Crypto market update highlights a familiar but powerful narrative in the digital asset space: sharp declines followed by a resilient recovery. After experiencing notable selling pressure earlier in the week, the Bitcoin price managed to rebound and ultimately end the week higher, signaling renewed confidence among traders and investors. This recovery did not happen in isolation—it reflected a complex mix of market psychology, technical support levels, and broader macroeconomic influences shaping the cryptocurrency market.

Earlier losses triggered fear across the market, forcing leveraged traders to reduce exposure while cautious investors waited on the sidelines. However, as selling pressure weakened, buyers stepped in aggressively, driving prices upward and restoring short-term optimism. The ability of Bitcoin to recover from downside volatility once again demonstrated its role as the market’s anchor asset and the primary barometer of overall crypto sentiment.

In this in-depth crypto market update, we explore what caused the initial drop, why the Bitcoin price was able to recover, how altcoins reacted, and what this price action may signal for the coming weeks. Whether you are a long-term investor or an active trader, understanding these dynamics is essential for navigating today’s fast-moving digital asset environment.

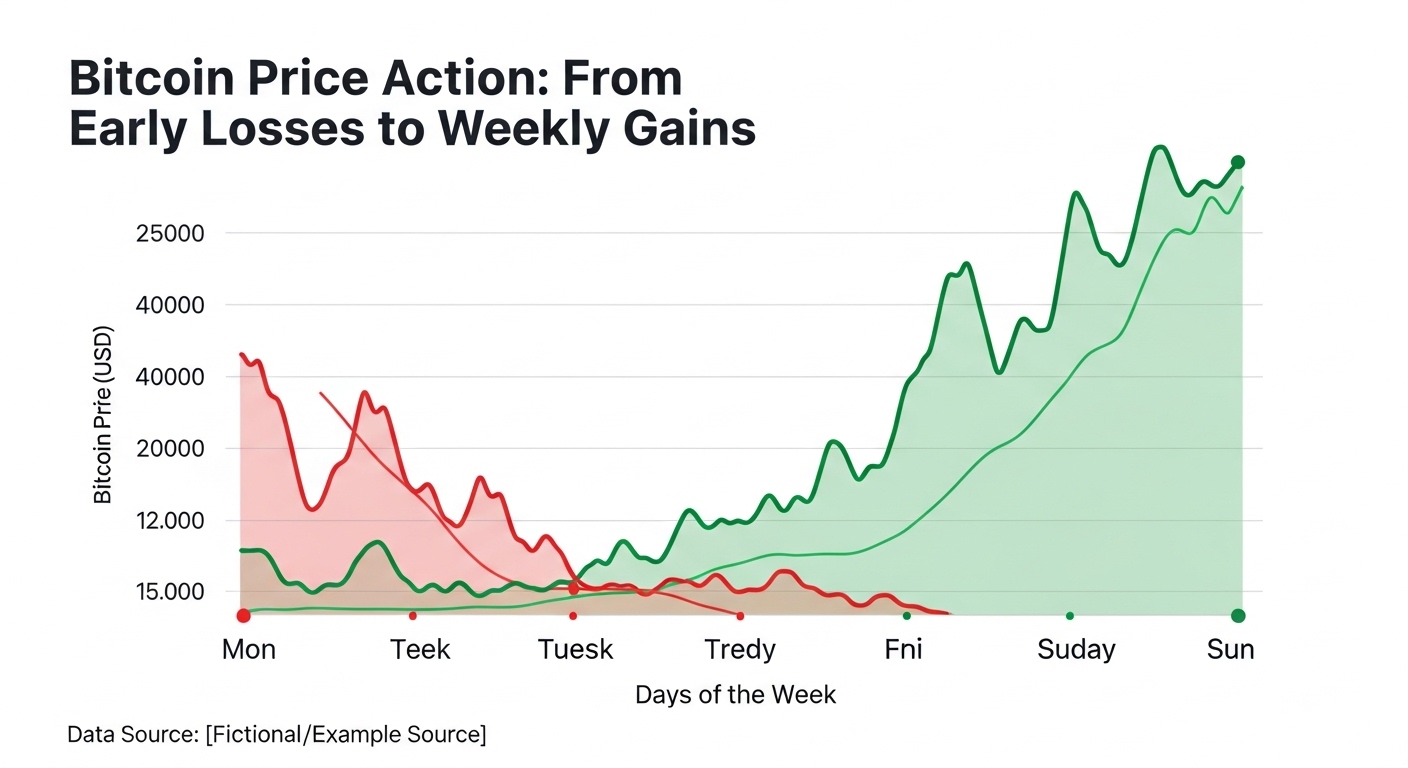

Bitcoin Price Action: From Early Losses to Weekly Gains

The week began with heavy selling pressure as Bitcoin struggled to maintain key price levels. Market uncertainty, combined with cautious risk sentiment, pushed the Bitcoin price lower and triggered a wave of liquidations across derivatives markets. These earlier losses created a tense environment, with many participants questioning whether a deeper correction was unfolding.

As the week progressed, however, the tone shifted. Selling momentum slowed, and Bitcoin found support at critical demand zones. Once buyers regained control, price action improved rapidly, allowing Bitcoin to recover much of its losses. By the end of the week, Bitcoin had reclaimed higher ground, closing with a net gain and reinforcing its reputation for resilience during volatile periods.

