Ethereum floods out of exchanges when investors rapidly withdraw ETH from centralized trading platforms into private wallets, staking contracts, or decentralized finance protocols. This shift is more than a routine movement of funds—it is a structural signal about market sentiment, liquidity positioning, and potential future price behavior.

In the latest on-chain data, Ethereum floods out of exchanges in what analysts describe as the largest withdrawal wave since October, with over 220,000 ETH leaving major exchanges within a short multi-day period. That scale of exchange outflows immediately captured attention across the crypto market because exchange-held supply represents the most liquid and readily sellable portion of Ethereum’s circulating supply.

When ETH leaves exchanges at this magnitude, it often suggests a shift toward long-term holding, self-custody, staking participation, or reduced immediate selling intent. While such events do not guarantee price appreciation, they significantly reshape the short-term supply dynamics of the Ethereum market.

Understanding why Ethereum floods out of exchanges—and what this means for traders, investors, and the broader crypto ecosystem—requires a deep look at on-chain metrics, liquidity mechanics, market psychology, and Ethereum’s evolving role in decentralized finance.

What It Means When Ethereum Floods Out of Exchanges

When analysts say Ethereum floods out of exchanges, they are referring to a surge in negative exchange netflows. Netflow measures the difference between ETH deposited into exchange wallets (inflows) and ETH withdrawn from them (outflows). If outflows exceed inflows by a significant margin, the netflow becomes sharply negative.

In this case, more than 220,000 ETH was withdrawn across exchanges in just a few days—marking the strongest wave of withdrawals since October. This is not normal day-to-day fluctuation. It represents a coordinated or widespread behavioral shift among market participants.

Exchange balances matter because they function as the market’s “immediate supply shelf.” ETH stored on exchanges can be sold instantly. ETH stored in cold wallets, staking contracts, or DeFi platforms requires additional steps before liquidation. Therefore, when Ethereum floods out of exchanges, the available liquid supply declines.

Why Exchange Supply Is So Important

The amount of Ethereum held on exchanges directly impacts short-term price pressure. High exchange balances increase potential sell pressure. Lower exchange balances reduce that pressure. When Ethereum floods out of exchanges, it often indicates: A move toward self-custody wallets Greater participation in Ethereum staking Deployment into DeFi protocols Long-term accumulation behavior Reduced trust in centralized platforms While none of these factors individually guarantees bullish price action, collectively they point to a shift away from short-term trading behavior.

Why This Is the Biggest Withdrawal Wave Since October

The phrase “biggest since October” matters because it provides historical context. Markets constantly experience inflows and outflows, but only certain events stand out in magnitude. In October, a similarly large withdrawal spike occurred during a period of market repositioning. The current outflow surpassing 220,000 ETH marks the most aggressive exchange balance decline since that time. This comparison signals that the current move is statistically significant—not just a minor fluctuation.

What Defines a True Withdrawal Wave?

A real withdrawal wave has several defining characteristics: A sharp acceleration over a short time frame Large-scale withdrawals across multiple exchanges Significant deviation from average daily netflo Alignment with broader market sentiment shifts When Ethereum floods out of exchanges under these conditions, it often reflects deliberate strategic positioning rather than random wallet activity.

The Most Common Reasons Ethereum Floods Out of Exchanges

There are several reasons why Ethereum floods out of exchanges, and they often overlap during major events.

Accumulation During Price Weakness

One of the most common drivers is strategic accumulation. When ETH experiences price pressure or trades near key support levels, long-term investors may see value opportunities. Instead of leaving purchased ETH on exchanges, they withdraw it to private wallets. This behavior reduces immediate sell-side liquidity and signals conviction. Large investors, often referred to as whales, typically move assets off exchanges once they complete accumulation.

Increased Staking Participation

Ethereum’s transition to proof-of-stake fundamentally changed supply dynamics. ETH holders can now lock their tokens into staking contracts to earn yield. When Ethereum floods out of exchanges, a portion of those funds often moves into: Direct validator staking Liquid staking derivatives Restaking ecosystems Yield-bearing DeFi vaults Staking reduces circulating liquid supply because staked ETH cannot be instantly sold.

Self-Custody and Risk Management

Another reason Ethereum floods out of exchanges is risk mitigation. In times of market uncertainty, regulatory scrutiny, or exchange-related concerns, users prioritize self-custody. The crypto principle “not your keys, not your coins” becomes especially relevant during volatile periods. Large-scale withdrawals can reflect heightened awareness of counterparty risk.

