The Pakistan Crypto Council Officially Launched to integrate blockchain technology with the financial landscape, marking a transformative milestone in the country’s digital finance evolution. This groundbreaking initiative represents Pakistan’s strategic pivot from cryptocurrency scepticism to embracing innovative blockchain solutions within its economic framework.

Finance Minister Muhammad Aurangzeb spearheaded this historic announcement on March 15, 2025, establishing a comprehensive regulatory body designed to bridge traditional finance with emerging digital technologies. The council’s primary mission focuses on seamlessly integrating blockchain infrastructure while ensuring robust investor protection and financial stability. This revolutionary approach positions Pakistan as a forward-thinking nation ready to harness blockchain’s potential for economic growth and technological advancement in the rapidly evolving global digital economy.

Understanding Pakistan’s Blockchain Integration Strategy

The establishment of the Pakistan Crypto Council represents a fundamental shift in how the country approaches digital finance. Previously, Pakistan maintained restrictive policies toward cryptocurrencies, with the central bank banning financial institutions from processing crypto transactions in 2018.

Now, the Pakistan Crypto Council has officially launched to integrate blockchain technology with the financial landscape through a comprehensive approach. This strategic transformation acknowledges the reality that approximately 40 million Pakistanis already engage with cryptocurrencies, generating an estimated annual trading volume exceeding $300 billion.

Key Components of Blockchain Integration

The council’s integration strategy encompasses several critical areas:

Smart Contract Implementation Pakistan plans to integrate smart contracts into government processes, reducing bureaucratic inefficiencies and enhancing transparency in public sector operations.

Digital Identity Systems Blockchain-based identity verification systems will streamline KYC processes across financial institutions, improving security while reducing compliance costs.

Supply Chain Transparency The integration includes blockchain solutions for tracking goods and services, particularly beneficial for Pakistan’s textile and agricultural exports.

Pakistan Crypto Council Officially Launched to Integrate Blockchain Technology with Financial Landscape: Leadership and Governance

The council operates under a sophisticated governance structure designed to ensure seamless blockchain integration across multiple sectors. Finance Minister Muhammad Aurangzeb chairs the organisation, while tech entrepreneur Bilal Bin Saqib serves as CEO, bringing extensive blockchain expertise to the leadership team.

Executive Board Composition

The immediate governing board includes:

- Governor of the State Bank of Pakistan

- Chairman of the Securities and Exchange Commission (SECP)

- Federal Law Secretary

- Federal IT Secretary

This diverse leadership ensures that blockchain integration considers regulatory compliance, financial stability, legal frameworks, and technological advancement simultaneously.

Strategic Advisory Panel

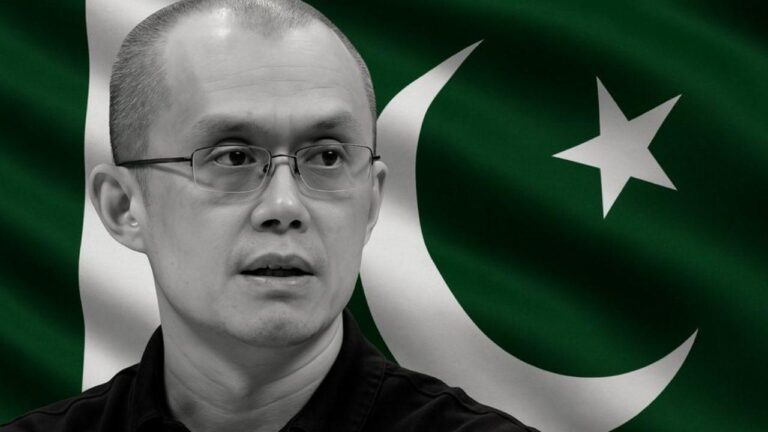

In a significant development, Pakistan appointed Changpeng Zhao, founder of Binance, as a strategic adviser. This appointment demonstrates the country’s commitment to implementing world-class blockchain solutions and learning from global industry leaders.

Comprehensive Blockchain Integration Framework

Financial Services Modernisation

The Pakistan Crypto Council’s blockchain integration extends beyond cryptocurrency regulation. The framework includes:

Central Bank Digital Currency (CBDC) Development Pakistan explores developing a digital rupee built on blockchain technology, enabling faster, more secure domestic and international transactions.

Cross-Border Payment Solutions: Blockchain technology will facilitate efficient remittance systems, crucial for Pakistan’s economy, given its large diaspora population.

Decentralised Finance (DeFi) Platforms: The council evaluates incorporating DeFi protocols to expand financial inclusion, particularly in underserved rural areas.