This type of price behavior is common in crypto markets, where sharp declines are often followed by equally sharp recoveries. The key takeaway from this crypto market update is not just that Bitcoin bounced, but that buyers were willing to step in decisively after fear peaked.

Why Bitcoin Was Able to Recover

Several factors contributed to Bitcoin’s ability to end the week higher following earlier losses. Understanding these drivers helps explain why the recovery was possible despite ongoing uncertainty.

Market Sentiment and Trader Psychology

Crypto markets are heavily influenced by sentiment. When prices fall quickly, fear tends to spread faster than fundamentals change. This week’s decline pushed sentiment into pessimistic territory, setting the stage for a rebound. Once selling exhaustion became evident, traders who had been waiting for confirmation began buying, fueling upward momentum. The psychological shift from fear to cautious optimism played a crucial role in stabilizing the Bitcoin price and supporting its recovery.

Short Covering and Liquidation Dynamics

Leverage is a defining feature of crypto trading. During the selloff, many long positions were liquidated, reducing downside pressure. As prices rebounded, traders who had opened short positions were forced to cover, creating additional buying demand. This short-covering effect accelerated the rebound and helped Bitcoin regain lost ground. While these dynamics can produce rapid price movements, they also underline the importance of understanding leverage-driven volatility in any crypto market update.

Long-Term Buyer Interest

Despite short-term volatility, Bitcoin continues to attract long-term buyers who view dips as opportunities. These participants are less concerned with daily price fluctuations and more focused on Bitcoin’s broader adoption and scarcity narrative. Their steady accumulation during periods of weakness helped form a base from which the price could recover.

Altcoins and Ethereum: Following Bitcoin’s Lead

Bitcoin’s recovery influenced the broader cryptocurrency market, but the response among altcoins was mixed. Ethereum and other large-cap digital assets showed signs of stabilization, though their rebounds were generally less pronounced than Bitcoin’s.

This divergence highlights an important aspect of market structure: when uncertainty remains high, capital often flows first into Bitcoin before rotating into altcoins. As a result, Bitcoin dominance can increase during recovery phases, even when the overall market improves. For investors, this crypto market update reinforces the idea that Bitcoin typically leads both downturns and recoveries, with altcoins following once confidence strengthens.

Technical Outlook: Key Levels Shaping the Market

Technical analysis remains a valuable tool for interpreting price behavior, especially after volatile weeks. Following Bitcoin’s rebound, traders are closely watching specific support and resistance zones to assess whether the recovery can continue.

Support Levels After the Rebound

The price zone where Bitcoin found support during the selloff has become a critical reference point. As long as the Bitcoin price remains above this area, short-term sentiment is likely to remain constructive. A break below it, however, could reopen the door to renewed selling pressure.

Resistance and Market Confirmation

On the upside, Bitcoin faces resistance near levels where selling previously intensified. Successfully reclaiming and holding above these zones would signal strengthening momentum and increase confidence in a sustained move higher. Failure to do so may result in continued sideways consolidation. This technical balance reflects a market still searching for direction, making upcoming price action especially important.

Broader Market Context and Macro Influence

Bitcoin does not exist in isolation. Global financial conditions, interest rate expectations, and risk appetite across traditional markets all influence crypto price action. During this week’s volatility, broader market uncertainty contributed to earlier losses, while stabilization elsewhere supported Bitcoin’s recovery. Understanding these macro influences is essential for interpreting any crypto market update, as shifts in global sentiment can quickly alter the outlook for digital assets.

What This Means for the Week Ahead

The fact that the Bitcoin price ended the week higher after earlier losses is a positive signal, but it does not eliminate risk. Volatility remains elevated, and markets may continue to react sharply to new information. For traders, flexibility and risk management are crucial. For long-term investors, maintaining perspective and focusing on broader trends can help navigate short-term noise. This crypto market update suggests a market that is resilient but cautious, capable of strong recoveries yet still sensitive to shifts in sentiment.

Conclusion

This week’s crypto market update showcased Bitcoin’s ability to recover from adversity. After suffering notable losses earlier in the week, the Bitcoin price rebounded and closed higher, restoring confidence and stabilizing the broader cryptocurrency market. While challenges remain, the recovery demonstrated that demand for Bitcoin persists even during uncertain conditions.

As the market moves forward, attention will remain on whether Bitcoin can build on this momentum or whether further consolidation lies ahead. Either way, the events of this week serve as a reminder of why Bitcoin continues to command attention as the leading digital asset.

FAQs

Q: Why did Bitcoin recover after earlier losses?

Bitcoin recovered as selling pressure eased, buyers stepped in at key levels, and short positions were forced to close, creating upward momentum.

Q: Does a higher weekly close mean Bitcoin will keep rising?

Not necessarily. A higher weekly close shows resilience, but sustained gains depend on follow-through, market confidence, and broader conditions.

Q: How did altcoins react to Bitcoin’s rebound?

Altcoins generally stabilized, but many underperformed Bitcoin, reflecting cautious sentiment and a preference for the market’s leading asset.

Q: What should traders watch next?

Traders should monitor key support and resistance levels, volume trends, and overall market sentiment for clues about the next move.

Q: Is this a good time for long-term investors?

Long-term investors often view volatility as part of the market cycle. Decisions should align with individual risk tolerance and investment goals.

Also Read: Crypto Market Volatility Sparks Bitcoin Liquidations