How Exchange Outflows Impact Ethereum’s Price

It is tempting to assume that if Ethereum floods out of exchanges, price must rise. However, market mechanics are more complex.

Reduced Immediate Sell Pressure

When exchange balances drop significantly, fewer coins are immediately available for market selling. This can reduce the intensity of downward pressure. Lower exchange liquidity often leads to thinner order books. In such conditions, relatively modest buy orders can have a larger price impact.

Potential Supply Shock Conditions

If Ethereum floods out of exchanges while demand simultaneously increases, the market may experience a supply shock. A supply shock occurs when available liquid supply tightens while buying interest rises. This combination can amplify upward price movements. However, if demand remains weak, ETH may continue consolidating despite strong outflows.

Volatility Remains Possible

Even with major exchange withdrawals, Ethereum can remain volatile. Derivatives markets, leverage, macroeconomic factors, and regulatory news can override spot supply dynamics in the short term. Exchange outflows should therefore be interpreted as a structural signal rather than a short-term trading guarantee.

Where the ETH Goes After Leaving Exchanges

When Ethereum floods out of exchanges, it does not disappear. Instead, it migrates into various segments of the blockchain ecosystem.

Cold Wallet Storage

Many investors move ETH into hardware wallets or secure cold storage solutions. This indicates long-term holding intent and reduced trading frequency.

DeFi Ecosystem Deployment

Ethereum remains the backbone of decentralized finance. Withdrawn ETH often enters:

- Lending protocols

- Liquidity pools

- Collateralized borrowing platforms

- Yield farming strategies

This movement strengthens Ethereum’s on-chain economic activity.

Liquid Staking Tokens

Liquid staking derivatives allow users to stake ETH while retaining liquidity through tokenized representations. This dual-layer participation contributes to declining exchange balances while preserving capital efficiency.

