The cryptocurrency landscape continues to evolve at breakneck speed, and among the standout projects capturing investor attention is the dYdX Token (DYDX). As one of the most promising decentralized finance protocols, dYdX Token has established itself as a cornerstone of the decentralized trading ecosystem.

This comprehensive guide explores everything you need to know about DYDX price predictions, trading strategies, staking opportunities, and the future potential of this innovative governance token. Whether you’re a seasoned crypto trader or just beginning your journey into decentralized finance, understanding the dYdX Token ecosystem is crucial for making informed investment decisions in 2025.

What is dYdX Token Understanding the Revolutionary DeFi Protocol?

The dYdX Token represents the governance token of dYdX, one of the most sophisticated decentralized trading platforms in the cryptocurrency space. Built on Ethereum and later migrating to its own blockchain infrastructure, dYdX has revolutionized how traders approach decentralized derivatives trading, perpetual contracts, and margin trading.

DYDX serves multiple critical functions within the ecosystem, acting as both a governance mechanism and an incentive structure for platform participants. Token holders can participate in protocol governance decisions, stake their tokens for rewards, and benefit from various fee reductions across the platform. The dYdX Token has emerged as more than just a utility token, evolving into a comprehensive ecosystem that bridges traditional finance concepts with cutting-edge blockchain technology.

The platform’s architecture allows users to trade cryptocurrencies with leverage, access perpetual swaps, and participate in sophisticated trading strategies previously available only through centralized exchanges. This positioning has made DYDX particularly attractive to institutional investors and professional traders seeking decentralized alternatives to traditional trading venues.

dYdX Token Price Analysis and Market Performance

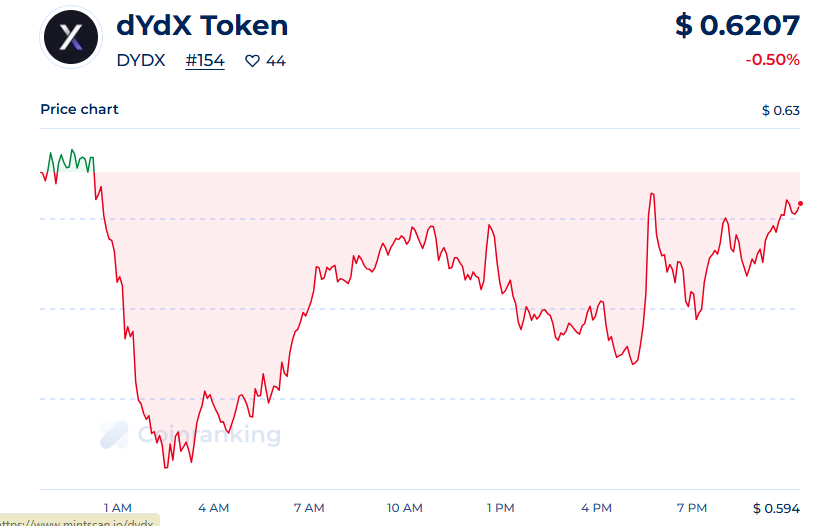

Understanding DYDX price movements requires analyzing various market factors, technological developments, and broader cryptocurrency trends. The dYdX Token has experienced significant volatility since its launch, reflecting both the platform’s growing adoption and the inherent volatility of the DeFi sector.

Historical price data reveals that DYDX has followed cyclical patterns common among governance tokens, with prices often correlating with platform usage metrics, trading volume, and overall DeFi market sentiment. The token reached its all-time high during the peak of DeFi summer, demonstrating the strong correlation between platform success and token valuation.

Market analysts consistently point to several key factors influencing DYDX price dynamics. Platform trading volume serves as a primary driver, as increased activity generates more fee revenue and enhances token utility. Additionally, governance proposals and protocol upgrades often trigger price movements as they signal future development directions and potential value accrual mechanisms.

