Bitcoin price is once again approaching a decisive moment as volatility compresses and market sentiment grows increasingly divided. After weeks of choppy, range-bound trading, analysts are now pointing to the possibility that Bitcoin could form a sub-$80K bottom this week, driven by a classic Wyckoff-style market structure. While such a move may sound alarming at first glance, seasoned traders recognize that sharp downside sweeps often occur near turning points, not at the beginning of prolonged collapses.

Bitcoin has historically shown a tendency to shake out weak hands before resuming directional trends. The current environment, marked by declining momentum, leveraged positioning, and repeated resistance rejections, has reignited debate over whether one final downside flush is needed to reset market structure. According to a new Wyckoff forecast, Bitcoin price action may be preparing for precisely that type of event.

Rather than predicting a long-term bearish reversal, this forecast suggests a short-lived breakdown below psychological support, designed to absorb excess supply and trigger capitulation. Understanding why analysts are watching the $80,000 level, how Wyckoff theory applies, and what confirmation would look like can help traders navigate the uncertainty with clarity instead of fear.

This article explores the mechanics behind the Bitcoin price sub-$80K bottom thesis, explains the Wyckoff method in detail, evaluates key price levels, and outlines the scenarios that could follow. Whether Bitcoin rebounds sharply or continues consolidating, the coming days may define the next major phase of the market.

Current Bitcoin price structure and market sentiment

The Bitcoin price has spent considerable time oscillating within a narrowing range, creating frustration for both bulls and bears. Each attempt to rally has been met with selling pressure, while downside moves have struggled to gain sustained follow-through. This type of behavior often signals indecision, but it also creates the conditions for explosive moves once equilibrium breaks.

From a market psychology standpoint, prolonged consolidation encourages leverage. Traders become confident that support will hold or resistance will break, leading to crowded positions on both sides. When too many market participants share the same expectation, price tends to move in the opposite direction to rebalance liquidity. This dynamic plays a central role in the Wyckoff accumulation and distribution model.

The rising discussion around a Bitcoin price drop below $80K stems from the idea that downside liquidity remains unfinished. Stops are clustered beneath obvious support levels, and price has yet to demonstrate a clear sign of strength that would invalidate the need for a deeper test. While this does not guarantee a breakdown, it does increase the probability of a volatility expansion aimed at flushing excess positioning.

