The crypto market is in one of those intriguing phases where the headline price looks deceptively steady, but the underlying market behavior tells a more complex story. Bitcoin holds near $90,000 and, at first glance, that suggests confidence, strength, and stability. Yet when you look closer, it becomes clear that the market’s energy is changing. Trading volumes shrink across major exchanges, volatility compresses, and the price action tightens. At the same time, the altcoin landscape refuses to follow a single narrative. Instead, altcoins diverge, with some pushing higher on sector-specific catalysts while others bleed liquidity and struggle to keep pace.

This kind of environment often marks an important transition period in the broader crypto markets today. When Bitcoin stabilizes near a major psychological level like $90,000, market participants become unusually sensitive to what happens next. A clean breakout can trigger momentum chasing and a fresh leg up, while a sharp rejection can lead to fast liquidations. But the most common outcome in such periods is neither a straight rally nor a clean crash. It’s rotation—capital shifting from one pocket of the market to another as traders and investors adjust their risk exposure.

Shrinking volume is especially important because it can mean two opposite things at once. On one hand, lower volume may signal consolidation and a healthier base-building phase, where buyers aren’t panicking and sellers aren’t dumping. On the other hand, declining participation can also indicate uncertainty and hesitation, making the market vulnerable to sudden spikes in volatility if a major macro headline, regulatory update, or large order hits the books.

Meanwhile, diverging altcoins highlight how the market is no longer moving as a single herd. Ethereum, top Layer-2 networks, DeFi tokens, AI-related crypto projects, and meme coins can all tell different stories in the same day. Traders increasingly focus on narratives, liquidity hotspots, and relative strength rather than assuming “alt season” lifts everything equally. In this article, we’ll explore why Bitcoin holds near $90,000 as trading volumes shrink, altcoins diverge, what it means for the near-term trend, and how investors can interpret the signals without getting caught in whipsaw moves.

Bitcoin Holds Near $90,000: What This Level Really Means

Whenever Bitcoin holds near $90,000, it’s not just another number on a chart. Round-number levels in crypto act like magnets because they attract attention, orders, and psychological expectations. For many traders, $90,000 becomes a line in the sand: a level that either confirms bullish dominance or reveals exhaustion. The longer Bitcoin consolidates around such a major area, the more meaningful the next move tends to be.

What makes this moment even more interesting is that Bitcoin is not surging with broad euphoria. Instead, it’s holding steady while trading volumes shrink, suggesting the market is in a waiting mode. That waiting can reflect confidence—investors may be comfortable holding positions at these levels without rushing to exit. But it can also reflect caution—new buyers might be unwilling to chase, waiting for a clearer breakout signal.

In the context of crypto markets today, Bitcoin stability often sets the tone for everything else. Bitcoin is still the dominant liquidity anchor, meaning capital typically flows in and out of the altcoin universe through Bitcoin cycles. When Bitcoin remains stable, traders feel more comfortable taking risk in altcoins. When Bitcoin becomes volatile, altcoins often suffer as traders de-risk and rotate back to BTC or stablecoins.

The key takeaway is that Bitcoin holding near $90,000 is not automatically bullish or bearish. It’s a condition. The outcome depends on what follows: a volume-supported breakout, a breakdown with heavy selling, or continued range trading that creates opportunities elsewhere in the market.

