The cryptocurrency market has once again entered a critical phase as Bitcoin and Ethereum attempt to stabilise after sharp corrections that have unsettled investors and traders worldwide. After weeks of heightened volatility, rapid sell-offs, and shifting sentiment, the two largest digital assets by market capitalization are showing early signs of consolidation. This period of stabilization is not only crucial for Bitcoin and Ethereum but also for the broader crypto ecosystem, which often follows their lead.

Sharp corrections are not new to the crypto market, yet each cycle brings its own unique drivers and psychological dynamics. Macroeconomic uncertainty, regulatory developments, shifting liquidity conditions, and profit-taking behavior have all played a role in the recent downturn. As prices pulled back from local highs, market participants began reassessing risk exposure, long-term value, and the sustainability of previous rallies.

Now, as Bitcoin and Ethereum attempt to stabilise after sharp corrections, investors are closely watching key technical levels, on-chain metrics, and market sentiment indicators. This article explores the causes behind the recent corrections, the current stabilization efforts, and what these developments could mean for the future direction of the crypto market. By examining technical analysis, fundamentals, and investor psychology, we aim to provide a comprehensive understanding of where Bitcoin and Ethereum may be heading next.

Understanding the Recent Sharp Corrections in Crypto Markets

The recent downturn that triggered concern across digital asset markets did not occur in isolation. Bitcoin and Ethereum attempt to stabilise after sharp corrections that were largely driven by a combination of internal market dynamics and external economic pressures. Understanding these forces is essential to evaluating whether the current stabilization phase can hold.

One of the primary contributors to the correction was aggressive profit-taking following strong price appreciation earlier in the cycle. As Bitcoin approached key resistance levels, long-term holders and short-term traders alike began locking in gains. This selling pressure cascaded across the market, impacting Ethereum and other major altcoins.

At the same time, tightening global financial conditions reduced risk appetite among institutional investors. Higher interest rates and uncertainty around inflation encouraged capital to flow away from speculative assets. Cryptocurrencies, often viewed as high-risk investments, were particularly affected. As liquidity tightened, price volatility increased, leading to rapid declines.

Regulatory concerns also added to the bearish sentiment. Ongoing discussions around crypto regulation in major economies created uncertainty about future compliance requirements. When combined with leverage unwinding in derivatives markets, these factors accelerated the correction and pushed prices lower in a relatively short period.

Bitcoin’s Price Action and Stabilisation Efforts

As Bitcoin and Ethereum attempt to stabilise after sharp corrections, Bitcoin’s behavior is especially significant due to its role as the market’s bellwether. Bitcoin experienced a notable pullback from recent highs, breaking below short-term support levels before finding temporary footing.

From a technical perspective, Bitcoin’s price action suggests a transition from a downtrend into a consolidation phase. The asset has been trading within a relatively narrow range, indicating that selling pressure may be diminishing. This sideways movement often reflects a balance between buyers and sellers, which is a necessary condition for stabilization.

On-chain data further supports the stabilization narrative. Metrics such as exchange outflows and long-term holder supply indicate that many investors are choosing to hold rather than sell at current levels. This behavior reduces available supply on exchanges, which can help absorb selling pressure and stabilize prices.

Market sentiment around Bitcoin has also begun to improve. While fear remains present, extreme pessimism has eased, suggesting that investors are becoming more comfortable with current price levels. As Bitcoin and Ethereum attempt to stabilise after sharp corrections, Bitcoin’s ability to maintain support will likely influence confidence across the entire market.

Ethereum’s Market Structure After the Correction

Ethereum’s correction mirrored Bitcoin’s decline but was shaped by its own unique factors. As Bitcoin and Ethereum attempt to stabilise after sharp corrections, Ethereum’s ecosystem developments and network activity play a central role in its recovery.

Ethereum faced additional selling pressure due to concerns around network fees, competition from alternative blockchains, and broader market deleveraging. However, despite these challenges, Ethereum has shown resilience by holding key support zones that have historically acted as accumulation areas.

From a structural standpoint, Ethereum’s price has begun forming a base, characterized by decreasing volatility and gradual buying interest. This pattern often precedes a more sustained stabilization period. Traders are watching closely for higher lows, which could indicate that bearish momentum is fading.

Fundamentally, Ethereum remains supported by strong network usage, decentralized finance activity, and ongoing development upgrades. These factors contribute to long-term confidence, even as short-term price fluctuations persist. As Bitcoin and Ethereum attempt to stabilise after sharp corrections, Ethereum’s fundamentals provide a solid foundation for potential recovery.

The Role of Market Sentiment in Stabilisation

Market sentiment plays a critical role when Bitcoin and Ethereum attempt to stabilise after sharp corrections. During periods of rapid decline, fear often dominates decision-making, leading to panic selling and exaggerated price movements. Stabilization typically begins when emotional responses give way to rational assessment.