Regulatory Technology (RegTech) Implementation

Blockchain integration includes sophisticated RegTech solutions for:

- Real-time transaction monitoring

- Automated compliance reporting

- Enhanced anti-money laundering (AML) capabilities

- Counter-terrorism financing (CFT) protocols

Economic Impact of Blockchain Integration

Investment Attraction and Job Creation

The Pakistan Crypto Council, officially launched to integrate blockchain technology with the financial landscape, creates significant economic opportunities. The initiative aims to:

- Attract foreign direct investment in blockchain startups

- Create high-skilled technology jobs

- Establish Pakistan as a regional blockchain hub

- Develop local expertise in distributed ledger technologies

Tax Revenue Optimisation

Proper blockchain integration enables the government to:

- Implement a 15% capital gains tax on cryptocurrency profits

- Track previously unregulated digital asset transactions

- Generate revenue from licensing blockchain service providers

- Create transparent tax collection mechanisms

Technical Infrastructure Development

Energy Allocation for Blockchain Operations

Pakistan allocated 2,000 megawatts of excess energy to support blockchain infrastructure, including:

- Bitcoin mining operations

- High-performance computing data centres

- Blockchain network maintenance

- Smart contract execution platforms

Cybersecurity and Data Protection

The integration framework prioritises security through:

Advanced Encryption Standards Implementation of military-grade encryption for blockchain transactions and data storage.

Multi-Signature Wallet Systems: Enhanced security protocols for institutional cryptocurrency custody.

Disaster Recovery Systems: Robust backup and recovery mechanisms ensure blockchain network resilience.

International Collaboration and Partnerships

Global Blockchain Standards Adoption

Pakistan actively collaborates with international organisations to adopt best practices in blockchain integration. The council works with:

- International Monetary Fund (IMF) guidelines

- Financial Action Task Force (FATF) recommendations

- Bank for International Settlements (BIS) frameworks

For comprehensive insights into global blockchain adoption standards, stakeholders can reference the World Economic Forum’s blockchain deployment toolkit.

Regional Leadership Initiatives

Pakistan’s proactive approach positions it as a potential leader in South Asian blockchain adoption, creating opportunities for regional cooperation and technology transfer.

Risk Management and Consumer Protection

Investor Safety Measures

The Pakistan Crypto Council was officially launched to integrate blockchain technology with the financial landscape while prioritising consumer protection through:

- Mandatory licensing for blockchain service providers

- Insurance requirements for cryptocurrency exchanges

- Clear dispute resolution mechanisms

- Educational programs for retail investors

Market Stability Protocols

The council implements measures to prevent market manipulation and ensure fair trading practices across blockchain-based financial services.

Future Roadmap and Development Milestones

Short-Term Objectives (2025-2026)

- Complete regulatory framework development

- Launch pilot blockchain projects in government sectors

- Establish cryptocurrency exchange licensing procedures

- Implement digital asset taxation systems

Medium-Term Goals (2027-2028)

- Deploy central bank digital currency (CBDC)

- Integrate blockchain solutions across major banks

- Develop local blockchain talent through education programs

- Establish international blockchain trade corridors

Long-Term Vision (2029-2030)

- Position Pakistan as a global blockchain innovation centre

- Achieve full financial system blockchain integration

- Export blockchain solutions to neighbouring countries

- Establish sovereign cryptocurrency reserves

Challenges and Mitigation Strategies

Technical Complexity Management

Blockchain integration requires sophisticated technical expertise. The council addresses this through:

- International partnerships with blockchain companies

- University curriculum development programs

- Continuous professional development initiatives

- Public-private collaboration frameworks

Regulatory Compliance Balance

Balancing innovation with regulation requires careful consideration of:

- International compliance standards

- Local market conditions

- Consumer protection requirements

- Financial stability maintenance.”

Conclusion: Pakistan’s Blockchain-Powered Financial Future

The Pakistan Crypto Council, officially launched to integrate blockchain technology with the financial landscape, represents a paradigm shift toward digital innovation and economic modernisation. This comprehensive initiative demonstrates Pakistan’s commitment to embracing technological advancement while maintaining regulatory oversight and consumer protection.

The successful implementation of blockchain integration will position Pakistan as a regional leader in digital finance, creating economic opportunities, attracting international investment, and improving financial inclusion across the country.

Frequently Asked Questions

What does it mean that the Pakistan Crypto Council has officially launched to integrate blockchain technology with the financial landscape?

The launch means Pakistan has established a government body to systematically incorporate blockchain solutions into banking, payments, and financial services, creating a regulated framework for digital asset adoption while maintaining financial stability.

How will blockchain integration affect traditional banking in Pakistan?

Blockchain integration will enhance traditional banking through faster transaction processing, reduced costs, improved security, and better regulatory compliance. Banks will gradually adopt blockchain solutions for payments, trade finance, and customer verification.

What specific blockchain technologies will Pakistan implement?

Pakistan plans to implement smart contracts, digital identity systems, supply chain tracking, central bank digital currency (CBDC), and decentralised finance protocols across various sectors of the economy.

How does Pakistan’s blockchain integration compare globally?

Pakistan’s approach follows international best practices while addressing local market needs. The country collaborates with global organisations and industry leaders to ensure world-class implementation standards.

What opportunities does blockchain integration create for businesses?

Blockchain integration creates opportunities for fintech startups, enables new business models, reduces operational costs, improves transparency, and opens access to global markets through efficient cross-border payment systems.