The cryptocurrency market continues to captivate investors worldwide. Cryptocurrency price prediction news is becoming one of the most sought-after information sources for traders and enthusiasts alike. As we navigate through 2025, the digital asset landscape presents unprecedented opportunities and challenges. That demands careful analysis and expert insights. From Bitcoin’s remarkable surge past $120,000 to emerging altcoins showing explosive growth potential, staying informed about cryptocurrency price predictions is crucial. It has never been more vital for making informed investment decisions.

Market analysts and blockchain experts are closely monitoring various factors that influence crypto. The valuations include institutional adoption, regulatory developments, technological advancements, and macroeconomic trends. The cryptocurrency price prediction news landscape has evolved significantly. Sophisticated analytical tools and AI-driven forecasting models provide more accurate market insights than ever before. Whether you’re a seasoned trader or a newcomer to the crypto space, understanding these predictions can help you navigate the volatile waters of digital asset investing with greater confidence and strategic clarity.

Latest Bitcoin Price Predictions and Market Analysis

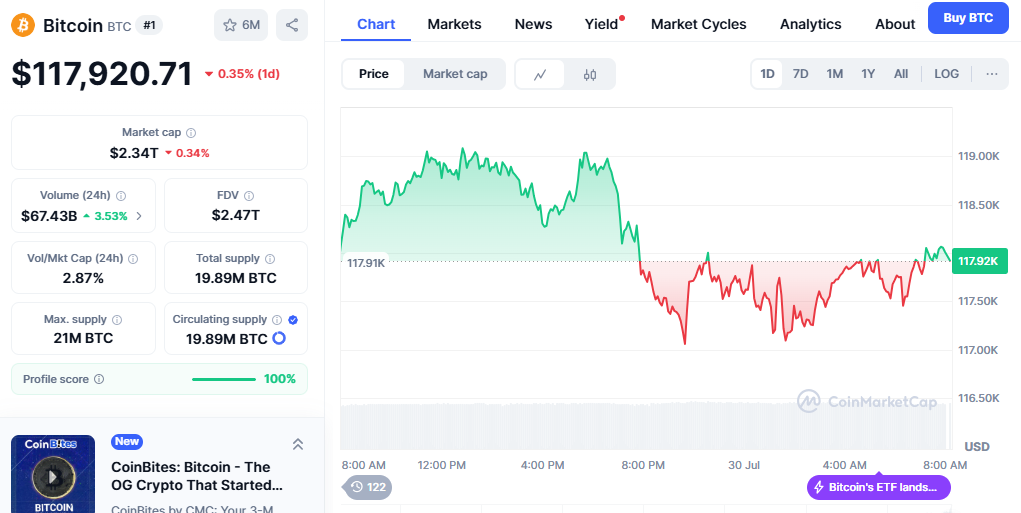

Bitcoin’s price trajectory continues to dominate cryptocurrency price prediction news headlines, with experts forecasting significant movements based on various fundamental and technical indicators. Recent institutional buying patterns suggest sustained upward pressure, particularly with the introduction of spot Bitcoin ETFs that have attracted billions in investor capital. Leading analysts project Bitcoin could reach $150,000 to $180,000 by the end of 2025, driven by increasing corporate adoption and potential inclusion in national strategic reserves.

The current market sentiment around Bitcoin remains overwhelmingly bullish, supported by on-chain metrics showing decreasing exchange reserves and increasing long-term holder accumulation. Mining difficulty adjustments and the upcoming halving effects continue to influence supply dynamics, creating fundamental support for higher price levels. Technical analysis reveals strong support levels around $100,000, with resistance points identified at $130,000 and $160,000, respectively.

Bitcoin ETF Impact on Price Forecasts

Exchange-traded funds focused on Bitcoin have revolutionized institutional access to cryptocurrency markets, generating consistent inflow patterns that support bullish price predictions. These financial instruments have attracted traditional investors who previously avoided direct cryptocurrency exposure, creating a new source of sustained demand. Market data indicates that ETF inflows directly correlate with Bitcoin price movements, suggesting continued positive pressure on valuations.

The approval of additional Bitcoin ETF products from major financial institutions signals growing mainstream acceptance and institutional confidence in cryptocurrency as an asset class. This development strengthens long-term price prediction models and reduces volatility concerns that previously deterred conservative investors from entering the market.

