Bitcoin price in USD in real time has become essential for investors, traders, and crypto enthusiasts worldwide. Whether you’re a seasoned trader or just starting your Bitcoin journey, having access to live price data can make the difference between profitable decisions and missed opportunities. In today’s fast-paced digital economy, Bitcoin’s price fluctuates continuously across global exchanges, making real-time tracking more crucial than ever. With Bitcoin reaching new heights and experiencing significant volatility, understanding how to monitor the Bitcoin price in USD real time effectively can help you navigate this dynamic market with confidence and make informed investment decisions.

Understanding Bitcoin’s Real-Time Price Dynamics

What Drives Bitcoin’s Live Price Movements

Bitcoin’s price moves 24/7 across hundreds of global exchanges, creating a constant stream of price updates that reflect market sentiment, trading volume, and external factors. The Bitcoin price in USD real time represents the aggregate of all these trading activities, weighted by volume and exchange credibility.

Several key factors influence Bitcoin’s real-time price movements:

Market Demand and Supply: The fundamental economic principle of supply and demand plays a crucial role in Bitcoin’s price fluctuations. With only 21 million Bitcoins ever to be mined, scarcity creates upward price pressure when demand increases.

Trading Volume: Higher trading volumes typically indicate stronger price movements and greater market confidence. When you monitor the Bitcoin price in USD real time, you’ll notice that significant price changes often coincide with volume spikes.

Global Events: Geopolitical events, regulatory announcements, and macroeconomic factors can cause immediate price reactions. Real-time price tracking helps you capture these movements as they happen.

Institutional Activity: Large institutional purchases or sales can create substantial price movements that are immediately reflected in real-time price feeds.

How Real-Time Bitcoin Pricing Works

Real-time Bitcoin pricing aggregates data from multiple cryptocurrency exchanges worldwide. These platforms use sophisticated algorithms to calculate weighted averages based on trading volume, ensuring that the displayed price accurately represents current market conditions.

Major exchanges like Coinbase, Binance, Kraken, and Bitstamp contribute to the global Bitcoin price discovery process. When you check the Bitcoin price in USD real time, you’re seeing the result of thousands of transactions happening simultaneously across these platforms.

Price aggregators collect this data every few seconds, processing millions of data points to provide the most accurate real-time pricing information. This system ensures that whether you’re in New York, London, or Tokyo, you’re seeing consistent and reliable price data.

Top Platforms for Tracking Bitcoin Price in USD Real Time

Professional Trading Platforms

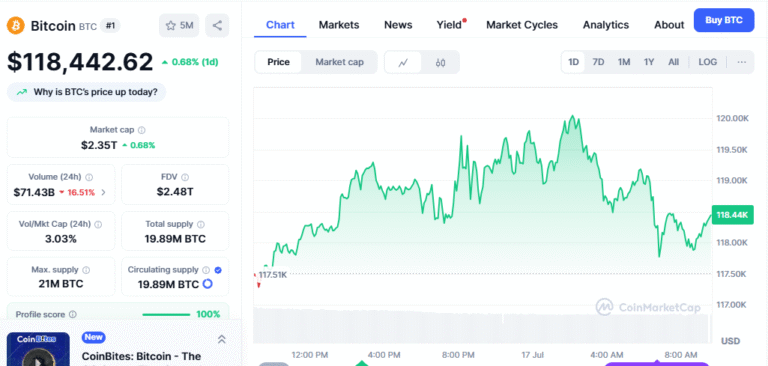

CoinMarketCap stands as one of the most popular choices for tracking cryptocurrency prices. Their real-time data updates every 10 seconds, providing comprehensive market information including trading volume, market cap, and 24-hour price changes.

CoinGecko offers detailed analytics alongside real-time pricing data. Their platform includes advanced features like price alerts, portfolio tracking, and market trend analysis, making it an excellent choice for serious investors monitoring the Bitcoin price in USD real time.

TradingView provides professional-grade charting tools with real-time Bitcoin price feeds. Their platform is particularly valuable for technical analysis enthusiasts who need precise timing for their trading decisions.

Mobile Applications for Real-Time Tracking

Coinbase Mobile App delivers instant price notifications and real-time trading capabilities. The app’s user-friendly interface makes it easy to monitor Bitcoin’s price movements throughout the day.

Binance App offers comprehensive real-time data with advanced trading features. Users can set custom price alerts and access detailed market analytics directly from their mobile devices.

CryptoCompare provides real-time price tracking with customizable widgets and alerts. Their mobile app includes portfolio management tools and detailed market analysis features.

Browser Extensions and Widgets

Several browser extensions allow you to monitor the Bitcoin price in USD in real time without leaving your current web page. These tools provide constant price updates in your browser toolbar, ensuring you never miss important price movements.

Popular options include CryptoCurrency Price Tracker, Bitcoin Checker, and Coin Market Cap extensions. These tools integrate seamlessly with your browsing experience while providing essential price monitoring functionality.