The dYdX Token has also benefited from increasing institutional adoption of decentralized trading platforms. As more professional traders and institutions seek decentralized alternatives, the demand for native tokens like DYDX tends to increase, creating positive price pressure.

How dYdX Trading Works Mastering Decentralized Derivatives

DYDx trading represents a paradigm shift in how cryptocurrency derivatives are accessed and executed. Unlike centralized exchanges that require users to deposit funds into custodial wallets, dYdX allows traders to maintain control of their assets while accessing sophisticated trading instruments.

The platform’s orderbook model provides deep liquidity for major cryptocurrency pairs, enabling traders to execute large orders with minimal slippage. dYdX trading supports perpetual contracts with leverage up to 20x, allowing both retail and institutional participants to implement complex trading strategies.

One of the most compelling aspects of dYdX trading is the integration of automated market making and professional market makers, ensuring consistent liquidity across different market conditions. This hybrid approach combines the benefits of decentralized architecture with the liquidity traditionally associated with centralized platforms.

The platform’s risk management system automatically handles position liquidations, margin requirements, and collateral management, reducing the complexity for traders while maintaining the security benefits of decentralized finance. DYD trading also incorporates advanced order types, including stop-loss orders, take-profit orders, and conditional orders that execute automatically based on predefined criteria.

DYDX Staking Rewards and Governance Participation

DYDX staking offers token holders multiple ways to generate passive income while contributing to network security and governance. The staking mechanism serves as a cornerstone of the dYdX Token ecosystem, aligning incentives between token holders and platform success.

Stakers receive rewards from multiple sources, including platform trading fees, governance participation incentives, and network security rewards. The DYDX staking system implements a sophisticated distribution mechanism that rewards long-term holders while encouraging active participation in protocol governance.

The governance aspect of DYDX staking enables token holders to propose and vote on protocol upgrades, fee structures, and strategic partnerships. This democratic approach to platform development ensures that dYdX Token holders have direct influence over the protocol’s future direction.

Staking rewards are distributed proportionally based on stake size and duration, with additional bonuses for participants who consistently engage in governance activities. The DYDX staking program also includes delegation options, allowing smaller holders to participate in governance through trusted representatives while still earning proportional rewards.

Also Read: Hyperliquid (HYPE) Price Forecast 2025–2030: What to Expect

dYdX Governance Token Decentralized Decision Making

As a dYdX governance token, DYDX empowers holders to participate in critical protocol decisions that shape the platform’s future. The governance framework covers various aspects of platform operation, from technical upgrades to economic parameters and strategic partnerships.

The dYdX governance token system implements a sophisticated proposal and voting mechanism that ensures broad community participation while maintaining efficient decision-making processes. Proposals typically undergo community discussion periods, formal voting phases, and implementation timelines that provide transparency and predictability for all stakeholders.

Recent governance decisions have addressed important topics such as fee structures, reward distribution mechanisms, and integration with other DeFi protocols. The dYdX governance token framework also enables emergency procedures for critical security updates while maintaining decentralized oversight of such decisions.

Token holder participation in governance activities directly influences platform development priorities, making DYDX ownership a genuine stake in the protocol’s future success. This governance model has proven effective in balancing community interests with technical requirements and competitive positioning.

dYdX V4 Migration and Technical Developments

The transition to dYdX V4 represents a significant milestone for the dYdX Token ecosystem, introducing substantial technical improvements and expanded functionality. This migration involves moving from Ethereum-based infrastructure to a custom blockchain built using Cosmos SDK, providing enhanced scalability and reduced transaction costs.

dYdX V4 maintains full decentralization while significantly improving performance metrics such as transaction throughput, settlement times, and gas costs. These improvements directly benefit dYdX Token holders through enhanced platform utility and increased adoption potential.

The new architecture introduces additional use cases for DYDX, including network validation rewards and enhanced governance mechanisms. Token holders can now participate in consensus mechanisms while earning additional rewards beyond traditional staking and governance activities.

