The cryptocurrency market continues to evolve at breakneck speed, and Ethereum remains at the forefront of investor attention. As we navigate through 2025, conducting a comprehensive Ethereum price forecast analysis 2025 has become crucial for both seasoned investors and newcomers alike. With institutional adoption accelerating, regulatory clarity improving, and technological upgrades transforming the network’s capabilities, Ethereum’s price trajectory presents both opportunities and challenges.

Understanding the complex factors that influence Ethereum’s valuation requires deep analysis of market fundamentals, technical indicators, and macroeconomic trends. This detailed examination will provide you with expert insights, data-driven predictions, and actionable intelligence to make informed investment decisions. Whether you’re seeking short-term trading opportunities or long-term investment strategies, our analysis covers all the essential aspects that affect Ethereum’s price movement throughout 2025.

Current Ethereum Market Position and 2025 Outlook

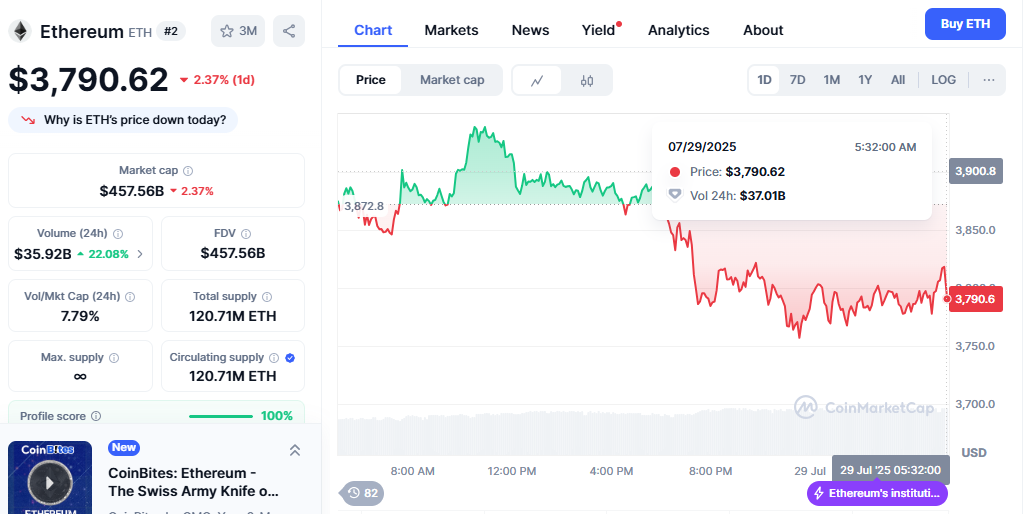

Ethereum has demonstrated remarkable resilience despite facing significant challenges in recent quarters. Trading at approximately $3,890 as of late July 2025, ETH has shown both volatility and strength in response to various market catalysts. The network’s transition to proof-of-stake, combined with ongoing layer-2 developments, has fundamentally altered Ethereum’s value proposition.

Market analysts consistently highlight Ethereum’s unique position as the dominant innovative contract platform. Unlike Bitcoin’s primary function as digital gold, Ethereum serves as the foundation for decentralized finance (DeFi), non-fungible tokens (NFTs), and enterprise blockchain solutions. This utility-driven demand creates multiple revenue streams and use cases that support long-term price appreciation.

The current market capitalization exceeds $469 billion, positioning Ethereum as the second-largest cryptocurrency by market value. This substantial market presence provides liquidity and stability, attracting institutional investors seeking exposure to blockchain technology beyond Bitcoin.

Expert Ethereum Price Predictions for 2025

Standard Chartered’s Bullish Forecast

Leading financial institution Standard Chartered has published one of the most optimistic projections, suggesting Ethereum could reach $14,000 by the end of 2025. This ambitious target represents a potential 284% increase from current levels. Their analysis emphasizes the impact of spot Ethereum ETF approvals and continued network upgrades as primary catalysts for this dramatic price appreciation.

The bank’s research team, led by analyst Geoff Kendrick, bases their forecast on Ethereum’s potential to capture market share from Bitcoin. They argue that Ethereum’s utility-driven demand could eventually lead to market cap parity with Bitcoin, especially if the platform successfully scales through upcoming technological improvements.

Finder Panel Consensus

A comprehensive survey of 50 industry analysts, conducted by Finder, reveals a more conservative yet still optimistic outlook. The panel’s average prediction places Ethereum at $6,105 by the end of 2025, with projections ranging from $2,300 to $11,411. This wide range reflects the inherent uncertainty in cryptocurrency markets while maintaining overall bullish sentiment.

Key factors cited by panel members include institutional investment flows, technological advancements, and regulatory developments. The consensus acknowledges potential volatility while emphasizing Ethereum’s fundamental strengths in smart contract functionality and the growth of its developer ecosystem.

Technical Analysis Perspectives

From a technical standpoint, cryptocurrency analysts identify several key price levels that could influence Ethereum’s trajectory. Current resistance levels near $4,000 represent significant psychological barriers, while support levels around $3,200-$3,400 provide potential buying opportunities for strategic investors.

Moving average indicators suggest a bullish medium-term trend, with the 50-day moving average providing dynamic support for continued upward momentum. However, technical analysts caution that overbought conditions may lead to short-term corrections before sustained growth resumes.

Ethereum Price Forecast Analysis 2025

Institutional Adoption and ETF Impact

The approval and launch of spot Ethereum ETFs represent a watershed moment for institutional adoption. These investment vehicles provide traditional investors with regulated exposure to Ethereum, thereby eliminating the complexities associated with direct cryptocurrency ownership. Daily inflows exceeding $500 million demonstrate strong institutional demand that continues to support price appreciation.