Trading Volumes Shrink: Why Low Volume Can Be Bullish or Dangerous

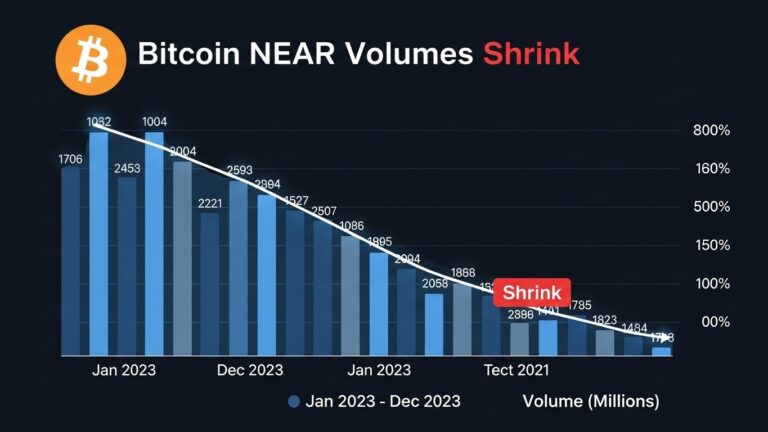

Shrinking Volume and Market Structure

The phrase trading volumes shrink might sound like a negative headline, but it’s more nuanced than that. In market structure terms, low volume can indicate a consolidation phase where the market pauses after a strong move. When prices rise aggressively, they often need time to “digest” gains. During that digestion period, volume naturally declines because fewer traders want to initiate fresh positions at uncertain levels.

From a technical perspective, shrinking volume during consolidation can be bullish if it occurs above key support zones. It may suggest sellers are losing conviction, and the market is coiling for a potential continuation move. In other words, the lack of volume can reflect a lack of supply.

However, low volume also has a major downside: it makes the market more fragile. Thin liquidity means it takes less capital to move the price dramatically. One large liquidation cascade, a whale sale, or a sudden macro shock can push Bitcoin sharply in either direction. That’s why, when Bitcoin holds near $90,000 as trading volumes shrink, traders watch for sudden volatility expansions.

The Role of Exchanges, Derivatives, and Liquidity Pools

Another reason trading volumes shrink is the changing behavior of market participants. Spot market activity may drop while derivatives activity remains strong, or the opposite. Sometimes volume migrates from centralized exchanges to decentralized platforms, or from retail-heavy venues to institutional OTC desks. This can create the illusion that the market is “quiet” when in reality liquidity is simply shifting location.

In crypto markets today, derivatives—especially perpetual futures—play a massive role in short-term price movements. Funding rates, open interest, and liquidation levels can matter more than raw volume. When spot volume declines but open interest increases, the market can become leveraged and prone to sharp squeezes. On the other hand, if both spot volume and derivatives activity decline, it can suggest genuine indecision, with traders waiting for the next catalyst.

The practical implication is simple: lower volume often means the next major move may come unexpectedly, and it can be amplified.

Altcoins Diverge: Rotation, Narratives, and Risk Appetite

Why Altcoins Aren’t Moving Together Anymore

The headline that altcoins diverge reflects a market that’s maturing in a strange way. In earlier crypto cycles, altcoins often moved in unison. When Bitcoin rallied, altcoins rallied. When Bitcoin fell, altcoins fell harder. But today’s market has more specialization, more sector-specific flows, and more sophisticated traders.

Now, it’s common to see one category of altcoins outperform while another collapses. A few tokens can pump on news, partnerships, or ecosystem growth while the broader market remains flat. This divergence is a sign of selective risk-taking. Traders are no longer buying “everything.” They are buying narratives.

Sector-Specific Strength: Ethereum, Layer-2, DeFi, AI, and Memecoins

In crypto markets today, several themes frequently drive divergence:

Ethereum and Layer-2 networks can outperform when traders anticipate ecosystem upgrades, rising on-chain activity, or increased institutional adoption. Layer-2 tokens often surge when transaction volumes grow and users seek cheaper, faster solutions.

DeFi tokens can outperform during periods of stable Bitcoin because yield opportunities become more attractive. When market volatility is low, some investors rotate into DeFi protocols to earn returns, pushing certain tokens higher even while others stagnate.

AI-related crypto can rally when the broader tech narrative is strong and speculative appetite returns. These projects tend to move on sentiment and hype cycles, which can create sudden bursts of upside.

Memecoins often thrive when retail engagement returns, especially during sideways Bitcoin periods. They can serve as volatility outlets when Bitcoin is too stable to trade aggressively.

This is why, when Bitcoin holds near $90,000 as trading volumes shrink, altcoins diverge, the altcoin market becomes a patchwork of micro-cycles rather than one unified trend.

