The world of digital assets has never been more dynamic, making cryptocurrency market news analysis essential for investors, traders, and enthusiasts alike. With Bitcoin reaching unprecedented heights above $120,000 and institutional adoption accelerating rapidly, understanding market movements has become crucial for making informed decisions in this volatile landscape.

Our comprehensive cryptocurrency market news analysis reveals that the digital asset ecosystem is experiencing a fundamental shift. From regulatory clarity in major economies to the emergence of AI-powered trading tools, the factors influencing crypto markets have evolved significantly. Whether you’re a seasoned investor or just beginning your crypto journey, staying informed through reliable market analysis can mean the difference between capitalizing on opportunities and missing critical market signals.

In this detailed guide, we’ll explore the latest developments shaping the cryptocurrency landscape, provide expert insights into market trends, and equip you with the knowledge needed to navigate today’s complex digital asset environment effectively.

Latest Cryptocurrency Market Trends and Analysis

Bitcoin’s Historic Rally Breaking Down the $120K Milestone

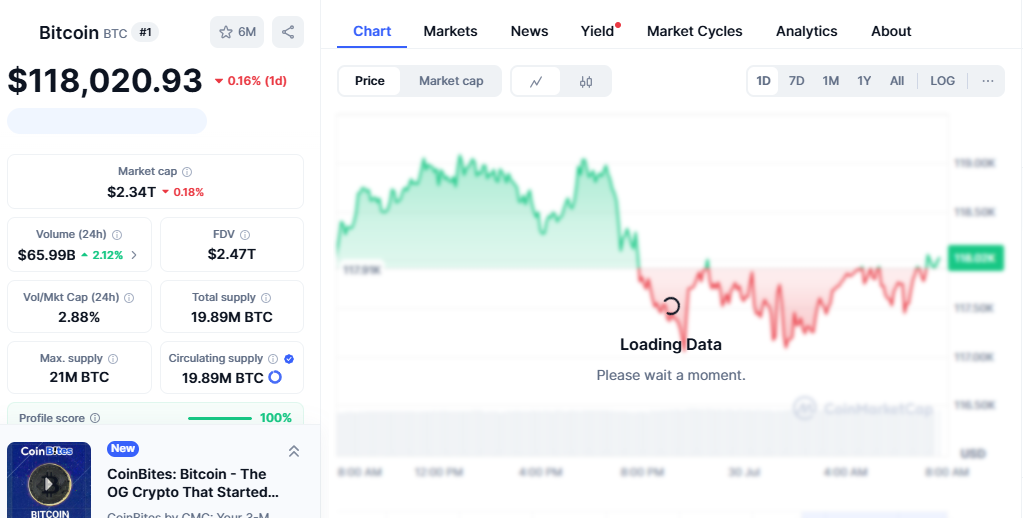

The cryptocurrency market has witnessed extraordinary momentum in 2025, with Bitcoin’s surge past $120,000 marking a pivotal moment in digital asset history. This remarkable achievement stems from several converging factors that our market analysis indicates will continue influencing price movements.

Institutional demand has emerged as the primary driver behind Bitcoin’s latest rally. BlackRock’s IBIT ETF alone has recorded inflows exceeding $1.18 billion in a single day, demonstrating unprecedented institutional appetite for cryptocurrency exposure. This influx of traditional finance capital represents a fundamental shift in how institutional investors perceive digital assets as legitimate portfolio components.

The technical analysis reveals strong support levels around $115,000, with resistance potentially forming near $125,000. Market sentiment indicators suggest that while short-term volatility remains likely, the underlying bullish structure appears intact. Trading volume patterns indicate that institutional buyers are accumulating positions rather than engaging in speculative trading, which historically supports more sustainable price appreciation.

Ethereum’s Recovery and Layer 2 Scaling Solutions

Ethereum’s performance in the current market cycle demonstrates the network’s evolving utility beyond simple value storage. Trading above $3,000, ETH has benefited from increased activity in decentralized finance (DeFi) protocols and the growing adoption of Layer 2 scaling solutions.

