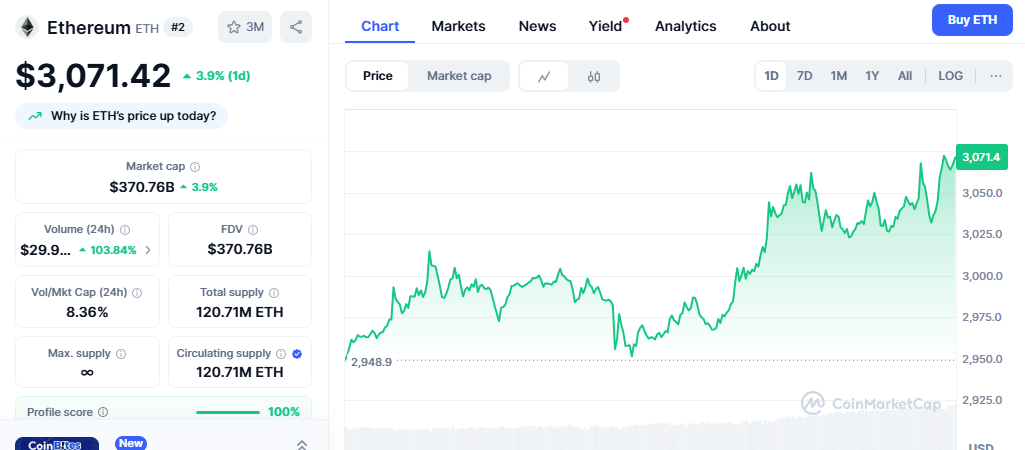

Ethereum has successfully breached the critical $2,800 resistance level, reaching $3,000 for the first time since February 2025, driven by unprecedented ETF inflows and surging institutional demand. The world’s second-largest cryptocurrency has benefited from record weekly inflows of $907.99 million into Ethereum ETFs, marking their best week since launching in July 2024. This breakthrough represents a pivotal moment for ETH investors as the digital asset builds momentum toward potential new all-time highs.

Understanding Ethereum’s Current Market Position

Ethereum’s recent price action demonstrates the growing maturity of the cryptocurrency market and increasing institutional adoption. With ETH reclaiming the $3,000 price level on Friday, buoyed by strategic treasury moves from Nasdaq-listed companies and surging institutional demand through spot ETFs, the market is witnessing a fundamental shift in investor sentiment.

The second-largest cryptocurrency by market capitalization has been consolidating near key technical levels throughout 2025, building the foundation for what many analysts believe could be a sustained upward trajectory. The weekly chart displayed Ethereum breaking through a bearish order block at $2,800, demonstrating strong buyer enthusiasm in the market.

Record-Breaking ETF Performance Drives Institutional Interest

BlackRock Leads the Charge

BlackRock’s strategic acquisition via ETHA has catalyzed the largest single-day inflow for the fund, with the cumulative weekly inflows for ETHA soaring to $629 million, reflecting a significant surge in institutional interest. On Thursday, BlackRock’s iShares Ethereum Trust (ETHA) booked its largest daily inflow to date, with over $300 million, pushing its total assets under management to $5.6 billion.

The dominance of BlackRock’s ETHA in the Ethereum ETF space highlights the institutional confidence in Ethereum’s long-term prospects. ETHA’s total net inflows have surpassed $5.4 billion since inception, showcasing its leadership in the Ether ETF space.

Sustained Institutional Demand

According to ETF Store President Nate Geraci, “18 straight days of inflows into spot ETH ETFs… Nearly $250M just today. And there’s still no staking or in-kind creation/redemption.” This consistent demand pattern indicates that institutional investors view Ethereum as more than just a speculative asset, recognizing its fundamental value proposition as the leading smart contract platform.

U.S.-listed spot Ethereum ETFs recorded strong demand with over $500 million in inflows month-to-date. This institutional interest marks a change from earlier periods of muted activity. The sustained inflows suggest that institutional adoption is accelerating, with corporate treasuries beginning to diversify their holdings beyond traditional assets.

Technical Analysis: Key Resistance and Support Levels

Breaking Through Critical Resistance

Ethereum cryptocurrency recently broke through the resistance zone located between the resistance level $2,800 and the 50% Fibonacci correction, with technical analysts expecting further movement toward the next resistance level at $3,200. This technical breakthrough is significant as it represents the culmination of months of consolidation and accumulation.

The price of Ethereum (ETH) is predicted to increase by 5–6% and may reach $2,940–$2,975 by the end of this week (July 13, 2025), if it successfully breaks and closes above the key $2,800 resistance.

Support Structure Strengthens

The establishment of new support levels above $2,800 provides a foundation for continued upward momentum. Ethereum has broken above multi-week resistance near $2,745, establishing higher support at $2,850. This creates a more robust technical structure that could support sustained price appreciation.

