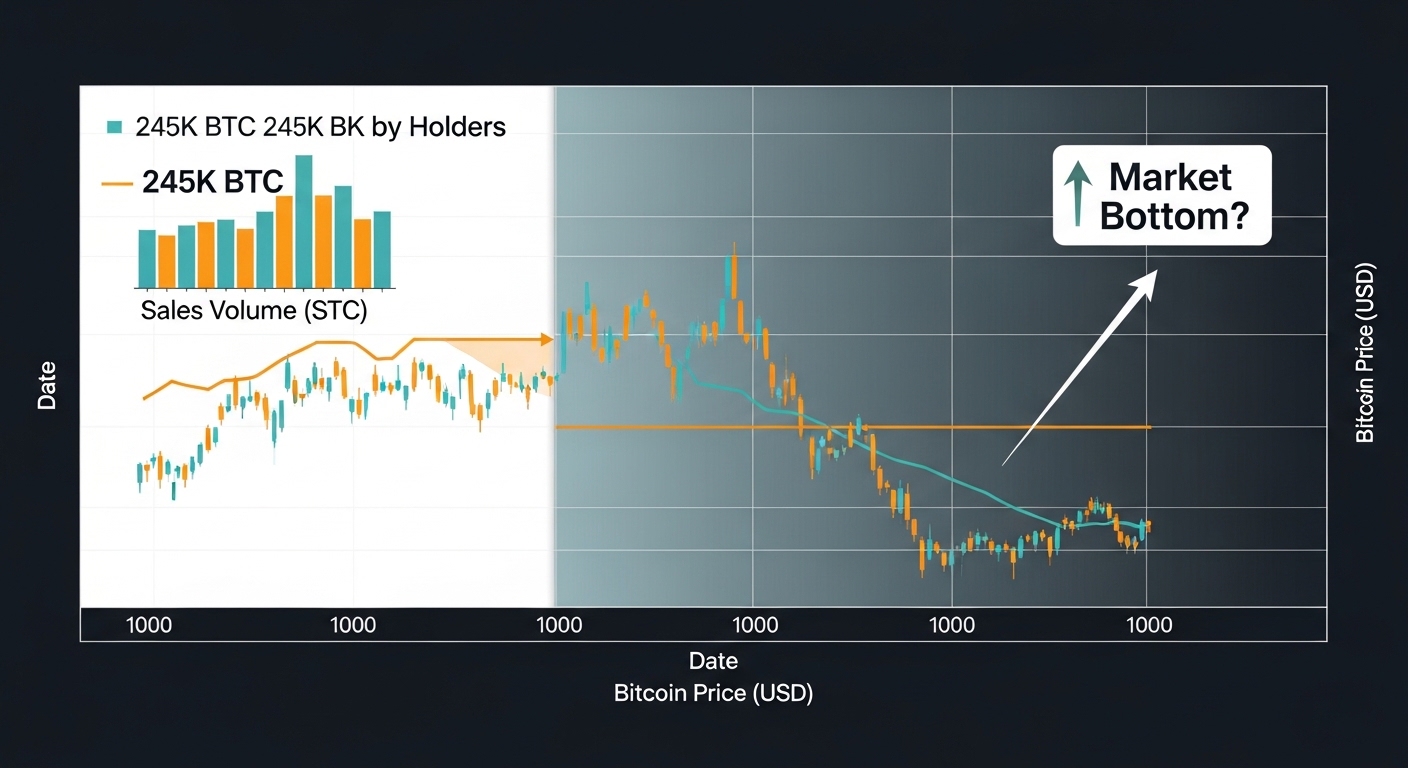

Bitcoin holders have sold approximately 245,000 BTC during a time of tight macroeconomic conditions, it naturally raises one of the most important questions in crypto investing: Did the market just form a bottom, or is more downside still ahead? Bitcoin has matured into a global asset influenced not only by crypto-native events but also by broader financial forces. Rising interest rates, restricted liquidity, cautious institutional behavior, and macroeconomic uncertainty all weigh heavily on price action. In this environment, decisions made by Bitcoin holders reflect far more than simple profit-taking; they represent stress, risk management, and shifts in conviction.