Bitcoin Price Analysis and Market Trends

Current Market Performance

As of 2025, Bitcoin continues to demonstrate its position as the leading cryptocurrency by market capitalization. The Bitcoin price in USD real time reflects ongoing institutional adoption, regulatory developments, and growing mainstream acceptance.

Recent market analysis shows Bitcoin trading within specific support and resistance levels, with technical indicators suggesting potential breakout scenarios. Real-time price monitoring helps identify these crucial moments when significant price movements are likely to occur.

Technical Analysis Indicators

Moving Averages: Real-time moving averages help identify trend directions and potential reversal points. The 50-day and 200-day moving averages are particularly important for long-term trend analysis.

Relative Strength Index (RSI): This momentum indicator helps determine whether Bitcoin is overbought or oversold at current price levels. Real-time RSI readings provide valuable insights for timing entry and exit points.

Volume Analysis: Trading volume confirmation is essential for validating price movements. High volume during price increases suggests strong bullish sentiment, while low volume may indicate weak price action.

Support and Resistance Levels: Real-time price data helps identify key support and resistance levels that often determine Bitcoin’s future price direction.

Fundamental Analysis Factors

Adoption Metrics: Increasing institutional adoption continues to drive long-term price appreciation. Companies like Tesla, MicroStrategy, and various institutional investors have added Bitcoin to their balance sheets.

Regulatory Environment: Government regulations and policy announcements significantly impact Bitcoin’s price. Real-time price monitoring helps capture immediate market reactions to regulatory news.

Network Activity: On-chain metrics such as active addresses, transaction volume, and hash rate provide insights into Bitcoin’s fundamental health and adoption.

Macroeconomic Factors: Inflation rates, currency debasement, and global economic conditions influence Bitcoin’s appeal as a store of value and digital gold alternative.

Setting Up Real-Time Price Alerts

Why Price Alerts Matter

Setting up price alerts for the Bitcoin price in USD in real time ensures you never miss critical market movements. Whether you’re looking to buy the dip or secure profits at resistance levels, automated alerts help you stay informed without constantly monitoring screens.

Effective alert systems can notify you via email, SMS, or push notifications when Bitcoin reaches specific price levels or percentage changes. This automation allows you to focus on other activities while staying connected to market opportunities.

Best Practices for Alert Configuration

Multiple Alert Levels: Set alerts at various price points to capture different market scenarios. Consider setting alerts for support levels, resistance levels, and percentage-based movements.

Time-Based Alerts: Configure alerts for specific timeframes to avoid notification overload. Daily summaries or significant hourly changes often provide the right balance of information.

Volume-Confirmed Alerts: Set alerts that trigger only when price movements are accompanied by significant trading volume, filtering out false signals and market manipulation.

Cross-Platform Notifications: Use multiple platforms for critical alerts to ensure redundancy and reliability in your notification system.

Popular Alert Platforms

CoinTracker offers comprehensive alert systems with customizable notification preferences. Their platform integrates with multiple exchanges and provides a detailed alert history.

Blockfolio (now FTX App) provides real-time price alerts with portfolio tracking capabilities. Users can set multiple alerts for different price levels and percentage changes.

CryptoWatch delivers professional-grade alerting systems with advanced customization options. Their platform is particularly suitable for active traders requiring precise alert timing.

Investment Strategies Using Real-Time Price Data

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves making regular Bitcoin purchases regardless of price, reducing the impact of volatility over time. Real-time price monitoring helps optimize DCA strategies by identifying optimal purchase intervals and amounts.

This strategy works particularly well for long-term investors who want to build Bitcoin positions gradually. By monitoring the Bitcoin price in USD real time, investors can adjust their DCA schedules based on market conditions and volatility patterns.

Swing Trading Approaches

Swing traders use real-time price data to identify short to medium-term price movements. This strategy requires precise entry and exit timing, making real-time price monitoring essential for success.

Technical analysis combined with real-time price feeds helps swing traders identify trend reversals, breakout patterns, and momentum shifts. Successful swing trading often depends on acting quickly when price patterns develop.

Day Trading Techniques

Day traders rely heavily on real-time price data for intraday profit opportunities. These traders need instant price updates, order book information, and market depth data to make profitable decisions within tight timeframes.

Advanced day trading strategies incorporate multiple timeframes, technical indicators, and real-time news feeds to identify profitable trading opportunities. The Bitcoin price in USD real time serves as the foundation for all day trading decisions.

Long-Term Investment Planning

Long-term investors use real-time price data to identify accumulation opportunities and portfolio rebalancing points. While less focused on short-term movements, these investors still benefit from real-time price monitoring for strategic decision-making.

Real-time price data helps long-term investors identify market cycles, accumulation phases, and distribution patterns. This information supports strategic buying decisions and portfolio optimization over extended periods.

Understanding Bitcoin Price Volatility

Factors Contributing to Volatility

Bitcoin’s volatility stems from several interconnected factors that affect its real-time price movements. Understanding these factors helps investors better interpret price action and make informed decisions.

Market Maturity: Despite significant growth, Bitcoin remains a relatively young asset class with limited market depth compared to traditional assets. This limited depth can amplify price movements in both directions.

