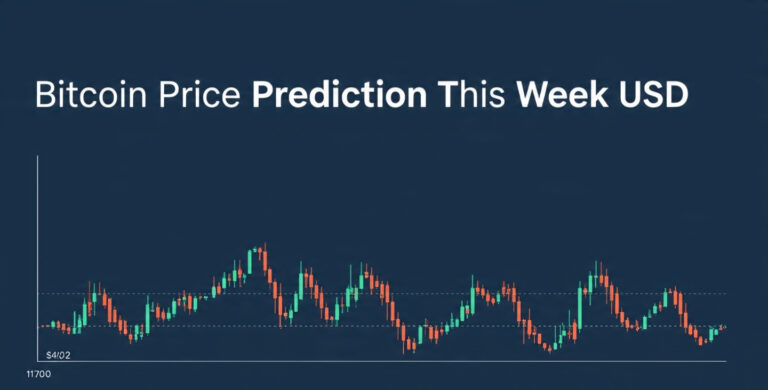

The Bitcoin price prediction this week presents a complex landscape of mixed signals as the world’s leading cryptocurrency navigates through significant market volatility. Currently trading around $118,400, Bitcoin (BTC) has shown remarkable resilience despite recent macroeconomic headwinds, including President Trump’s modified tariff policies that triggered a temporary selloff across risk assets.

Market analysts are closely monitoring several key factors that could influence Bitcoin’s price movement in the coming days. The cryptocurrency has maintained its position above critical moving averages, with the 20-day EMA at $117,105 providing immediate support. However, recent trading sessions have revealed increased volatility, with BTC experiencing a 3% decline following geopolitical developments and policy announcements.

The current market sentiment reflects a neutral stance, with the Fear & Greed Index sitting at 53 (Neutral), down from 62 (Greed) recorded the previous week. This shift in sentiment comes as institutional investors continue to evaluate their positions while retail traders remain cautious about the cryptocurrency’s near-term direction.

Expert technical analysis suggests that Bitcoin’s price action remains above all major exponential moving averages, including the 50-day ($112,980), 100-day ($107,603), and 200-day ($100,239), indicating that the underlying bullish momentum remains intact despite short-term fluctuations.

Current Bitcoin Market Analysis

Technical Indicators and Price Levels

The Bitcoin price prediction for next week is between $115,472 on the lower end and $123,367 on the high end, according to leading cryptocurrency analysts. The technical analysis reveals several critical price levels that traders should monitor:

Key Support Levels:

- Primary Support: $117,000-$118,000 zone

- Secondary Support: $113,000-$115,000 range

- Critical Support: $110,000 psychological level

Key Resistance Levels:

- Immediate Resistance: $120,000-$122,000

- Significant Resistance: $125,000-$128,000

- Psychological Target: $130,000

The Relative Strength Index (RSI) currently stands at 40.58, indicating that Bitcoin is in neutral territory, neither oversold nor overbought. This suggests room for movement in either direction based on market catalysts.

Market Sentiment and Volume Analysis

Bitcoin saw $228 million in liquidations across centralised exchanges in the past 24 hours, according to CoinGlass, highlighting the increased volatility following recent market events. The trading volume has spiked significantly, with Bitcoin’s 24-hour trading volume on major exchanges spiking to over $30 billion during the sell-off.

Volume indicators suggest heightened market activity, which often precedes significant price movements. The surge in trading activity reflects both institutional and retail participation, with many traders positioning themselves for potential breakouts or breakdowns from current levels.

Also Read: Bitcoin Next 24 Hours Prediction 2025 Expert Analysis and Market Insights

Expert Bitcoin Price Predictions for This Week

Short-Term Price Targets

Leading cryptocurrency analysts have provided varied Bitcoin price predictions for the current week. According to our Bitcoin forecast, the price of Bitcoin will increase by 4.95% over the next week and reach $119tby by August 8, 2025.

Bullish Scenario:

- Target 1: $120,000-$122,000 (24-48 hours)

- Target 2: $125,000-$127,000 (end of week)

- Upside Catalyst: Breaking above $118,000-$120,000 resistance

Bearish Scenario:

- Support Test: $113,000-$115,000

- Downside Risk: Below $110,000 could accelerate selling

- Risk Factors: Continued macro uncertainty and policy developments

Mid-Term Outlook (August 2025)

If the price holds above the $117K–$118K support zone, Bitcoin price prediction suggests a surge of 6%–8%, targeting $125,000 to $128,000 by August 2025. Several analysts maintain optimistic projections for the remainder of August:

Monthly Targets:

- Conservative Estimate: $121,855 (3.4% monthly gain)

- MoPredictiondiction: $128,765 (9.3% monthly increase)

- Optimistic Scenario: $141,645 (potential peak value)

Bitcoin price prediction for August 2025. The initial price was $117,854. The high cost is 130385, while the low price is 98148, indicating significant volatility expected throughout the month.