Historically, some of Bitcoin’s strongest recoveries have begun shortly after waves of aggressive selling. These moments often mark the transfer of coins from emotionally driven sellers to long-term, conviction-based buyers. However, not every large selloff signals capitulation, and not every decline produces an immediate rebound.

This article explores what it truly means when Bitcoin holders sell 245K BTC, how tight macro conditions amplify market reactions, what on-chain and technical indicators suggest about potential bottom formation, and how investors can evaluate whether the worst may already be behind us.

Tight macro conditions and their impact on Bitcoin

Tight macro conditions occur when liquidity is constrained across financial markets. Central banks maintain higher interest rates, borrowing becomes more expensive, and investors grow more selective about risk exposure. In such an environment, capital flows toward assets offering stability and predictable returns rather than volatility.

For Bitcoin, this backdrop creates a challenging short-term landscape. Although its long-term value proposition remains intact for many, short-term price movements often mirror broader risk-off sentiment. Bitcoin holders operating under leverage or shorter investment horizons are particularly sensitive to these conditions, as volatility becomes harder to justify when safer alternatives offer competitive yields.

Macroeconomic pressure also affects psychology. Fear becomes magnified, patience wears thin, and drawdowns feel heavier. This combination can turn a routine correction into a sharp selloff as Bitcoin holders rush to reduce exposure. Understanding this context is essential before interpreting any large-scale selling event.

What does it mean when Bitcoin holders sell 245K BTC?

A headline figure like 245,000 BTC sounds dramatic, but its significance depends on who sold and why. Bitcoin ownership is diverse, ranging from long-term holders who have held through multiple cycles to short-term traders reacting to momentum and fear.

When selling is dominated by short-term holders, it often reflects panic rather than strategic distribution. These participants typically entered the market at higher prices and are more likely to exit during downturns to avoid further losses. In contrast, when long-term holders sell aggressively, it may suggest broader structural concerns or profit realization after extended rallies.

In many cases, large selloffs represent redistribution rather than destruction of value. Coins move from weaker hands to stronger ones, reducing future selling pressure. Whether the market bottoms depends on whether this redistribution exhausts sellers or whether additional supply continues to enter the market.

On-chain behavior and what it reveals about market stress

Seller exhaustion as a foundation for a bottom

Market bottoms rarely occur while sellers remain highly motivated. Instead, they tend to form once selling pressure diminishes, even if price remains subdued. Seller exhaustion is a critical component of this process.

When Bitcoin holders rush to sell, on-chain activity often shows spikes in coin movement and realized losses. As fear subsides, these metrics gradually decline. If the market absorbs heavy selling without accelerating further downward, it suggests that demand is beginning to match or exceed supply. Seller exhaustion does not imply optimism; it simply means panic has peaked. This state often creates the conditions necessary for stabilization.

Short-term holder capitulation

Short-term holder capitulation is one of the clearest signs that a market may be nearing a bottom. These participants are more reactive and more likely to sell at a loss during downturns. When short-term Bitcoin holders exit en masse, they effectively transfer coins to buyers willing to hold through uncertainty. This shift reduces immediate sell pressure and increases the share of supply held by more patient investors. While painful, this process has historically played a central role in Bitcoin’s recovery phases.

Long-term holders and conviction capital

Long-term holders tend to act as Bitcoin’s stabilizing force. Their behavior offers insight into broader market confidence. When long-term Bitcoin holders continue to hold or only sell modestly during downturns, it suggests belief in Bitcoin’s long-term trajectory remains intact.

Even when long-term holders sell, the rate of selling matters. Gradual distribution followed by stabilization often aligns with bottom formation, whereas accelerating long-term selling during weakness may signal deeper structural concerns.

Technical market structure during heavy selloffs

Support zones and price acceptance

Technical analysis complements on-chain insights by revealing how the market reacts to selling pressure. A potential bottom often forms near established support zones where buyers repeatedly step in. When Bitcoin holders sell large volumes yet price fails to break significantly lower, it indicates that demand is absorbing supply. This price acceptance is more meaningful than brief rebounds because it reflects sustained interest rather than short-lived speculation.