Sentiment indicators suggest that the market has moved from extreme fear toward cautious neutrality. This shift indicates that investors are no longer reacting impulsively to price drops. Instead, they are evaluating value, risk, and long-term prospects more carefully.

Social media discussions and trading volume data also reflect this transition. While enthusiasm remains muted, the absence of aggressive selling suggests that many participants are willing to wait for clearer signals. This patience is a key ingredient in any stabilization phase.

As Bitcoin and Ethereum attempt to stabilise after sharp corrections, sentiment-driven stability can create a platform for gradual recovery. However, it also means that upside momentum may be limited until confidence strengthens further.

Technical Indicators Supporting Stabilisation

Technical analysis provides valuable insights into whether Bitcoin and Ethereum attempt to stabilise after sharp corrections is likely to succeed. Several indicators currently point toward consolidation rather than continued decline.

Moving averages have begun to flatten, indicating a slowdown in bearish momentum. While prices remain below certain long-term averages, the lack of further breakdowns suggests that sellers are losing control. Relative strength indicators have also moved away from oversold conditions, reducing the likelihood of immediate sharp declines.

Volume patterns reinforce this outlook. Declining selling volume during recent pullbacks suggests that fewer participants are willing to sell at lower prices. This behavior often precedes a stabilization period, as supply and demand reach equilibrium.

Support and resistance levels are now well-defined, providing traders with clearer reference points. As long as these support zones hold, the narrative that Bitcoin and Ethereum attempt to stabilise after sharp corrections remains intact.

Macroeconomic Factors Influencing Crypto Stability

The broader economic environment cannot be ignored when evaluating how Bitcoin and Ethereum attempt to stabilise after sharp corrections. Macroeconomic conditions heavily influence risk assets, including cryptocurrencies.

Interest rate expectations remain a key driver. When central banks signal a pause or slowdown in tightening, risk sentiment often improves. This can provide relief to crypto markets and support stabilization efforts. Conversely, renewed hawkish signals could reignite volatility.

Inflation trends also play a role. Persistent inflation can increase interest in alternative stores of value, including Bitcoin. However, if inflation moderates, traditional assets may become more attractive, potentially limiting crypto inflows.

Global liquidity conditions further affect market stability. As liquidity improves, speculative assets often benefit. For Bitcoin and Ethereum attempt to stabilise after sharp corrections to succeed, a supportive macro backdrop would significantly enhance the chances of sustained consolidation.