Technical indicators suggest that Ethereum’s current positioning resembles patterns observed before previous significant bull runs. The asset has strong support at $2,350, whereas $2,675 and $2,850 will act as strong resistance.

Market Dynamics and Trading Volume

Increased Institutional Participation

Chicago Mercantile Exchange data shows Open Interest reaching $3.27 billion, the highest level since February 2, 2025. This metric indicates increased institutional capital flowing into Ethereum markets. The surge in open interest reflects growing institutional participation in Ethereum derivatives markets, suggesting sophisticated investors are positioning for potential price movements.

Trading data revealed a market capitalization of $361.54 billion. The 24-hour trading volume reached $44.75 billion after a 47.71% increase. This substantial increase in trading volume indicates heightened market interest and provides the liquidity necessary for sustained price movements.

Corporate Treasury Adoption

Corporate treasury strategies have expanded to include ETH alongside Bitcoin. Companies like Sharplink Gaming and Bitmine Immersion Technology recently added the asset to their balance sheets. This trend represents a significant development in cryptocurrency adoption, as corporations increasingly view Ethereum as a legitimate treasury asset.

Staking and Network Fundamentals

Supply Dynamics

Staking activity has surged, with more than 34 million ETH now locked, reducing the available supply and putting upward pressure on price. With nearly 29% of ETH’s total supply staked, the market is tightening. This supply reduction creates favorable conditions for price appreciation, as fewer tokens are available for trading while demand continues to increase.

On-chain data from Glassnode shows ETH balances on centralized exchanges have fallen to an eight-year low of 13.5%, a level not seen since July 2016. The decrease in exchange balances indicates that investors are holding their ETH for longer periods, reducing selling pressure.

Network Activity and Utility

Ethereum’s fundamental strength extends beyond price appreciation to encompass real-world utility and adoption. Market strategist Joel Kruger from LMAX Group noted ETH’s growing role in settlement and tokenization infrastructure. This expanding utility reinforces Ethereum’s position as the dominant smart contract platform.

DeFi platforms experienced increased activity on the Ethereum network. Growing usage supported the bullish price predictions from analysts. The continued growth in decentralized finance applications built on Ethereum demonstrates the platform’s ongoing relevance and utility.

Comparative Analysis with Other Cryptocurrencies

Ethereum vs Bitcoin Performance

The ETH/BTC ratio showed improvement during the rally period. This metric indicated Ethereum gaining relative strength against Bitcoin. This relative outperformance suggests that investors are rotating capital from Bitcoin to Ethereum, recognizing the latter’s potential for superior returns.

While Bitcoin still leads in total ETF volume, Ethereum is catching up faster than expected. The appeal of Ethereum staking, combined with real-world applications in decentralized finance, NFTs, and tokenized assets, positions ETH as a serious contender in the broader crypto market.

Market Positioning

Ethereum is holding up as the strongest of the three, supported by ETF demand, locked supply, and cleaner price action. When compared to other major cryptocurrencies like Solana and XRP, Ethereum demonstrates superior technical and fundamental characteristics that support continued price appreciation.

Future Price Predictions and Market Outlook

Short-term Projections

Ethereum price is predicted to trade between $2,600 and $3,100 in July 2025, with a potential upside toward $3,200 if institutional inflows persist and the market sustains momentum from ETF-driven rallies. These near-term projections reflect the continued strength in institutional demand and improving technical positioning.

Analysts are now forecasting a potential rally toward $8,000 by the end of 2025. While such projections require sustained institutional adoption and favorable market conditions, they reflect the growing confidence in Ethereum’s long-term prospects.

Long-term Growth Drivers

Ethereum 2.0 upgrades enhanced network efficiency and reduced gas fees. These improvements made the platform more attractive for institutional adoption. The ongoing technological improvements to the Ethereum network provide a foundation for sustained growth and adoption.

The upcoming Fusaka hard fork and continued dominance in DeFi could serve as long-term tailwinds. These network upgrades and ecosystem developments support the thesis for continued price appreciation.

Investment Considerations and Risk Factors

Regulatory Environment

However, the SEC’s pending decision on staking provisions in ETFs (expected July 2025) creates uncertainty in the near term. Regulatory clarity remains an important factor for institutional adoption, and positive developments could further accelerate ETF inflows.

Market Volatility

Some traders anticipated a pullback to $2,800 before the next leg up. The support zone could provide entry opportunities for swing traders. While the long-term outlook remains positive, investors should be prepared for potential volatility as the market consolidates recent gains.

Conclusion

Ethereum’s breakthrough above $2,800 resistance, supported by record ETF inflows and strengthening fundamentals, positions the cryptocurrency for continued growth. The combination of institutional adoption, technological improvements, and supply dynamics creates a favorable environment for price appreciation. However, investors should remain mindful of regulatory developments and market volatility as they consider their investment strategies in this evolving landscape.