Volatility compression after panic

After extreme price moves, volatility often compresses as the market transitions from fear to exhaustion. This phase is characterized by smaller price swings and range-bound trading. Although some traders find this period frustrating, it is frequently a precursor to trend reversals. Volatility compression suggests that selling urgency has faded and that remaining Bitcoin holders are less inclined to exit at current prices.

Institutional influence and evolving demand dynamics

Bitcoin’s market structure has evolved dramatically over the past few years. Institutional participation has increased, introducing new forms of demand that do not always behave like retail flows. These participants often operate on longer time horizons and may accumulate during periods of weakness. When Bitcoin holders sell heavily, institutional demand can help absorb supply, reducing downside volatility.

However, institutional capital is also sensitive to macro conditions, meaning inflows and outflows can change rapidly. This dynamic can lead to prolonged bottoming processes rather than sharp reversals. Markets may stabilize quietly before momentum returns, catching overly aggressive traders off guard.

Did the market bottom after Bitcoin holders sold 245K BTC?

Rather than seeking a definitive yes-or-no answer, it is more useful to evaluate probabilities. A market bottom becomes more likely when several conditions align. First, selling pressure must visibly decline. If the bulk of panic-driven Bitcoin holders have already exited, additional downside becomes harder to sustain. Second, price must stabilize near key levels rather than continuing to make lower lows.

Third, macro conditions must stop deteriorating, even if they do not immediately improve. If these elements are present, the 245K BTC selloff may represent a capitulation event rather than the start of a deeper decline. However, tight macro conditions can delay confirmation, leading to extended consolidation rather than a rapid recovery.

What investors should watch moving forward

Changes in selling behavior

Monitoring whether Bitcoin holders continue to sell aggressively is crucial. A noticeable reduction in selling volume often precedes stabilization. If each dip attracts buyers rather than triggering new waves of selling, confidence slowly returns.

Shifts in holder composition

A growing share of supply held by long-term participants strengthens the case for a bottom. This shift indicates that coins are moving into hands less likely to sell under pressure.

Macro clarity and liquidity signals

Bitcoin does not exist in isolation. Improvements in liquidity conditions, clearer monetary policy direction, and reduced uncertainty can all act as catalysts once selling pressure subsides.

Conclusion

The fact that Bitcoin holders sold 245K BTC during tight macro conditions is significant, but it is not a standalone verdict on market direction. Large selloffs can mark moments of panic, redistribution, or strategic de-risking, depending on context.

Market bottoms are rarely clean or obvious. They form through a process of exhaustion, stabilization, and gradual rebuilding of confidence. If selling pressure continues to fade, demand absorbs remaining supply, and macro conditions stop worsening, the recent selloff may ultimately be remembered as a turning point rather than a warning sign. For investors, patience and perspective remain essential. Attempting to pinpoint the exact bottom is far less important than recognizing when risk begins to skew favorably over time.

FAQs

Q: Why do Bitcoin holders sell during tight macro conditions?

Tight macro conditions increase the cost of holding volatile assets. Bitcoin holders may sell to reduce risk, meet liquidity needs, or rotate into assets perceived as safer during uncertain periods.

Q: Does a large Bitcoin selloff always mean the market has bottomed?

No. While large selloffs can coincide with capitulation, a true bottom usually requires declining sell pressure, price stabilization, and improving market sentiment over time.

Q: Are short-term or long-term Bitcoin holders more important for bottoms?

Short-term holder capitulation often triggers bottoms, but long-term holder stability helps confirm them. Both groups play different but complementary roles.

Q: How long does Bitcoin typically consolidate after heavy selling?

Consolidation periods vary. Some last weeks, while others extend for months, especially during restrictive macro environments where recovery catalysts take time to emerge.

Q: What is the biggest mistake investors make during potential bottoms?

The biggest mistake is assuming bottoms are immediate and obvious. Markets often move sideways and test patience before a sustainable trend reversal takes shape.

See More: Crypto Market Update Bitcoin Price Ends Week Higher