The cryptocurrency market continues to evolve at breakneck speed, and investors worldwide are seeking reliable insights into where Bitcoin might head next. If you’re looking for a comprehensive bitcoin price prediction 2025 today, you’ve come to the right place. With Bitcoin trading at unprecedented levels and institutional adoption reaching new heights, understanding the potential price movements for 2025 has never been more crucial for both seasoned traders and newcomers alike.

Recent market developments have positioned Bitcoin as a significant player in the global financial landscape. The world’s largest cryptocurrency has demonstrated remarkable resilience, breaking through multiple resistance levels and establishing itself as a legitimate store of value. As we analyze the current market conditions and examine expert predictions, this comprehensive guide will provide you with the essential information needed to make informed investment decisions in today’s volatile crypto environment.

Bitcoin Price Analysis Current Market Conditions

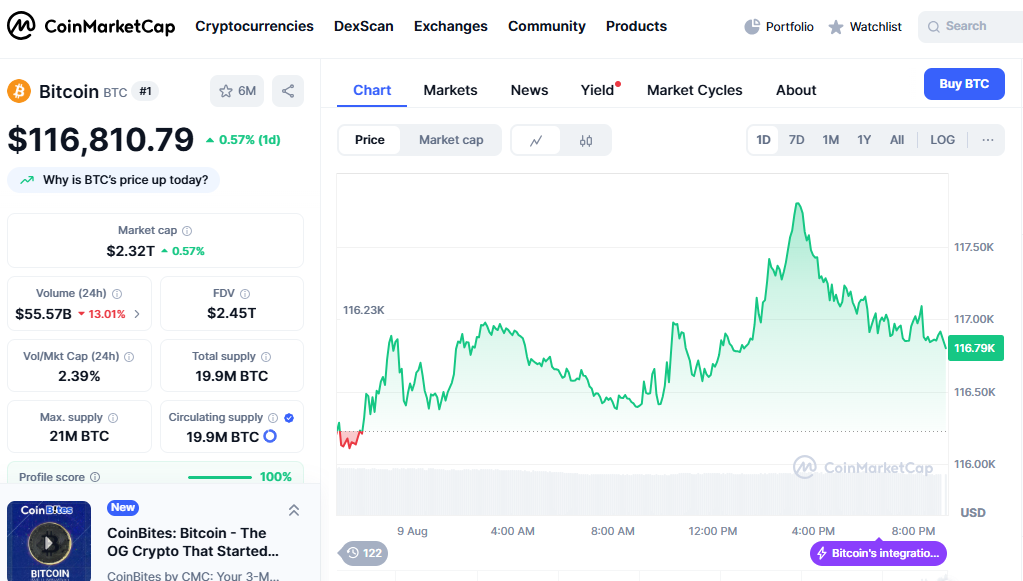

Bitcoin’s price performance in recent months has been nothing short of extraordinary. The cryptocurrency has shown impressive strength, maintaining levels above $100,000 for over 80 consecutive days. This sustained performance has caught the attention of institutional investors, governments, and retail traders alike.

Current technical indicators suggest that Bitcoin is consolidating around key support levels. The BTC price analysis reveals several important factors influencing today’s market:

Market Sentiment and Trading Volume

Trading volumes have remained robust, with daily volumes consistently exceeding $50 billion. This high liquidity indicates strong market participation and confidence among investors. The bitcoin market analysis shows that both retail and institutional investors are actively participating in the current price action.

Exchange outflows have reached multi-year lows, with only 147.5K BTC remaining in miner over-the-counter balances. This scarcity of available supply on exchanges typically precedes significant upward price movements, supporting a bullish crypto price forecast.

Technical Resistance and Support Levels

Key resistance levels for Bitcoin currently sit around $120,000-$123,000, while strong support has been established near $110,000-$112,000. These levels are crucial for determining the short-term direction of Bitcoin’s price movement.