Crypto Markets Today: Key Drivers Behind the Mixed Momentum

Macro Conditions: Rates, Dollar Strength, and Liquidity

Even in crypto, macro factors still matter. Bitcoin has increasingly behaved like a macro-sensitive risk asset at key moments. Shifts in interest rate expectations, global liquidity conditions, and currency strength can all influence market sentiment.

When global risk appetite improves, Bitcoin often benefits. When markets become cautious, traders may reduce risk exposure, causing trading volumes to shrink and volatility to compress. This macro backdrop can contribute to Bitcoin holding steady while altcoins move independently based on internal catalysts.

Institutional Behavior and Spot Demand

Institutional participation has changed how Bitcoin trades. Larger players tend to accumulate strategically, often using dips and consolidations to build positions rather than chasing vertical moves. This can help explain why Bitcoin holds near $90,000 without explosive volume.

Institutions also typically prefer Bitcoin and Ethereum, which can create a gap between major assets and smaller tokens. That gap contributes to the reality that altcoins diverge—some benefit from institutional flows, while others remain purely retail-driven.

On-Chain Activity and Sentiment

On-chain metrics often provide clues about whether a consolidation is healthy or fragile. Rising network activity, increasing active addresses, and strong long-term holder behavior can support the case for an eventual bullish continuation. Meanwhile, declining activity and increased exchange inflows can signal distribution.

Sentiment also plays a big role in crypto markets today. When traders believe Bitcoin’s next move is higher, they are more willing to take altcoin risk. When sentiment turns uncertain, traders sit on the sidelines, contributing to shrinking volume.

Technical View: What Traders Watch When Bitcoin Hovers Near $90,000

Bitcoin Support and Resistance Zones

When Bitcoin holds near $90,000, traders typically focus on whether that level acts as support or resistance. If Bitcoin repeatedly tests $90,000 and holds, it can become a stronger base. If it repeatedly fails and rejects, it can become a ceiling that triggers sell pressure.

The next major move often depends on whether Bitcoin breaks above the consolidation range with rising volume. A breakout without volume can be a trap. A breakout with strong participation can be the start of a fresh trend leg.

Volatility Compression and the “Spring” Effect

A common pattern during low-volume consolidations is volatility compression. The longer the market stays tight, the more energy builds up. When the breakout happens, it often happens quickly. This is sometimes called the “spring” effect: the market coils, then releases.

That’s why shrinking volume is not always a sign of weakness. It can signal a calm before a storm. But whether that storm is bullish or bearish depends on catalysts and liquidity conditions.

Dominance and Risk Rotation

Bitcoin dominance is another important indicator in crypto markets today. If Bitcoin dominance rises while Bitcoin stays stable, it suggests capital is leaving altcoins and returning to BTC. If dominance falls during Bitcoin consolidation, it suggests capital is rotating into altcoins, supporting broader risk-on behavior.

Diverging altcoins often coincide with dominance fluctuations. Some sectors will outperform, but the broad altcoin index may not. This is where careful selection matters.

Ethereum and Major Altcoins: Divergence Signals in Real Time

Ethereum often acts as a bridge between Bitcoin and the broader altcoin market. When Ethereum shows strength relative to Bitcoin, it can signal rising risk appetite and an environment where altcoins may start outperforming. When Ethereum underperforms, it can signal that traders prefer the safety of Bitcoin.

In a market where Bitcoin holds near $90,000 as trading volumes shrink, altcoins diverge, Ethereum’s performance becomes a key clue. Strong Ethereum can pull attention toward smart contract ecosystems, DeFi activity, and Layer-2 adoption. Weak Ethereum can reinforce a “Bitcoin-only” narrative and limit altcoin rallies.

Meanwhile, other major altcoins often respond to individual catalysts. Some outperform because they benefit from increased network activity or ecosystem developments. Others lag due to dilution, token unlocks, or weak demand. This uneven performance is the essence of divergence.

What Shrinking Volume Means for Retail Traders and Long-Term Investors

For Retail Traders: Beware of Traps and Sudden Spikes

For active traders, shrinking volume means two things: fewer clean opportunities and a higher chance of fake-outs. In low volume environments, price can be pushed around more easily, leading to false breakouts and sudden reversals.