Ethereum Price Predictions DeFi and Layer 2 Growth Drivers

Ethereum’s price outlook remains closely tied to the growth of decentralized finance (DeFi) protocols and layer two scaling solutions that enhance network utility and user adoption. Current cryptocurrency price prediction news suggests Ethereum could surpass $6,000 in 2025, driven by increased transaction volume from emerging applications in gaming, social media, and enterprise blockchain solutions. The successful implementation of proof-of-stake consensus and ongoing network upgrades continues to improve efficiency and reduce environmental concerns.

Smart contract innovation and the rise of real-world asset tokenization create additional demand for Ethereum’s native token, supporting bullish price predictions from industry experts. Layer 2 solutions like Optimism and Arbitrum are processing increasing transaction volumes while reducing costs, making Ethereum more accessible to retail users and developers building new applications.

DeFi Protocol Growth and ETH Demand

The total value locked (TVL) in DeFi protocols continues expanding, with projections suggesting it could exceed $200 billion by year-end. This growth directly impacts Ethereum demand as most DeFi applications require ETH for transaction fees and collateral purposes. Yield farming opportunities and liquid staking derivatives are creating new use cases that support higher price predictions for Ethereum.

Emerging DeFi innovations, including decentralized autonomous organizations (DAOs), prediction markets, and synthetic assets, are driving sustained network activity. That translates into increased fee revenue and token burn mechanisms, creating deflationary pressure that supports bullish price forecasts.

Altcoin Market Predictions and Emerging Opportunities

The altcoin sector offers diverse investment opportunities with varying risk profiles and growth potential, as indicated by recent cryptocurrency price prediction news reports. Tokens focused on artificial intelligence, gaming, and Web3 infrastructure are attracting significant attention from investors seeking exposure to emerging technological trends. Market analysts identify several categories of altcoins positioned for substantial growth based on fundamental developments and adoption metrics.

Layer 1 blockchain competitors to Ethereum, including Solana, Cardano, and Polkadot, continue developing unique value propositions that could drive price appreciation as the multi-chain ecosystem matures. These platforms offer different approaches to scalability, governance, and developer experience, creating diverse investment opportunities for portfolio diversification strategies.

AI-Powered Cryptocurrency Projects

Artificial intelligence integration with blockchain technology represents one of the most promising sectors for altcoin investments in 2025. Projects focusing on AI agents, machine learning optimization, and decentralized computing resources are gaining traction among developers and investors alike. These tokens often exhibit higher volatility but offer significant upside potential as the AI crypto narrative gains mainstream attention.

Token projects that successfully integrate AI functionality with practical use cases are expected to outperform the broader market, with some predictions suggesting 500-1000% gains for leading projects in this sector. However, investors should carefully evaluate the technical capabilities and real-world applications of AI crypto projects before making investment decisions.

Market Sentiment Indicators and Technical Analysis

Understanding market sentiment remains crucial for interpreting cryptocurrency price prediction news and making informed trading decisions. Fear and greed index measurements, social media sentiment analysis, and on-chain metrics provide valuable insights into market psychology and potential price movements. Current indicators suggest cautious optimism among crypto investors, with institutional participation providing stability during volatile periods.

Technical analysis tools, including moving averages, relative strength indicators, and support/resistance levels, help traders identify optimal entry and exit points based on historical price patterns. Fibonacci retracement levels and Elliott Wave theory applications provide additional frameworks for understanding potential price targets and correction phases in cryptocurrency markets.

Also Read: Cryptocurrency Market Analysis Expert Insights & Trends 2025

On-Chain Metrics and Price Correlations

Blockchain analytics platforms provide unprecedented visibility into cryptocurrency market dynamics through on-chain data analysis. Metrics such as active addresses, transaction volumes, and whale accumulation patterns offer leading indicators for price movements. That complements traditional technical analysis methods. These data sources have become essential components of professional cryptocurrency price prediction methodologies.

Network growth metrics, including developer activity, protocol upgrades, and ecosystem expansion, provide fundamental analysis frameworks for evaluating long-term investment opportunities in various cryptocurrency projects. Correlation analysis between on-chain metrics and price movements helps identify reliable indicators for future market trends.

Regulatory Impact on Cryptocurrency Valuations

Government regulations continue shaping cryptocurrency markets through policy announcements, legal clarifications, and enforcement actions that directly impact price predictions. The evolving regulatory landscape in major markets, including the United States, European Union, and Asia-Pacific regions, creates both opportunities and challenges for cryptocurrency valuations. Recent developments suggest increasing regulatory clarity that supports institutional adoption and mainstream acceptance.