Market Factors Influencing Bitcoin Price

Macroeconomic Environment

The cryptocurrency market continues to be influenced by broader economic factors. Recent developments include:

Federal Reserve Policy:

- Potential interest rate cuts are on the horizon. Weakening US Dollar Index (DXY) supporting risk assets

- Increased global liquidity is benefiting Bitcoin

Geopolitical Factors: President Donald Trump unveiled his modified “reciprocal” tariffs on dozens of countries, creating short-term volatility but potentially reinforcing Bitcoin’s role as a hedge against currency debasement.

Institutional Adoption and ETF Flows

Bitcoin ETFs continue to play a crucial role in price discovery and institutional adoption. Strong inflows have provided underlying support for Bitcoin prices, despite short-term volatility. Strong inflows of spot U.S. Bitcoin ETFs drive this optimistic outlook among institutional analysts.

ETF Impact Factors:

- Continued institutional accumulation

- Major wirehouses’ approval process

- Projected asset management growth

On-Chain Analysis

Blockchain data reveals essential insights about Bitcoin’s network health:

Network Metrics:

- Hash Rate: Maintaining strong levels indicating miner confidence

- Active Addresses: Steady growth in network participation

- Long-term Holders: Continued accumulation patterns

- Exchange Reserves: Declining supplies suggest reduced selling pressure

Risk Factors and Market Challenges

Short-Term Risks

Several factors could negatively impact Bitcoin’s price in the near term:

Market Risks:

- Leverage Liquidations: High leverage positions are vulnerable to volatility

- Regulatory Uncertainty: Potential policy changes affecting market sentiment

- Correlation Risk: Continued correlation with traditional equity markets

Technical Challenges

On the four-hour chart, Bitcoin is bearish. The 50-day moving average is falling, suggesting a weakening short-term trend. This presents challenges for immediate price action, though longer-term indicators remain positive.

Technical Concerns:

- Short-term moving average weakness

- Increased volatility metrics

- Potential head-and-shoulders pattern formation

Long-Term Bitcoin Price Outlook 2025

Year-End Projections

Cryptocurrency experts maintain largely bullish projections for Bitcoin through the remainder of 2025:

2025 Price Targets:

- Conservative: $142,500-$155,000

- Moderate: $168,000-$180,000

- Aggressive: $200,000+ (institutional adoption scenario)

Analysts at research and brokerage firm Bernstein have revised their Bitcoin price target upwards, forecasting that the cryptocurrency could reach nearly $200,000 by the end of next year.

Fundamental Drivers

Key Growth Catalysts:

- Bitcoin Halving Effects: Continued supply reduction impact

- Institutional Adoption: Growing corporate treasury adoption

- Regulatory Clarity: Improved regulatory framework development

- Technological Improvements: Lightning Network and scaling solutions

Trading Strategies and Risk Management

Professional Trading Approaches

Risk Management Strategies:

- Stop-Loss Levels: Below $115,000 for short-term positions

- Position Sizing: Limit exposure to 2-5% of portfolio

- Profit Taking: Scale out profits at resistance levels

- Hedging Options: Consider derivatives for portfolio protection

Investment Considerations

For long-term investors, current levels may present opportunities, but timing and risk management remain crucial. If you invest $1,000.00 in Bitcoin today and hold it until September 4, no prediction suggests you could see a potential profit of $86.11, reflecting an 8.61% ROI over the next 31 days.

Investment Strategies:

- Dollar-Cost Averaging: A Systematic accumulation approach

- Buy-the-Dip: Strategic purchases during pullbacks

- HODL Strategy: Long-term accumulation and holding

- Diversification: Balanced cryptocurrency portfolio approach

Market Sentiment and Social Indicators

Fear and Greed Analysis

Per our technical indicators, the current sentiment is Neutral while the Fear & Greed Index is showing 53 (neutral). This neutral sentiment suggests the market is balanced between fear and greed, potentially setting up for significant moves in either direction based on upcoming catalysts.

Sentiment Indicators:

- Social Media Activity: Moderate engagement levels

- Google Trends: Stable search volume for Bitcoin-related terms

- Institutional Surveys: Cautiously optimistic outlook

- Retail Sentiment: Mixed signals from retail investors

Conclusion

The Bitcoin price prediction this week suggests a critical juncture for the cryptocurrency as it consolidates around the $118,000 level. While technical indicators show mixed signals with neutral sentiment prevailing, the underlying bullish structure remains intact with Bitcoin trading above major moving averages.

Key takeaways for the week ahead include monitoring the $117,000-$118,000 support zone for stability and watching for a potential breakout above $120,000-$122,000 resistance. Market volatility is expected to remain elevated due to ongoing macroeconomic factors and geopolitical developments.