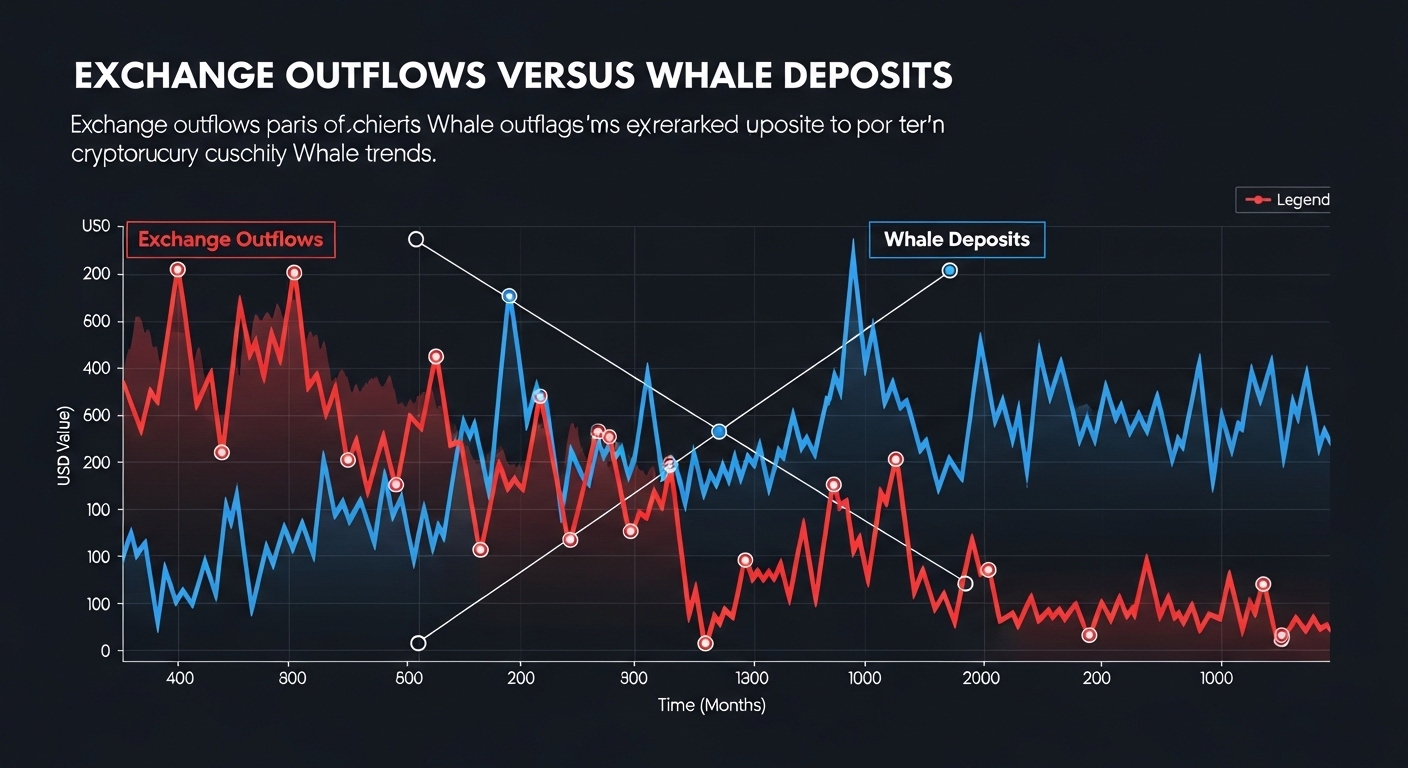

Exchange Outflows Versus Whale Deposits

Interestingly, Ethereum floods out of exchanges even when some large holders deposit ETH to trading platforms. These events can coexist. Individual whales may prepare to sell or rebalance, while the broader market withdraws significantly larger volumes. Metrics measure aggregate behavior, not isolated wallet activity. Therefore, a few high-profile deposits do not negate widespread withdrawal trends.

Market Sentiment and Psychological Impact

When Ethereum floods out of exchanges in a major wave, it influences trader psychology. Reduced exchange supply often fosters narratives of accumulation and tightening liquidity. Sentiment can shift from fear to cautious optimism, particularly if price stabilizes near strong technical support levels. On-chain data increasingly shapes market perception. Institutional participants, retail traders, and algorithmic funds monitor exchange balances closely as part of broader risk assessment models.

Long-Term Implications for Ethereum

Large-scale exchange withdrawals reinforce Ethereum’s evolving identity as more than a speculative asset. It functions as: A yield-generating staking asset DeFi collateral A base-layer settlement token A store of digital value When Ethereum floods out of exchanges repeatedly over time, it suggests maturation of holder behavior. Fewer coins remain in speculative circulation, while more become embedded within the broader Ethereum ecosystem. This structural shift can gradually reshape supply-demand dynamics over multi-year cycles.

What Investors Should Watch Next

After a major withdrawal wave, analysts typically monitor: Continued exchange balance decline Staking participation rates DeFi total value locked (TVL) Funding rates in derivatives markets Spot buying volume If exchange balances continue trending downward while demand recovers, the probability of stronger price reactions increases. If outflows reverse quickly, the signal weakens.

Conclusion

Ethereum floods out of exchanges in the biggest withdrawal wave since October, marking a significant shift in short-term liquidity dynamics. With over 220,000 ETH withdrawn in just a few days, the event signals reduced exchange supply, potential accumulation, and heightened self-custody or staking participation.

While large exchange outflows do not guarantee immediate price appreciation, they alter the structural balance between liquid supply and potential demand. Reduced sell-ready inventory can create conditions favorable for future upside—especially if buying interest strengthens.

In the evolving crypto landscape, monitoring when Ethereum floods out of exchanges provides valuable insight into investor behavior, risk appetite, and long-term conviction. This latest wave suggests that many holders are positioning for something beyond short-term speculation.

FAQs

Q: Is it bullish when Ethereum floods out of exchanges?

It can be supportive for price because reduced exchange supply lowers immediate sell pressure. However, demand must also increase for significant upward movement.

Q: Why do investors withdraw ETH from exchanges?

Common reasons include self-custody, staking participation, DeFi deployment, and long-term accumulation strategies.

Q: Does exchange outflow mean whales are buying?

Not necessarily, but large outflows often align with accumulation behavior. It reflects aggregate movement rather than individual wallet decisions.

Q: Can ETH still fall after major withdrawals?

Yes. Macroeconomic factors, leverage liquidations, and regulatory news can drive price declines regardless of exchange balances.

Q: How often do large Ethereum withdrawal waves happen?

Significant waves occur periodically during market transitions, major price levels, or sentiment shifts. The current move is notable because it is the largest since October.

Also Read: Ethereum Drops Below $2,800 Should Investors Worry?