Technical upgrades in dYdX V4 also include improved order matching algorithms, enhanced risk management systems, and expanded asset support. These developments position the dYdX Token ecosystem for sustained growth and competitive advantages in the evolving DeFi landscape.

DYDX Price Prediction 2025 Expert Analysis and Market Outlook

DYDX price prediction 2025 requires careful analysis of multiple factors including platform adoption, competitive positioning, regulatory developments, and broader cryptocurrency market trends. Industry experts generally maintain optimistic outlooks based on the platform’s strong technical foundation and growing user base.

Several key metrics support positive DYDX price prediction 2025 scenarios, including increasing trading volumes, expanding institutional adoption, and successful technical migrations. The platform’s ability to capture market share from centralized competitors represents a significant growth catalyst that could drive sustained price appreciation.

Market analysts highlight the importance of successful DYDXV4 implementation for DYDX price prediction 2025 accuracy. The technical improvements and expanded functionality should enhance platform competitiveness and attract additional users, directly benefiting token valuation through increased utility and demand.

Conservative DYDX price prediction 2025 estimates suggest potential price ranges based on historical volatility patterns and fundamental analysis. However, the rapidly evolving DeFi sector and potential regulatory clarity could create scenarios significantly above or below these baseline projections.

Competitive Analysis dYdX vs Other DeFi Protocols

The dYdX Token ecosystem faces competition from various decentralized trading platforms, each offering unique advantages and targeting different market segments. Understanding this competitive landscape is crucial for evaluating DYDX’s investment potential and long-term viability.

Major competitors include platforms like Perpetual Protocol, GMX, and traditional centralized exchanges expanding into DeFi services. Each competitor offers different approaches to decentralized trading, from automated market makers to orderbook models and hybrid architectures.

DYDx trading advantages include deep liquidity, professional-grade trading tools, and proven scalability. The platform’s institutional focus and regulatory compliance efforts also differentiate it from more retail-oriented competitors, potentially providing sustainable competitive advantages.

The dYdX Token benefits from first-mover advantages in decentralized derivatives trading while continuously evolving to maintain competitive positioning. Strategic partnerships, technical innovations, and governance-driven development cycles help maintain the platform’s market leadership position.

Regulatory Landscape and Compliance Considerations

The regulatory environment significantly impacts dYdX Token valuation and platform adoption prospects. As governments worldwide develop cryptocurrency and DeFi regulations, platforms like dYdX must balance decentralization principles with compliance requirements.

Recent regulatory developments have generally been favorable for established DeFi protocols that demonstrate strong governance structures and compliance efforts. The dYdX team’s proactive approach to regulatory engagement positions the platform advantageously as clarity emerges across different jurisdictions.

DYDX holders benefit from the platform’s emphasis on compliance and regulatory cooperation, which reduces regulatory risks that could negatively impact token valuation. This approach also facilitates institutional adoption, as professional investors typically require regulatory clarity before making significant commitments.

The evolving regulatory landscape creates both opportunities and challenges for dYdX Token holders. Clear regulations could accelerate mainstream adoption while potentially limiting certain platform features or requiring operational modifications.

Risk Factors and Investment Considerations

Investing in the dYdX Token involves various risks that potential investors should carefully consider before making financial commitments. Understanding these risk factors enables more informed investment decisions and appropriate position sizing strategies.

Smart contract risks represent a fundamental consideration for DYDX investors, as the platform relies on complex blockchain-based systems that could contain vulnerabilities or face security breaches. While the protocol has undergone extensive auditing, the inherent risks of smart contract platforms remain relevant.

Market volatility significantly impacts DYDX price movements, often amplifying broader cryptocurrency market trends. The token’s correlation with both DeFi sector performance and general risk asset movements creates additional volatility that investors must consider in their portfolio allocation decisions.

Competitive pressures pose ongoing challenges for dYdX Token valuation, as new platforms and technologies continuously emerge in the rapidly evolving DeFi sector. Maintaining competitive advantages requires ongoing innovation and adaptation, which may not always be successful.