Institutional and Retail Investor Behavior

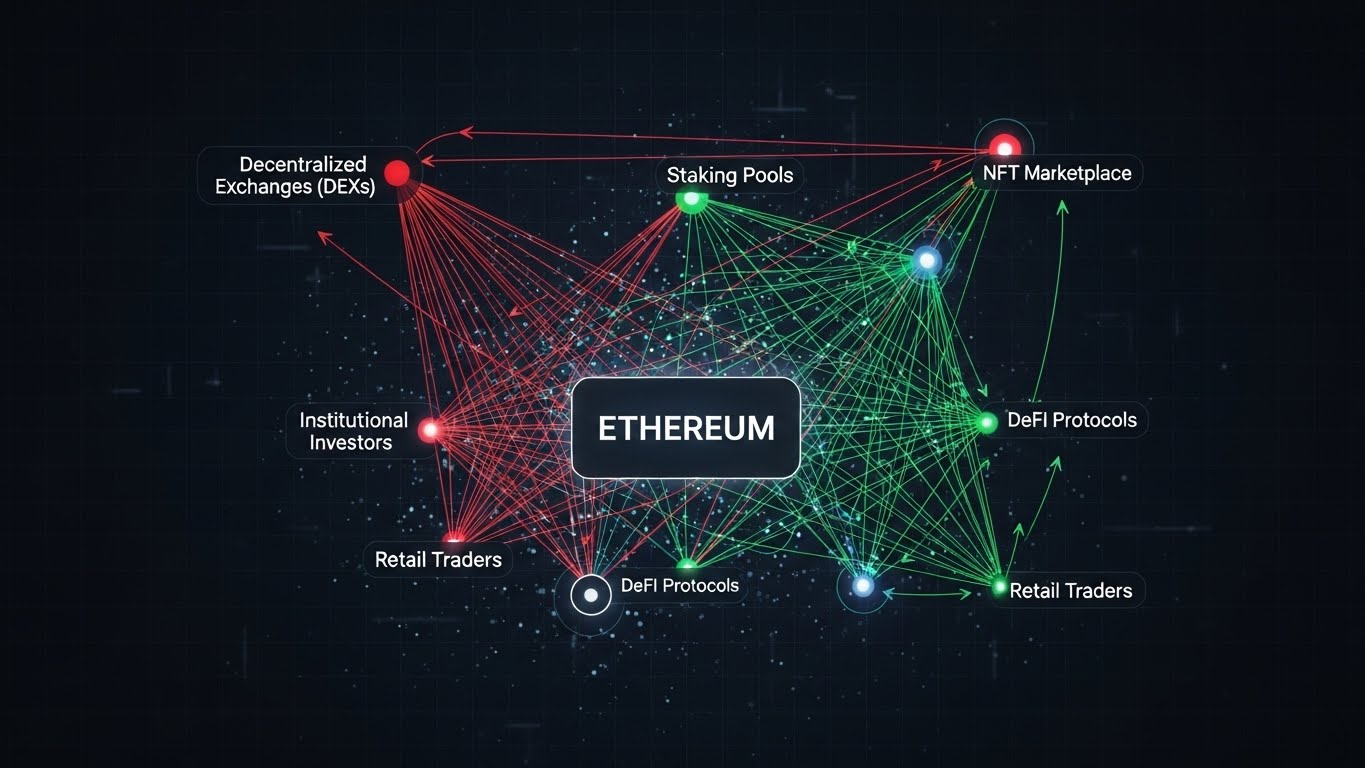

Investor behavior offers important clues about whether Bitcoin and Ethereum attempt to stabilise after sharp corrections will lead to recovery or further decline. Institutional and retail participants often react differently during periods of uncertainty.

Institutional investors tend to take a longer-term view, focusing on strategic allocation and risk management. Recent data suggests that while some institutions reduced exposure during the correction, others used lower prices as entry points. This balanced approach contributes to price stability.

Retail investors, on the other hand, are more sensitive to price fluctuations. Panic selling among retail traders often exacerbates downturns. However, as prices stabilize, retail participation typically becomes more measured, reducing volatility.

The interaction between these two groups creates the market dynamics observed during stabilization phases. As Bitcoin and Ethereum attempt to stabilise after sharp corrections, a gradual return of both institutional and retail confidence will be essential for sustained growth.

Long-Term Fundamentals Supporting Bitcoin and Ethereum

Despite short-term volatility, long-term fundamentals remain strong as Bitcoin and Ethereum attempt to stabilise after sharp corrections. These fundamentals provide context for why many investors remain optimistic despite recent declines.

Bitcoin’s fixed supply and growing adoption as a digital store of value continue to underpin its long-term thesis. Network security and hash rate resilience further reinforce confidence in its durability.

Ethereum’s value proposition lies in its programmable blockchain and expansive ecosystem. Ongoing upgrades, increased scalability, and developer activity contribute to its long-term appeal. These strengths help offset short-term market turbulence.

As stabilization progresses, investors often refocus on these fundamentals. This shift from speculative trading to value-based investing can help anchor prices and support gradual appreciation over time.

Potential Scenarios Ahead for the Crypto Market

As Bitcoin and Ethereum attempt to stabilise after sharp corrections, several potential scenarios could unfold. Understanding these possibilities helps investors manage expectations and risk.

One scenario involves extended consolidation, where prices move sideways for an extended period. This outcome allows the market to absorb excess supply and rebuild confidence. While less exciting, it often sets the stage for healthier future rallies.

Another possibility is a gradual recovery driven by improving sentiment and supportive macro conditions. In this case, higher lows and sustained buying interest could signal the start of a new upward trend.

Alternatively, renewed volatility could emerge if external shocks or negative developments occur. This would challenge stabilization efforts and potentially lead to further corrections.

Regardless of the scenario, the current phase where Bitcoin and Ethereum attempt to stabilise after sharp corrections is a critical inflection point for the market.

Conclusion

The current market environment highlights a pivotal moment as Bitcoin and Ethereum attempt to stabilise after sharp corrections that tested investor confidence and market resilience. While uncertainty remains, early signs of consolidation, improving sentiment, and strong long-term fundamentals suggest that stabilization is achievable.

Bitcoin’s role as a market leader and Ethereum’s robust ecosystem provide a foundation for recovery, even as macroeconomic factors continue to influence price action. Stabilization does not guarantee immediate gains, but it represents a necessary step toward sustainable growth.

For investors and observers alike, patience and perspective are essential. By focusing on fundamentals, technical signals, and broader economic trends, market participants can better navigate this transitional phase. As the dust settles, the efforts of Bitcoin and Ethereum to regain balance may ultimately define the next chapter of the cryptocurrency market.

Frequently Asked Questions

Q: What does it mean when Bitcoin and Ethereum attempt to stabilise after sharp corrections?

It refers to a phase where prices stop falling rapidly and begin moving sideways as buying and selling pressure balance out.

Q: Are sharp corrections normal in the crypto market?

Yes, sharp corrections are common due to high volatility and speculative trading, especially after strong price rallies.

Q: How long can a stabilization phase last?

Stabilization can last weeks or even months, depending on market conditions, sentiment, and external factors.

Q: Should investors buy during stabilization periods?

This depends on individual risk tolerance and strategy. Many investors use stabilization phases to accumulate gradually.

Q: What factors could disrupt Bitcoin and Ethereum’s stabilization efforts?

Macroeconomic shocks, regulatory changes, or sudden shifts in investor sentiment could reignite volatility.

See More: Bitcoin Consolidates at $89K as Volatility Hits Lows