Understanding the Wyckoff method in Bitcoin trading

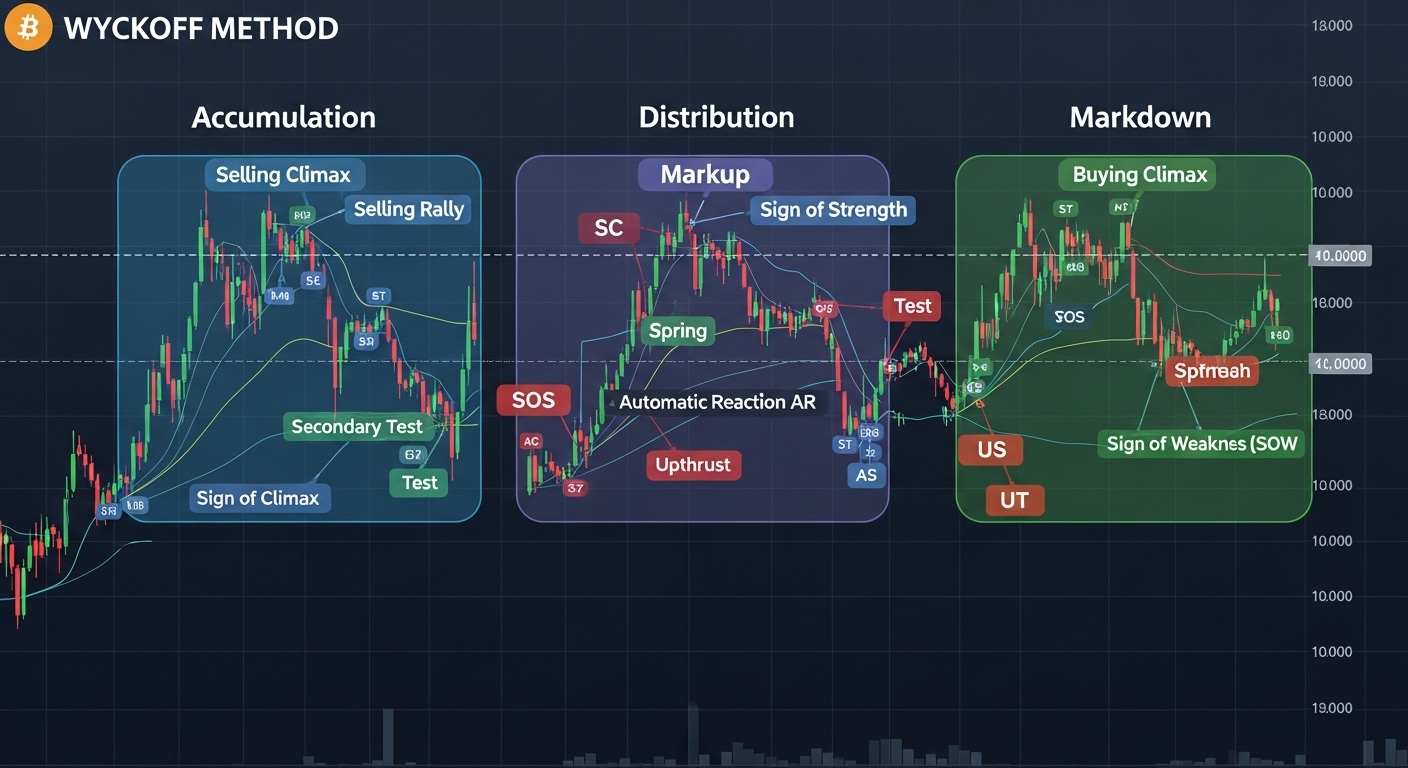

The Wyckoff method is a market analysis framework that focuses on supply and demand, price structure, and trader behavior rather than indicators alone. It divides market cycles into four primary phases: accumulation, markup, distribution, and markdown. Each phase reflects a different balance between buyers and sellers.

The psychology behind Wyckoff patterns

Wyckoff theory assumes that large market participants accumulate or distribute positions gradually to avoid moving price against themselves. During accumulation, price often moves sideways with deceptive breakdowns and rallies designed to mislead retail traders. These false moves are not random; they serve to transfer assets from emotional participants to stronger hands.

In the context of the Bitcoin price, Wyckoff patterns are particularly relevant due to Bitcoin’s liquidity and leverage-driven volatility. Crypto markets frequently exhibit exaggerated reactions to support and resistance levels, making them fertile ground for Wyckoff-style setups.

Why Wyckoff analysis resonates in crypto markets

Unlike traditional markets with fixed trading hours, Bitcoin trades continuously, allowing momentum and sentiment shifts to play out rapidly. This constant flow increases the likelihood of stop runs and liquidity grabs. Wyckoff analysis helps traders interpret these moves not as chaos, but as structured behavior driven by incentives.

When analysts reference a Wyckoff forecast for a sub-$80K Bitcoin price, they are not predicting collapse. Instead, they are identifying a possible “spring” — a temporary breakdown that fails and reverses, signaling the exhaustion of selling pressure.

The sub-$80K Bitcoin price forecast explained

The core idea behind the current forecast is that Bitcoin may need to briefly trade below $80,000 to complete its corrective phase. This move would serve as a final stress test of demand before a more sustainable advance can begin.

In Wyckoff terminology, this event is known as a spring. A spring occurs when price dips below established support, triggering stop-loss orders and panic selling, only to recover quickly. The failure of the breakdown reveals hidden demand and often marks the end of accumulation.

A sub-$80K Bitcoin price does not necessarily imply weakness. In fact, it can indicate strength if followed by a swift reclaim and higher lows. The danger lies not in the dip itself, but in how the market responds afterward.

What would support the spring thesis

For the spring scenario to remain valid, Bitcoin price must demonstrate rapid recovery after breaking support. Increased volume during the rebound, improved momentum, and the inability of sellers to push price lower on subsequent tests would all strengthen the bullish case.

What would invalidate the forecast

If Bitcoin price drops below $80K and remains there, forming acceptance rather than rejection, the Wyckoff spring thesis weakens. Sustained trading below support suggests genuine supply dominance, opening the door to deeper downside and extended consolidation.

Key Bitcoin price levels to watch

Price levels play a critical role in shaping trader behavior. The $80,000 level has become a psychological anchor, not because of any intrinsic value, but because of collective attention. Markets often gravitate toward such levels to resolve uncertainty.

