simply suggests the market may need time. During these phases, TVL growth can quietly strengthen the foundation for a later breakout.

Bearish Scenario: Risk-Off Market and Failed Resistance Break

In a bearish case, Bitcoin drops, risk appetite collapses, or macro conditions tighten. STX could lose support levels and retrace significantly, even if the ecosystem remains healthy. This is important: fundamentals don’t always stop a selloff in the short term.

A responsible Stacks price prediction must acknowledge that if Bitcoin enters a prolonged downturn, STX can fall harder than BTC because it is still an altcoin with higher volatility.

Long-Term Stacks Price Prediction: What Could Drive the Next Major Cycle?

Long-term forecasts depend less on chart patterns and more on whether Stacks becomes deeply integrated into Bitcoin’s future economy. The most important questions aren’t about weekly candles—they’re about adoption and utility.

Bitcoin DeFi and the Future of Programmable Bitcoin Liquidity

If Bitcoin DeFi becomes a multi-hundred-billion-dollar category over time, networks that support that growth could capture immense value. Stacks is positioned to benefit from this theme. More DeFi protocols, more lending markets, deeper DEX liquidity, and stronger BTC-linked assets could transform STX from a speculative asset into a core infrastructure token.

That would reshape the Stacks price prediction outlook dramatically, because infrastructure tokens often gain value as the ecosystem grows—especially if fees, demand, and usage increase.

Why Developer Activity Matters for STX Valuation

Developer activity often precedes adoption. Chains with strong builders tend to survive downturns and outperform in bull markets. If Stacks continues improving tooling, scaling performance, and usability, it becomes more attractive for builders looking for Bitcoin-native applications.

From a Stacks price prediction standpoint, developer momentum can act as a long-term bullish signal. More developers usually means more apps, more users, and more capital inflows, which often translates into stronger token demand.

Institutional Interest in Bitcoin Ecosystem Plays

Institutions tend to follow narratives with clearer logic. Bitcoin scaling, tokenization, and BTC-linked DeFi are easy narratives to understand compared to many experimental altcoin concepts. If institutional capital begins allocating toward Bitcoin ecosystem infrastructure, STX could benefit significantly.

This is another reason the Stacks price prediction discussion often intensifies during periods of Bitcoin strength.

Risk Factors That Could Disrupt the Stacks Price Prediction Outlook

Every investment thesis has risks, and Stacks is no exception.

Competition is one factor. The Bitcoin layer-2 landscape is growing quickly, and new solutions may emerge with different trade-offs. If Stacks fails to maintain its relevance, adoption could slow.

Liquidity fragmentation is another risk. DeFi ecosystems need deep liquidity to attract long-term users. If liquidity migrates elsewhere or incentives decline, TVL growth may stall.

Regulatory uncertainty is also a factor for all crypto assets. While Stacks is a decentralized network, shifts in policy can influence investor behavior and exchange access, which can impact STX price.

Finally, market cycles are brutal. Even strong projects can see major drawdowns in bear markets. A grounded Stacks price prediction must account for that volatility.

How Traders and Investors Can Approach STX Without Overexposure

STX tends to move faster than Bitcoin, which is both an opportunity and a risk. A smart approach often depends on timeframe.

Short-term traders may focus on resistance breaks, volume confirmation, and market sentiment shifts around Bitcoin ecosystem news. Long-term investors may prioritize TVL trends, developer growth, and whether Stacks continues expanding Bitcoin-native utility.

Either way, the most sustainable strategy is to avoid emotional trading. The Stacks price prediction can look extremely bullish during breakout phases and extremely bearish during corrections, but disciplined positioning is what keeps traders and investors from getting shaken out.

Conclusion

The current Stacks price prediction sits at a compelling intersection: key resistance is in focus while Bitcoin layer-2 demand and Stacks TVL continue to climb. That combination matters because it suggests this isn’t just a speculative pump—there are measurable indicators of ecosystem growth behind the narrative.

If STX breaks above resistance with strong volume and holds higher levels, the market may reprice Stacks as a leading Bitcoin scaling and DeFi infrastructure play. If resistance holds, consolidation could continue while fundamentals quietly strengthen. And if the broader market turns risk-off, STX could retrace, even if adoption stays intact.

Ultimately, STX is a high-volatility asset tied to one of crypto’s biggest themes: expanding what Bitcoin can do. As Bitcoin ecosystem development accelerates, Stacks remains a project worth watching closely—especially as TVL and demand keep rising.

FAQs

Q: What is the biggest factor influencing the Stacks price prediction right now?

The biggest driver behind the Stacks price prediction is the combination of Bitcoin layer-2 demand and improving on-chain metrics such as TVL. When usage grows alongside market interest, resistance levels become more likely to break.

Q: Why does TVL matter so much for STX?

TVL reflects how much value users lock into the ecosystem through DeFi protocols and applications. Rising TVL suggests stronger adoption, which can support a more bullish Stacks price prediction over time.

Q: Is Stacks a true Bitcoin layer-2?

Stacks is often described as a Bitcoin layer-2 or Bitcoin smart contract layer because it extends Bitcoin utility without changing Bitcoin’s base rules. Its positioning makes it closely tied to the Bitcoin ecosystem and shapes the Stacks price prediction narrative.

Q: Can STX outperform Bitcoin in a bull market?

Historically, assets tied to strong narratives can outperform Bitcoin in percentage terms during bull cycles. If Bitcoin layer-2 adoption continues expanding, the Stacks price prediction could remain favorable for relative outperformance, though risk is higher.

Q: Is STX a good long-term investment?

STX may appeal to long-term investors who believe Bitcoin DeFi and Bitcoin scalability will grow substantially. However, it remains volatile, so any Stacks price prediction should be viewed as a scenario-based outlook rather than a guarantee.

See More: Bitcoin Price Prediction Remittix Ignites Altcoin Demand