Central bank digital currency (CBDC) developments and stablecoin regulations are creating new frameworks that could influence cryptocurrency demand and utility. These regulatory changes often trigger significant price movements as markets adjust to new compliance requirements and operational standards for cryptocurrency businesses and service providers.

Global Regulatory Trends and Market Impact

International cooperation on cryptocurrency regulations is improving market stability and reducing regulatory arbitrage opportunities that previously created price discrepancies across different jurisdictions. Standardized compliance frameworks are emerging that provide greater certainty for institutional investors and traditional financial services companies considering cryptocurrency exposure.

Tax policy developments and reporting requirements continue evolving, with implications for cryptocurrency trading strategies and long-term holding decisions. Clear regulatory guidelines generally support higher valuations by reducing uncertainty and compliance costs for market participants.

Institutional Adoption and Price Catalysts

Corporate treasury allocations to cryptocurrency continue expanding, with major companies announcing Bitcoin and Ethereum purchases as inflation hedges and alternative investment strategies. This institutional adoption trend provides fundamental support for bulls. The cryptocurrency price prediction news reduces volatility through sustained demand from large-scale buyers with long-term investment horizons.

Traditional financial institutions, including banks, insurance companies, and pension funds, are gradually increasing their cryptocurrency exposure through various investment vehicles. This institutional participation brings professional risk management practices and sophisticated analytical capabilities that contribute to market maturation and price stability.

Corporate Treasury Strategies

Fortune 500 companies are increasingly considering cryptocurrency allocations as part of diversified treasury management strategies. These corporate investments often involve substantial amounts that can significantly impact market liquidity and price discovery mechanisms. Public announcements of corporate cryptocurrency purchases frequently trigger positive price movements across the broader market.

The trend toward corporate cryptocurrency adoption is expected to accelerate as accounting standards and regulatory frameworks become more established, providing clear guidelines for reporting and managing digital asset investments within corporate structures

Trading Strategies Based on Price Predictions

Professional traders employ various strategies to capitalize on cryptocurrency price predictions while managing downside risks through proper position sizing and risk management techniques. Dollar-cost averaging, momentum trading, and mean reversion strategies each offer different approaches to cryptocurrency investment based on individual risk tolerance and market outlook preferences.

Derivatives markets, including futures, options, and perpetual swaps, provide additional tools for implementing sophisticated trading strategies that can profit from both upward and downward price movements. These instruments allow traders to hedge existing positions or amplify returns through leveraged exposure to cryptocurrency price movements.

Risk Management in Crypto Trading

Successful cryptocurrency trading requires disciplined risk management practices, including stop-loss orders, position sizing rules, and portfolio diversification strategies. Professional traders typically risk only small percentages of their capital on individual trades while maintaining diversified exposure across multiple cryptocurrency projects and market sectors.

Technical analysis combined with fundamental research provides frameworks for identifying high-probability trading opportunities while avoiding common pitfalls that lead to significant losses in volatile cryptocurrency markets. Education and continuous learning remain essential components of successful cryptocurrency trading strategies.

Future Market Outlook and Long-Term Predictions

The long-term outlook for cryptocurrency markets remains positive according to most expert analyses, with technological improvements, institutional adoption, and regulatory clarity supporting sustained growth over multi-year periods. Blockchain technology applications continue expanding beyond financial services into supply chain management, digital identity, and decentralized autonomous organizations.

Emerging trends, including Web3 gaming, virtual reality integration, and Internet of Things (IoT) connectivity, are creating new use cases for cryptocurrency tokens. That could drive demand and price appreciation over the coming decade. These technological developments represent fundamental shifts in how digital value is created, stored, and transferred across global networks..

Conclusion

Staying informed about cryptocurrency price prediction news is essential for navigating the dynamic digital asset landscape successfully. The insights and analysis provided by industry experts help investors make more informed decisions while understanding the risks and opportunities present in cryptocurrency markets. As the sector continues maturing with increased institutional participation and regulatory clarity, price predictions become more sophisticated and reliable.

Ready to stay ahead of the cryptocurrency market trends? Subscribe to our newsletter for daily cryptocurrency price prediction news updates, expert analysis, and exclusive market insights that can help optimize your investment strategy. Don’t miss the next significant or price movement – join thousands of successful crypto investors. They rely on professional analysis to guide their trading decisions.