Resistance near the upper range

Repeated failures to hold higher levels suggest that buyers are hesitant to commit aggressively. Each rejection reinforces the idea that price must first revisit lower liquidity zones before a breakout becomes possible.

Why $80K attracts volatility

Round numbers naturally attract stop-loss orders and breakout trades. This clustering creates liquidity pockets that price can access quickly. In leveraged markets, these moves are often sharp and emotional, amplifying volatility.

The importance of the high-$70K zone

Some analysts view the upper-$70,000 range as a deeper liquidity pocket that could be tapped if $80K fails. However, such a move would still align with a Wyckoff spring if followed by a swift reclaim and improved structure.

What could trigger a sub-$80K move this week

Several factors could combine to push Bitcoin price briefly below support.

Leverage and liquidation dynamics

When price approaches key levels, liquidation cascades can accelerate moves beyond what spot market demand alone would produce. Forced selling can exaggerate downside moves, creating temporary dislocations that reverse once leverage resets.

Sentiment shifts and fear-driven selling

As Bitcoin price approaches widely discussed levels, sentiment can shift rapidly. Fear-driven selling often peaks near local lows, not at the start of trends. This emotional component is central to Wyckoff-based shakeouts.

Timing and trader expectations

When a particular week is framed as “decisive,” traders concentrate their risk within that window. This clustering of expectations increases the probability of sharp moves designed to surprise the majority.

What a Bitcoin price bottom could look like

Market bottoms are rarely clean or obvious in real time. They are often accompanied by heightened volatility, conflicting signals, and emotional extremes.

The breakdown that feels final

The initial move below support often feels decisive, triggering narratives of failure. This is the moment when most traders abandon positions, providing liquidity for accumulation.

The reclaim that changes the story

If Bitcoin price reclaims $80K quickly after dipping below it, the narrative can flip just as fast. This reclaim is often the most important signal in distinguishing a spring from a true breakdown.

The consolidation that builds confidence

After the reclaim, price may move sideways, frustrating traders who expect immediate upside. This phase allows the market to test demand and establish higher lows, laying the foundation for future advances.

Risks and alternative scenarios

While the Wyckoff forecast offers a structured interpretation, it is not immune to invalidation.

Macroeconomic shocks, regulatory developments, or unexpected liquidity events can overwhelm technical setups. Additionally, Bitcoin price may continue consolidating without breaking $80K at all, resolving the range through time rather than volatility.

Another risk is misidentification. Not every breakdown is a spring, and not every consolidation leads to markup. Flexibility and risk management remain essential.

How traders can approach Bitcoin price uncertainty

Rather than predicting a single outcome, traders benefit from preparing for multiple scenarios.

If Bitcoin price dips below $80K and reclaims quickly, confidence in a bottom increases. If price breaks and holds below support, caution is warranted. If price never breaks at all, patience may be rewarded as the range resolves upward.

The key is reacting to confirmation rather than anticipation. Markets reward adaptability, not stubborn conviction.

Conclusion

The idea that Bitcoin price may form a sub-$80K bottom this week reflects a broader understanding of market structure rather than outright bearishness. A Wyckoff-based interpretation suggests that one final liquidity sweep could clear excess leverage and fear, setting the stage for a healthier trend.

Whether this scenario plays out depends not on the dip itself, but on what follows. A swift reclaim and improving structure would support the bottom thesis, while sustained weakness would challenge it. As always, the market will reveal its intentions through price action, not predictions.

For traders and investors alike, the coming days may offer clarity. Until then, understanding the mechanics behind volatility can turn uncertainty into opportunity.

FAQs

Q: Why do analysts think Bitcoin price could drop below $80K?

Analysts believe liquidity and stop-loss orders below $80K may attract price temporarily, especially in a leveraged market seeking balance.

Q: What is a Wyckoff spring in Bitcoin trading?

A Wyckoff spring is a brief breakdown below support that fails and reverses, often signaling the end of a correction.

Q: Does a sub-$80K Bitcoin price mean the bull market is over?

Not necessarily. A temporary dip below support can occur within a broader bullish structure if followed by a strong recovery.

Q: How can traders confirm a Bitcoin price bottom?

Confirmation typically comes from rapid reclaim of support, reduced selling pressure, and the formation of higher lows.

Q: What should traders watch most closely this week?

Traders should monitor how Bitcoin price reacts around $80K, focusing on reclaim strength, volume behavior, and follow-through.