Major corporations increasingly recognize Ethereum’s utility for enterprise applications, including supply chain management, digital identity solutions, and automated contract execution. This corporate adoption creates sustained demand pressure, supporting long-term price stability and growth.

Network Upgrades and Scalability Solutions

Ethereum’s ongoing development roadmap includes several critical upgrades designed to enhance scalability, security, and sustainability. The Pectra upgrade, implemented in 2025, has enhanced network efficiency and reduced transaction costs, making Ethereum more accessible to retail users and small-scale applications.

Layer-2 scaling solutions continue expanding Ethereum’s transaction capacity while maintaining security guarantees. These developments address historical concerns about network congestion and high gas fees that previously limited mainstream adoption.

DeFi and Smart Contract Ecosystem Growth

The decentralized finance sector built on Ethereum continues to expand despite market volatility. Total value locked (TVL) in Ethereum-based DeFi protocols demonstrates the network’s utility beyond speculative trading. This productive use of Ethereum creates deflationary pressure through gas fee burning while generating network effects that attract additional users and developers.

Smart contract innovation drives continuous demand for ETH as the network’s native currency. Every transaction, contract deployment, and protocol interaction requires ETH payment, creating consistent demand regardless of speculative trading activity.

Also Read: Latest ETH Forecast News Today Ethereum Price Prediction 2025

Monthly Ethereum Price Projections Through 2025

2025 Outlook (August-September)

Current momentum suggests that Ethereum could test resistance levels near $4,200-$4,500 during late summer 2025. Historically, seasonal patterns have shown increased cryptocurrency activity during this period, which may support upward price movements. However, investors should prepare for potential volatility as markets digest ongoing regulatory developments and macroeconomic uncertainties.

Technical indicators suggest continued bullish momentum, although overbought conditions may trigger short-term corrections. Strategic investors often view these dips as opportunities for accumulation, particularly if support levels around $3,600-$3,800 hold firm.

2025 Projections (October-December)

The final quarter of 2025 could prove pivotal for Ethereum’s price trajectory. Historical data suggests cryptocurrency markets often experience significant movements during Q4, driven by institutional rebalancing, tax considerations, and year-end investment decisions.

Analyst projections for December 2025 range from conservative estimates around $4,500 to optimistic targets exceeding $6,000. The wide range reflects uncertainty about macroeconomic conditions, regulatory developments, and potential market catalysts that could emerge during this period.

Risk Factors and Challenges Affecting Ethereum Prices

Regulatory Uncertainty

Despite improving regulatory clarity in significant markets, uncertainties persist regarding the classification and taxation of cryptocurrencies. Changes in regulatory frameworks could significantly impact institutional adoption rates and overall market sentiment.

The evolving regulatory landscape requires continuous monitoring, as policy shifts in major economies, such as the United States, the European Union, or China, could create sudden market volatility. Investors must consider these regulatory risks when evaluating long-term Ethereum positions.

Competition from Alternative Platforms

Ethereum faces increasing competition from newer blockchain platforms offering faster transaction speeds, lower costs, or specialized functionality. Solana, Avalanche, and other “Ethereum killers” continue developing features that could potentially capture market share from Ethereum’s ecosystem.

However, Ethereum’s first-mover advantage, extensive developer community, and established ecosystem provide significant competitive moats. The network effect benefits tend to favor established platforms, though vigilance regarding competitive threats remains essential.

Macroeconomic Factors

Global economic conditions have a significant impact on cryptocurrency markets, including those of Ethereum. Interest rate changes, inflation concerns, and geopolitical tensions create broader market volatility that affects riskier assets, such as cryptocurrencies.

Central bank monetary policies particularly impact cryptocurrency valuations, as changes in fiat currency stability influence investor appetite for alternative assets. Fears of an economic recession or banking sector instability could either benefit Ethereum as a hedge against risk or harm it as investors flee to safer assets.

Investment Strategies for Ethereum in 2025

Dollar-Cost Averaging Approach

For long-term investors, dollar-cost averaging represents a prudent strategy for building Ethereum positions while managing volatility risks. This approach involves making regular purchases, regardless of short-term price movements, which can potentially smooth out the impact of market fluctuations over time. The strategy is particularly effective for investors who believe in Ethereum’s long-term fundamentals but acknowledge the short-term unpredictability of its price. Regular accumulation during market downturns can improve average entry prices and maximize potential returns.

Technical Trading Strategies

Active traders may focus on technical analysis to identify short-term entry and exit points. Key support and resistance levels, moving averages, and momentum indicators provide frameworks for making tactical trading decisions.

However, the 24/7 nature of cryptocurrency markets and their high volatility require sophisticated risk management strategies. Stop-loss orders, position sizing, and diversification remain essential components of any active trading approach.

Staking and Yield Generation

Ethereum’s proof-of-stake consensus mechanism allows holders to stake their ETH and earn rewards. Current staking yields provide additional income while potentially reducing selling pressure from long-term holders.

Staking strategies require an understanding of lock-up periods, validator risks, and tax implications. However, for investors with multi-year time horizons, staking can enhance total returns while supporting network security.

Conclusion

Our comprehensive Ethereum price forecast analysis 2025 reveals a complex but generally optimistic outlook for the world’s second-largest cryptocurrency. Multiple factors converge to support significant price appreciation potential, including institutional adoption through ETFs, technological improvements that enhance network utility, and growing real-world applications across DeFi and the enterprise sector.

While expert predictions vary widely, ranging from conservative targets around $4,500 to ambitious projections exceeding $14,000, the consensus points toward substantial growth opportunities for strategic investors. However, success requires careful risk management, diversification, and understanding of the multiple factors that influence cryptocurrency valuations.