Investment Strategies for dYdX Token

Developing effective investment strategies for dYdX Token requires understanding various approaches suitable for different risk tolerances and investment objectives. Both short-term trading and long-term holding strategies can be viable depending on individual circumstances and market conditions.

Long-term DYDX investment strategies often focus on the platform’s fundamental growth prospects, including user adoption, trading volume growth, and successful technical developments. This approach benefits from the compounding effects of DYDX staking rewards and potential price appreciation over extended periods.

Active trading strategies for dYdX Token can capitalize on the volatility that characterizes most DeFi tokens. Technical analysis, event-driven trading around governance proposals or platform updates, and correlation trading with broader DeFi sector movements represent common approaches.

Dollar-cost averaging represents a balanced approach for DYDX investment, reducing timing risks while enabling gradual position building over time. This strategy particularly suits investors who believe in long-term platform prospects but want to mitigate short-term volatility impacts.

Integration with DeFi Ecosystem

The dYdX Token ecosystem’s integration with broader DeFi protocols creates additional utility and value accrual opportunities for token holders. These integrations expand DYDX use cases beyond the native platform while contributing to overall ecosystem growth.

Cross-protocol collaborations enable dYdX Token holders to access additional earning opportunities through various DeFi strategies. Yield farming protocols, lending platforms, and automated portfolio management services increasingly support DYDX, expanding investment options for token holders.

The dYdX platform’s integration with major DeFi infrastructure providers ensures compatibility with popular wallets, analytics tools, and portfolio management applications. This integration reduces friction for users while increasing platform accessibility across different user segments.

Interoperability developments allow DYDX to function across multiple blockchain networks, potentially expanding the token’s utility and market reach. These technical integrations position the dYdX Token ecosystem for continued growth as blockchain infrastructure evolves.

Future Developments and Roadmap

The dYdX Token ecosystem’s future developments focus on scalability improvements, feature expansion, and enhanced user experience across all platform components. Understanding these planned developments helps investors evaluate long-term value creation potential.

Upcoming technical upgrades aim to improve dYdX trading performance through enhanced matching algorithms, reduced latency, and expanded asset support. These improvements should increase platform competitiveness while creating additional utility for DYDX holders.

The development roadmap includes governance system enhancements that provide dYdX Token holders with greater influence over platform direction and value distribution mechanisms. These governance improvements aim to increase community engagement while maintaining efficient decision-making processes.

Strategic partnership announcements and integration developments continue expanding the dYdX ecosystem’s reach and functionality. These partnerships often create new use cases for DYDX while providing access to additional user bases and market opportunities.

Conclusion

The dYdX Token represents one of the most compelling opportunities in the decentralized finance sector, combining proven platform performance with innovative governance mechanisms and substantial growth potential. As the DeFi landscape continues evolving, DYDX stands positioned to benefit from increasing institutional adoption, technical improvements, and expanding use cases.

Successful dYdX V4 implementation, continued platform growth, and favorable regulatory developments could drive significant value creation for dYdX Token holders throughout 2025 and beyond. The platform’s focus on professional-grade trading tools and institutional adoption differentiates it from competitors while creating sustainable competitive advantages.

For investors considering DYDX allocation, the combination of staking rewards, governance participation, and potential price appreciation creates multiple value accrual mechanisms that could generate attractive risk-adjusted returns. However, as with all cryptocurrency investments, careful consideration of risk factors and appropriate position sizing remains essential.

The dYdX Token ecosystem’s future success depends on continued innovation, community engagement, and successful adaptation to evolving market conditions. Investors who understand these dynamics and believe in decentralized finance’s long-term prospects may find DYDX an attractive addition to diversified cryptocurrency portfolios.

Ready to explore dYdX Token investment opportunities? Research the platform’s current developments, consider your risk tolerance, and evaluate how DYDX fits within your broader investment strategy before making any financial commitments.