Bitcoin Price Prediction 2025 Expert Forecasts Today

Leading analysts and financial institutions have released their bitcoin price prediction 2025 today, and the consensus remains cautiously optimistic. Here’s what top experts are saying:

Institutional Predictions

JPMorgan’s Bitcoin Forecast: The investment banking giant expects Bitcoin to maintain its dominance over other cryptocurrencies throughout 2025. Their analysts cite Bitcoin’s appeal as a digital hedge against inflation and continued institutional investment as primary drivers.

Morgan Stanley’s Outlook: The financial services company believes the cryptocurrency market is on the verge of transformation. They expect significant price appreciation driven by institutional interest and regulatory progress, with BTC price targets potentially reaching $135,000-$150,000.

Fidelity Investments’ Perspective: The asset management firm predicts 2025 will be the year of further decentralization adoption, which could positively impact Bitcoin’s price through increased utility and demand.

Independent Analyst Predictions

Peter Brandt’s Analysis: The veteran trader and CEO of Factor LLC maintains a bitcoin price prediction of $135,000 ± $15,000 for 2025, though he acknowledges the possibility of significant volatility.

Robert Kiyosaki’s Bold Forecast: The “Rich Dad Poor Dad” author has suggested Bitcoin could reach as high as $500,000, though this represents a more aggressive prediction compared to mainstream analysts.

Algorithmic and Model-Based Predictions

Advanced algorithmic models suggest more conservative targets:

- Short-term models indicate Bitcoin may trade between $115,000-$117,000 in the coming weeks

- Medium-term projections point to potential ranges of $130,000-$170,000 by year-end

- Long-term models maintain targets of $146,000-$250,000 by 2026

Factors Influencing Bitcoin Price in 2025

Several key factors will likely determine Bitcoin’s price trajectory throughout 2025:

Regulatory Developments

The regulatory landscape continues to evolve favorably for Bitcoin. The recent executive order signed by President Trump calling for a federal digital asset strategy, including Bitcoin in national reserves, represents a significant milestone for mainstream adoption.

Institutional Adoption

Cryptocurrency investment by institutions shows no signs of slowing. Major corporations continue to add Bitcoin to their treasury reserves, while financial institutions are developing new Bitcoin-related products and services.

Technological Improvements

Layer 2 solutions and scaling improvements continue to enhance Bitcoin’s utility. These developments could increase demand and support higher Bitcoin valuations in 2025.

Macroeconomic Factors

Global economic uncertainty, inflation concerns, and currency devaluation fears continue to drive interest in Bitcoin as a store of value. The digital asset market benefits from these macroeconomic trends.

Bitcoin Investment Strategies for 2025

Given the current bitcoin price prediction 2025 today, here are strategic approaches investors might consider:

Dollar-Cost Averaging (DCA)

DCA strategy remains one of the most effective approaches for Bitcoin investment. This method involves making regular purchases regardless of price, helping to smooth out volatility over time.

HODLing Strategy

Long-term holders who maintain their positions through market cycles have historically achieved the best returns. The HODL strategy requires patience but has proven effective for Bitcoin investors.

Technical Analysis Approach

Active traders can benefit from understanding Bitcoin chart patterns, support and resistance levels, and momentum indicators to time their entries and exits more effectively.

Risks and Considerations for Bitcoin Investment

While bitcoin price predictions remain optimistic, investors should be aware of potential risks:

Market Volatility

Cryptocurrency volatility remains high, and prices can fluctuate dramatically in short periods. Investors should only invest what they can afford to lose.

Regulatory Changes

Future regulatory developments could impact Bitcoin’s price positively or negatively. Staying informed about policy changes is crucial for long-term investors.

Technology Risks

As with any digital asset, technological risks including security breaches, protocol changes, or technical failures could affect Bitcoin’s market value.

Bitcoin vs. Alternative Cryptocurrencies in 2025

Bitcoin dominance in the cryptocurrency market remains strong, but investors often wonder about alternative investments:

Ethereum Comparison

While Ethereum offers different utility through smart contracts, Bitcoin’s position as digital gold remains unchallenged. The BTC vs ETH debate continues, but both serve different purposes in a diversified crypto portfolio.

