Hyperliquid HYPE price forecast: The scene of cryptocurrencies is changing quickly, and one project attracting much interest is Hyperliquid (HYPE). Built from the ground up with a proprietary Layer-1 blockchain, Hyperliquid offers ultra-low latency, excellent liquidity, and an on-chain order book as a distributed derivatives exchange. HYPE, the native cryptocurrency, finds use in the ecosystem for gas fees, staking rewards, and governance, among other things.

Many investors and analysts are focusing on the HYPE price estimate for 2025 through 2030, given the protocol’s special architecture and significant community involvement. To grasp HYPE’s possibilities, one must delve deeply into Hyperliquid’s present posture in the distributed finance (DeFi) ecosystem, competitive advantages, tokenomics, and more general trends influencing the crypto derivative market.

Core Value Proposition of Hyperliquid

Designed especially for trade efficiency, Hyperliquid runs on its own blockchain, unlike Layer-2 rollups or sidechains like Optimism or Arbitrum. Deep on-chain liquidity is enabled by an inventive Automated Market Maker (AMM) and a hybrid approach to limit order book. The platform offers zero gas fees for traders and immediate order execution.

While maintaining decentralised transparency and security, this design allows performance on par with centralised exchanges like Binance or Bybit. Such trustless infrastructure gives Hyperliquid a compelling value proposition in a market growing more dubious of centralised guardians following occurrences like the FTX collapse.

With low slippage and consistently high trading volume, Hyperliquid has also started perpetual futures markets on more than one hundred assets. HYPE, its native coin, increases the protocol’s inherent value through applications beyond speculation.

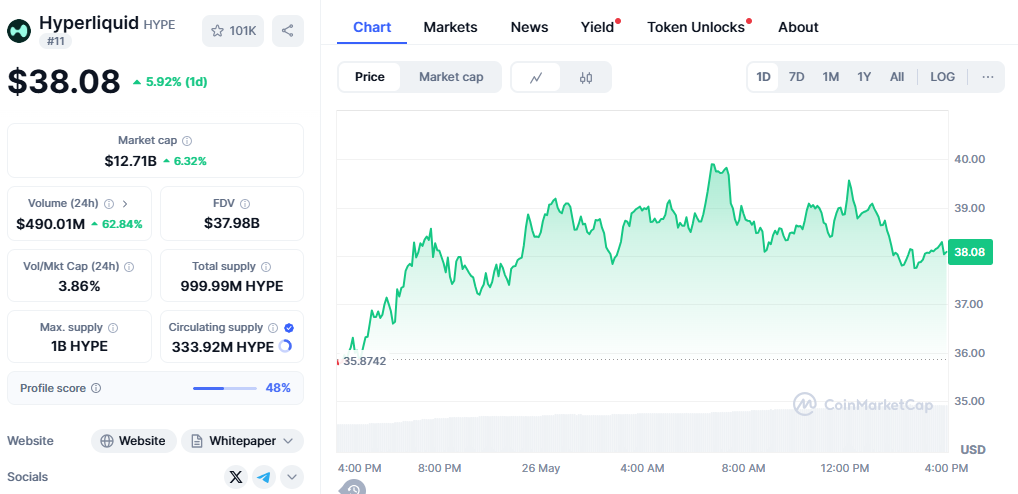

Current Market Analysis and Performance

With a total diluted worth of over $1.8 billion, HYPE is selling at about $4.80 as of mid-2025. Particularly after the news of integration with well-known Web3 wallets like MetaMask and Ledger Live, this demonstrates quick user uptake and institutional interest.

The Hyperliquid staff has also maintained transparency by releasing technical improvements, roadmaps, and regular governance updates. Hyperliquid has created a strong niche in the DeFi derivatives market since daily trade volumes often reach $500 million.

Regarding token distribution, HYPE stays in balance among development reserves, early contributors, and community incentives. Two issues that usually afflict new DeFi projects—severe inflationary pressure and whale manipulation—decrease the danger.