The implementation of Ethereum’s proof-of-stake consensus mechanism continues to influence market dynamics through its deflationary tokenomics. Transaction fee burns have reduced ETH’s circulating supply, creating upward pressure on prices while improving network efficiency. This fundamental change in Ethereum’s monetary policy represents a significant factor in long-term valuation models.

Layer 2 solutions like Arbitrum and Optimism have processed billions in transaction volume, alleviating network congestion while maintaining security guarantees. This technological advancement positions Ethereum favorably for continued growth in decentralized applications and institutional adoption.

Cryptocurrency Market News Analysis

Regulatory Developments Shaping Market Sentiment

Regulatory clarity has emerged as one of the most significant factors influencing cryptocurrency valuations in 2025. The United States’ evolving approach to digital asset regulation, particularly regarding Bitcoin strategic reserves and ETF approvals, has created a more favorable environment for institutional participation.

The Securities and Exchange Commission’s recent approval of in-kind Bitcoin and Ethereum ETFs represents a significant milestone in crypto market maturation. These developments reduce regulatory uncertainty while providing traditional investors with familiar investment vehicles for cryptocurrency exposure.

International regulatory frameworks continue evolving, with countries like Brazil approving spot XRP ETFs and other nations developing comprehensive digital asset legislation. This global trend toward regulatory clarity supports long-term market stability and institutional confidence.

Institutional Adoption and Corporate Treasury Strategies

Corporate adoption of cryptocurrency as a treasury asset has accelerated significantly, with numerous public companies allocating portions of their cash reserves to Bitcoin. This trend reflects growing recognition of digital assets as hedges against inflation and currency debasement.

Payment processors and financial institutions are integrating cryptocurrency capabilities into their service offerings, expanding the practical utility of digital assets. Major credit card companies now support cryptocurrency transactions, while traditional banks offer custody services for institutional clients.

The emergence of cryptocurrency-based lending and borrowing platforms has created new revenue opportunities for institutional investors. These DeFi protocols offer yields that often exceed traditional fixed-income investments, attracting institutional capital seeking higher returns.

Also Read: Ethereum Price Forecast Analysis 2025 Expert Predictions & Market

Technical Analysis and Price Predictions

Bitcoin Price Trajectory and Support Levels

Current technical indicators suggest Bitcoin’s price structure remains bullish despite short-term volatility concerns. The Relative Strength Index (RSI) approaching overbought conditions indicates potential for short-term consolidation around current levels.

Support levels have been established at $110,000 and $105,000, providing downside protection during market corrections. The 50-day moving average continues trending upward, supporting the overall bullish narrative while giving dynamic support during pullbacks.

Options market data reveals significant interest in $130,000 and $150,000 strike prices for the remainder of 2025, suggesting market participants anticipate continued upward momentum. However, implied volatility levels indicate expectations for substantial price swings in both directions.

Altcoin Performance and Market Rotation

Alternative cryptocurrencies have demonstrated mixed performance relative to Bitcoin’s gains, with some projects outperforming while others lag significantly. Market analysis reveals increasing discrimination among investors, who are favoring projects with straightforward utility and strong fundamentals.

Ethereum’s ecosystem tokens, including those supporting DeFi protocols and Layer 2 solutions, have generally outperformed the broader altcoin market. This performance differential reflects investors’ preference for tokens with demonstrated use cases and revenue generation potential.

Meme coins and speculative assets have experienced heightened volatility, with some achieving extraordinary gains while others have declined substantially. This divergence suggests market maturation, where fundamental analysis increasingly influences investment decisions.

Understanding Market Volatility and Risk Management

Factors Contributing to Crypto Market Volatility

Cryptocurrency markets remain inherently volatile due to several structural factors that distinguish them from traditional asset classes. Relatively low market capitalization compared to global equity markets means that large transactions can significantly impact prices.

News events, regulatory announcements, and social media sentiment continue to exert an outsized influence on cryptocurrency prices. The 24/7 nature of crypto markets amplifies these effects, as there are no trading halts or circuit breakers to moderate extreme price movements.

Leverage usage in cryptocurrency trading remains substantial, with many platforms offering high margin ratios. This leverage amplifies both gains and losses, contributing to rapid price swings during periods of market stress or euphoria.