Regulatory Uncertainty: Changing regulations and government policies create uncertainty that often translates into price volatility. Real-time price monitoring helps capture immediate market reactions to regulatory announcements.

Media Coverage: News events and media coverage can trigger significant buying or selling pressure, creating rapid price movements that are immediately reflected in real-time price feeds.

Whale Activity: Large Bitcoin holders (whales) can influence price through substantial transactions. Real-time price monitoring helps identify potential whale activity through unusual price and volume patterns.

Managing Volatility Risk

Position Sizing: Proper position sizing helps manage volatility risk while maintaining profit potential. Real-time price data supports dynamic position sizing based on current market conditions.

Stop-Loss Orders: Automated stop-loss orders help limit downside risk during volatile periods. These orders execute automatically when Bitcoin reaches predetermined price levels.

Diversification: Spreading investments across multiple assets helps reduce overall portfolio volatility. Real-time price monitoring supports rebalancing decisions based on correlation changes.

Time Horizon Management: Aligning investment time horizons with volatility tolerance helps manage emotional responses to price movements. Long-term investors can better withstand short-term volatility.

Security Considerations for Real-Time Price Tracking

Platform Security

When using platforms to track the Bitcoin price in USD real time, security should be a primary concern. Choose platforms with strong security records, two-factor authentication, and transparent security practices.

Reputable platforms implement robust security measures, including encrypted data transmission, secure server infrastructure, and regular security audits. Research platform security practices before providing personal information or connecting financial accounts.

Data Privacy

Real-time price tracking platforms often collect user data for analytics and service improvement. Review privacy policies and understand how your data is used, stored, and potentially shared with third parties.

Consider using privacy-focused browsers, VPNs, or dedicated devices for cryptocurrency activities to enhance data protection. Limit the amount of personal information shared with tracking platforms when possible.

API Security

If using APIs for real-time price data, implement proper security measures, including API key management, rate limiting, and secure storage practices. Never expose API keys in client-side code or public repositories.

Use read-only API keys when possible and regularly rotate credentials to maintain security. Monitor API usage for unusual activity that might indicate unauthorized access.

Future of Real-Time Bitcoin Price Tracking

Technological Improvements

Emerging technologies continue to improve real-time price tracking capabilities. Faster data processing, improved algorithms, and enhanced user interfaces make price monitoring more accurate and user-friendly.

Artificial Intelligence: AI-powered price prediction models and pattern recognition systems are becoming more sophisticated, providing enhanced insights alongside real-time price data.

Blockchain Integration: Direct blockchain data integration provides more accurate and tamper-proof price information by accessing transaction data directly from the Bitcoin network.

Real-Time Analytics: Advanced analytics platforms now offer real-time sentiment analysis, social media monitoring, and news impact assessment alongside price tracking.

Market Evolution

As the cryptocurrency market matures, real-time price tracking tools continue to evolve. Institutional-grade features, improved accuracy, and enhanced user experiences reflect the growing sophistication of market participants.

Institutional Tools: Professional trading platforms now offer institutional-grade real-time price feeds with microsecond precision and guaranteed uptime for professional traders.

Mobile Integration: Mobile applications continue to improve with better user interfaces, faster data updates, and enhanced notification systems for on-the-go price monitoring.

Cross-Platform Compatibility: Modern price tracking tools offer seamless integration across multiple devices and platforms, ensuring consistent access to real-time price data.

Conclusion

Tracking the Bitcoin price in USD real time has become an essential skill for anyone involved in the cryptocurrency market. Whether you’re a long-term investor, active trader, or simply curious about Bitcoin’s performance, having access to accurate, real-time price data empowers you to make informed decisions in this dynamic market.

The tools and strategies outlined in this guide provide a comprehensive foundation for effective real-time Bitcoin price monitoring. From choosing the right platforms to setting up alerts and understanding market dynamics, these insights help you navigate the cryptocurrency market with confidence.

FAQs

Q: How often is the Bitcoin price in USD real-time?

A: Most professional platforms update Bitcoin prices every 1-10 seconds, depending on the data provider and exchange connections. High-frequency trading platforms may offer millisecond updates for professional traders.

Q: Why do different platforms show slightly different Bitcoin prices in real time?

A: Price variations occur due to different exchange connections, data aggregation methods, and update frequencies. Most reputable platforms show prices within 1-2% of each other, with differences typically lasting only seconds.

Q: Can I trade Bitcoin directly through real-time price tracking platforms?

A: Some platforms offer integrated trading capabilities, while others focus solely on price tracking. Check platform features and regulatory compliance before attempting to trade through price tracking services.

Q: Are real-time Bitcoin price feeds free, or do they require subscriptions?

A: Basic real-time price feeds are typically free, while advanced features like detailed analytics, faster updates, and professional tools may require premium subscriptions or API access fees.

Q: How accurate are Bitcoin price predictions based on real-time data?

A: Real-time data provides the foundation for analysis, but Bitcoin price predictions remain speculative. Use real-time data for timing decisions rather than relying solely on predictions for investment choices.