HYPE Pricing Forecast 2025

Several triggers could affect HYPE’s price path in 2025. The most urgent is the forthcoming Layer-1 upgrade from Hyperliquid, which promises increased throughput, zk-rollup integration, and even more node infrastructure decentralising power. Should the road map be effectively implemented, HYPE might reach a conservative estimate of $8–$12 by Q4 2025.

This estimate is predicated on predicted rises in total value locked (TVL), more synthetic asset introduction, and rising institutional interest in distributed derivatives. Here, market mood is imperative. Driven by macroeconomic events like Fed rate reduction or Bitcoin ETF inflows, HYPE might challenge the $15–$18 zone in the case of a wider crypto bull run. On the other hand, bearish circumstances or government restrictions could stifle development, hence keeping the token around $6.

HYP Price Project for 2026–2027

With more legislative clarity and technology standardisation as we enter 2026 and 2027, the DeFi ecosystem should grow more mature. Hyperliquid finds a good position to profit from this development. Should Hyperliquid’s network keep drawing high-frequency trading companies, arbitrage bots, and worldwide retail consumers, HYPE’s price may grow dramatically by 2026.

By the end of 2026, researchers anticipate the token might range between $20 and $28, assuming constant development and partnerships. This estimate includes new incentive models for liquidity providers, governance voting rights, and the most likely launch of HYPE staking pools.

Should Hyperliquid maintain or increase its market share in on-chain derivatives trading in 2027, HYPE might approach $35, particularly if trade volumes continue rising at 25–40% annually. Another main development driver could be integration with conventional financial systems using tokenised derivatives.

Hypertensive Price Forecast 2028–2030

Blockchain technology is predicted to support much of the world’s financial system by the decade’s end. Like CME or Nasdaq in conventional finance, Hyperliquid might become a main on-chain venue for professional-grade derivatives trading should this trend continue.

If Hyperliquid develops into a multi-chain centre for cross-asset trading with relationships spanning Web3 and fintech, the long-term worth of HYPE might be more than $50- $75 by 2029. If the platform creates new products like tokenised interest rate swaps, carbon credit futures, or real-world asset derivatives, some optimistic forecasts even point to $100+. Long-term projections, however, by nature, contain more uncertainty. Sustainable HYPE will depend on protocol security, token inflation management, government efficiency, and user experience.

Comparative Markets and Competitive Analysis

Hyperliquid rivals various DeFi systems such as Aevo, GMX, and dYdX. Although Hyperliquid decided to create a unique Layer-1, providing complete control over latency, gas prices, and composability, dYdX has chosen Cosmos-based infrastructure and off-chain order books. GMX mostly depends on an xDAI-based liquidity model, which, although distributed, lacks the speed and depth of Hyperliquid’s approach. Meanwhile, Aevo continues in beta and deals with scaling issues.

Key players like Andre Cronje and early DeFi inventors’ support legitimises the Hyperliquid ecosystem. Moreover, interactions with instruments such as Flashbots, Chainlink oracles, and TradingView support the protocol’s technological development.

Main Forces behind HYPE Token Development

Several macro and microeconomic elements will drive the future price of HYPE. Macro-wise, users’ preference for trustless alternatives like Hyperliquid is probably driven by increased acceptance of distributed financial instruments, geopolitical unpredictability, inflation concerns, and mistrust.

Micro-level improvements like better UX/UI, governance token utility, and high-yield staking systems will draw consumers and investors equally. Working with well-known blockchain foundations, colleges, and research laboratories could help to validate the protocol and stimulate cash flows.

Risk Factors and Investor Considerations

Like every cryptocurrency investment, HYPE carries natural volatility and risk. Short-term performance can suffer from possible regulatory crackdowns, smart contract flaws, and liquidity crunches. Still, the project’s open road map, expanding ecosystem, and capable technical staff give a solid basis. Before investing, users should examine their risk tolerance and monitor governance initiatives, GitHub changes, and social media sentiment.