If you are trading this market, it’s important to recognize that the “quiet” can become violent quickly. Stop placement, position sizing, and patience matter more when liquidity is thin.

For Long-Term Investors: Consolidation Can Be a Feature, Not a Bug

For long-term investors, a market where Bitcoin holds near $90,000 can be a signal of strength, especially if Bitcoin maintains higher lows over time. Shrinking volume may simply mean that the market is pausing after a strong advance.

Long-term participants often focus less on short-term price noise and more on whether broader adoption, network fundamentals, and institutional participation continue to improve. In that context, consolidation near a major level can be encouraging.

Risks to Watch: What Could Break the Calm

No discussion of crypto markets today is complete without acknowledging the risks. Bitcoin stability is not guaranteed. Several factors can disrupt the balance:

A macro shock, such as sudden changes in interest rate expectations or risk-off moves in global markets, can trigger rapid selling. Regulatory headlines can also shift sentiment quickly, especially if they affect exchanges, stablecoins, or institutional access.

Another risk is leverage. Even if spot volume is low, derivatives leverage can build quietly. When leverage becomes excessive, price moves can trigger liquidation cascades, causing sudden volatility spikes.

Finally, divergence among altcoins can sometimes signal fragility. If only a narrow group of tokens is performing well, while most are weak, it may indicate that liquidity is concentrated and vulnerable to reversals.

Outlook: What Comes Next for Bitcoin and Altcoins?

When Bitcoin holds near $90,000 as trading volumes shrink, altcoins diverge, the most likely near-term scenario is continued range trading until a catalyst forces direction. That catalyst could come from macro data, institutional flow shifts, ETF-related developments, or market-specific events such as network upgrades.

If volume returns and Bitcoin breaks higher, that could ignite broader optimism and potentially pull more altcoins upward. If Bitcoin loses support and breaks lower, it may trigger a risk-off rotation, dragging altcoins down more aggressively.

The altcoin divergence will likely remain a defining feature regardless. Even if the market turns bullish, leadership will matter. Some sectors will outperform; others may remain weak. This creates an environment where research and selection become more important than simple “buy everything” strategies.

Conclusion

The current setup in crypto markets today is defined by a steady Bitcoin price and shifting internal dynamics. Bitcoin holds near $90,000, but the shrinking participation reflected in the fact that trading volumes shrink suggests hesitation, consolidation, and potential fragility. At the same time, the fact that altcoins diverge highlights a more selective market where narratives, sector rotation, and relative strength matter more than broad hype.

For traders, this is an environment where discipline is essential, because low volume can produce sudden spikes and fake-outs. For investors, the consolidation may represent a healthy pause that sets the stage for the next major move. Either way, understanding the relationship between Bitcoin stability, volume behavior, and altcoin divergence is the key to navigating this phase without getting caught off guard.

FAQs

Q: Why is Bitcoin holding near $90,000 important?

Because $90,000 is a major psychological and technical level that attracts liquidity and attention. When Bitcoin holds near $90,000, it often signals a consolidation phase that can precede a major breakout or breakdown.

Q: What does it mean when trading volumes shrink in crypto?

When trading volumes shrink, it usually indicates reduced participation and uncertainty. It can be bullish if it reflects reduced selling pressure during consolidation, but it can also make the market vulnerable to sudden volatility spikes.

Q: Why do altcoins diverge instead of moving together?

Because crypto has become more narrative-driven and sector-based. In crypto markets today, liquidity rotates into specific themes like DeFi, Layer-2, AI tokens, or memecoins, causing altcoins to diverge rather than rally uniformly.

Q: Is low volume a sign that a crash is coming?

Not necessarily. Low volume can reflect healthy consolidation. However, it can also increase fragility, meaning prices may react sharply to catalysts. The direction depends on whether volume returns with bullish or bearish momentum.

Q: What should investors watch next in crypto markets today?

Investors should watch whether Bitcoin remains stable above key support, whether volume returns, how Ethereum performs relative to Bitcoin, and whether market leadership broadens beyond a small set of strong altcoins.

Also Read: Crypto Markets Today Bitcoin Slides Altcoins Drop