Altcoin Considerations

Altcoin season patterns suggest that while alternative cryptocurrencies may experience periods of outperformance, Bitcoin typically maintains its leadership position during major bull markets.

Global Economic Impact on Bitcoin Price

The global economy continues to influence Bitcoin’s price through various channels:

Inflation Hedge Properties

Bitcoin’s fixed supply makes it attractive as an inflation hedge, particularly as central banks continue expansionary monetary policies.

Currency Debasement

As fiat currencies face devaluation pressures, Bitcoin’s appeal as a store of value increases among both individual and institutional investors.

Geopolitical Tensions

Political uncertainty and international conflicts often drive capital flows toward safe-haven assets, including Bitcoin.

Technical Analysis: Bitcoin Price Patterns in 2025

Technical analysis reveals several important patterns for Bitcoin in 2025:

Chart Patterns

Current Bitcoin chart analysis shows the formation of bullish flag patterns and ascending triangles, suggesting potential upward momentum.

Moving Averages

Bitcoin continues to trade above key moving averages, indicating a healthy uptrend. The 200-day moving average serves as crucial support.

Volume Analysis

Trading volume patterns suggest strong institutional participation and reduced selling pressure from long-term holders.

Mining Economics and Bitcoin Price

Bitcoin mining economics play a crucial role in price determination:

Hash Rate Trends

The Bitcoin hash rate continues to reach new all-time highs, indicating network security and miner confidence in future price appreciation.

Mining Difficulty Adjustments

Regular difficulty adjustments help maintain network stability while influencing mining profitability and potential selling pressure.

Miner Behavior

Reduced selling by miners, as evidenced by lower exchange inflows, supports current price levels and future price appreciation.

Bitcoin Adoption Trends Affecting 2025 Price

Mainstream adoption continues to accelerate across multiple sectors:

Corporate Treasury Adoption

More companies are adding Bitcoin to their corporate treasuries, reducing available supply and supporting higher prices.

Payment Integration

Increased Bitcoin payment acceptance by merchants and financial institutions enhances utility and demand.

Government Reserves

The potential inclusion of Bitcoin in government reserves represents a paradigm shift that could significantly impact prices.

Investment Portfolio Considerations

Portfolio allocation strategies for Bitcoin in 2025 should consider:

Risk Management

Proper risk management techniques include position sizing, stop-loss strategies, and diversification across asset classes.

Asset Allocation

Financial advisors increasingly recommend Bitcoin allocation of 1-5% in traditional investment portfolios.

Tax Considerations

Understanding cryptocurrency taxation is essential for optimizing after-tax returns on Bitcoin investments.

Future Price Catalysts for Bitcoin

Several potential price catalysts could drive Bitcoin higher in 2025:

ETF Developments

Additional Bitcoin ETF approvals and increased institutional access could drive significant capital inflows.

Regulatory Clarity

Clear cryptocurrency regulations would likely reduce uncertainty and encourage broader adoption.

Technological Breakthroughs

Blockchain innovation and scaling solutions could enhance Bitcoin’s utility and value proposition.

Conclusion

The bitcoin price prediction 2025 today presents a compelling case for continued growth, with expert analyses pointing toward significant appreciation potential. While volatility remains a constant in the cryptocurrency market, Bitcoin’s fundamentals continue to strengthen through institutional adoption, regulatory progress, and technological improvements.

Current market conditions suggest that Bitcoin is well-positioned for further gains in 2025, with technical indicators supporting bullish sentiment and fundamental factors remaining favorable. However, investors should approach Bitcoin investment with careful consideration of their risk tolerance and investment objectives.

Whether you’re a seasoned crypto investor or considering your first Bitcoin purchase, staying informed about market developments and maintaining a long-term perspective will be crucial for success. The bitcoin price prediction 2025 today offers optimism, but remember that cryptocurrency markets can be unpredictable, and proper risk management remains essential.