Risk Management Strategies for Crypto Investors

Successful cryptocurrency investing requires robust risk management strategies that account for the asset class’s unique characteristics. Position sizing becomes critical, with many experts recommending that cryptocurrency investments represent no more than 5-10% of total investment portfolios.

Dollar-cost averaging has proven effective for long-term investors seeking to minimize timing risk. This strategy involves making regular purchases regardless of price, helping smooth out the volatility’s impact on overall portfolio performance.

Stop-loss orders and profit-taking strategies help protect gains while limiting downside exposure. However, these tools require careful implementation in highly volatile markets to avoid premature exits during temporary price declines.

Future Outlook and Market Predictions

Emerging Trends in Cryptocurrency Markets

Artificial intelligence integration with cryptocurrency trading and analysis tools represents a significant emerging trend. AI-powered trading algorithms and analysis platforms are becoming increasingly sophisticated, potentially improving market efficiency while creating new opportunities for informed investors.

Central Bank Digital Currencies (CBDCs) development continues to progress globally, with several countries conducting pilot programs. While CBDCs differ fundamentally from decentralized cryptocurrencies, their introduction may increase overall digital asset awareness and adoption.

Non-Fungible Tokens (NFTs) and tokenization of real-world assets are expanding beyond art and collectibles into practical applications like real estate, intellectual property, and financial instruments. This trend could significantly expand the total addressable market for blockchain-based assets.

Long-term Market Outlook

Long-term cryptocurrency market prospects remain positive despite short-term volatility concerns. Institutional adoption continues accelerating, while technological improvements address scalability and usability challenges that previously limited mainstream adoption.

Demographics favor continued cryptocurrency growth, as younger generations demonstrate higher comfort levels with digital assets. This generational shift suggests that cryptocurrency adoption will continue expanding as digital natives accumulate wealth and investment decision-making authority.

Global economic uncertainty and monetary policy concerns support the investment thesis for decentralized digital assets. As central banks maintain accommodative policies and government debt levels increase, cryptocurrencies may benefit from their scarcity and decentralized characteristics.

Investment Strategies and Portfolio Allocation

Building a Diversified Cryptocurrency Portfolio

Effective cryptocurrency portfolio construction requires understanding the different categories of digital assets and their risk-return characteristics. Bitcoin typically serves as the foundation for crypto portfolios due to its established market position and relatively lower volatility compared to smaller cryptocurrencies.

Ethereum and other innovative contract platforms represent the next layer of portfolio construction, offering exposure to the growing decentralized application ecosystem. These platforms benefit from network effects and have demonstrated revenue generation through transaction fees and staking rewards.

Smaller alternative cryptocurrencies can provide portfolio diversification and higher growth potential, but they also carry significantly higher risks. Limiting exposure to these assets while maintaining some allocation allows investors to participate in potential breakthrough projects without excessive risk.

Tax Considerations and Regulatory Compliance

Cryptocurrency taxation continues evolving, with most jurisdictions treating digital assets as taxable property subject to capital gains regulations. Proper record-keeping becomes essential for accurate tax reporting and compliance with local laws.

Regulatory compliance requirements vary significantly between jurisdictions, making it essential for investors to understand their local obligations. Some countries require registration for cryptocurrency activities, while others impose restrictions on certain types of digital assets.

Professional tax and legal advice becomes valuable for significant cryptocurrency investments, particularly for institutional investors or high-net-worth individuals. The regulatory landscape continues evolving rapidly, making ongoing compliance monitoring essential.

Conclusion

The cryptocurrency landscape in 2025 presents unprecedented opportunities for informed investors willing to navigate its complexities through comprehensive market analysis. From Bitcoin’s historic rally to institutional adoption acceleration, the factors driving digital asset valuations continue evolving rapidly.

Staying informed through reliable cryptocurrency market news analysis has never been more critical for investment success. Whether you’re building your first crypto portfolio or managing institutional digital asset allocations, understanding market trends, regulatory developments, and technological innovations provides the foundation for sound investment decisions.

Ready to enhance your cryptocurrency investment strategy? Start by following reputable news sources, developing a systematic approach to market analysis, and considering how digital assets fit within your overall investment objectives. Remember that successful cryptocurrency investing requires patience, discipline, and continuous learning in this rapidly evolving market.