As Bitcoin slows down after its latest uptrend, the spotlight has shifted to a new group of fast-moving altcoins. The most talked-about names right now are HYPE, WLFI, and ENA. Each one has caught the attention of traders for different reasons, but they share a common theme: strong narratives, fresh excitement, and the potential for higher short-term returns.

When Bitcoin cools, the crypto market often enters a phase where traders begin searching for the next big mover. Altcoins tend to benefit from this shift in attention because they can rise much faster with smaller amounts of capital. That is exactly what we are seeing with HYPE, WLFI, and ENA. Their recent gains show how quickly momentum can shift when the market starts looking beyond Bitcoin.

In this article, we’ll explore why these altcoins are surging, the stories driving each one, the risks involved, and what this trend means for the crypto market. Everything is explained clearly and simply, with an easy reading flow that anyone can follow, even without deep crypto knowledge.

Why Altcoins Rise When Bitcoin Slows

Bitcoin usually leads the market. When it climbs, money flows into crypto. But once Bitcoin begins to cool down or trade sideways, traders often take profits and look for new opportunities. Altcoins become the next target because they can move much faster in both directions. This shift is called capital rotation. It happens for a few key reasons:

When Bitcoin becomes quiet, traders get bored and look for tokens with bigger upside potential. Fresh stories, new launches, and strong community excitement can send smaller coins soaring. Because altcoins have lower market caps than Bitcoin, even a little extra demand can create sharp price increases. HYPE, WLFI, and ENA are rising at the same time because each one has strong momentum, strong narratives, and a growing number of traders talking about them. In a market driven heavily by attention, that combination is powerful.

HYPE: The Token Behind a Fast-Growing Derivatives Exchange

HYPE is the native token of Hyperliquid, a decentralized derivatives exchange that has been expanding quickly. More traders are choosing Hyperliquid because it offers low-cost trading, fast execution, and a user experience that feels close to a centralized exchange—without giving up control of their funds.

The surge in HYPE comes from a few important factors. As decentralized trading grows, Hyperliquid’s active user base has been rising. More traders mean more attention, and more attention often leads to increased demand for the token. HYPE also benefits from a strong narrative around decentralized derivatives, which is one of the hottest areas in crypto right now.

Many traders see HYPE as a pure play on the future of on-chain trading. That idea alone has brought both retail traders and large crypto funds into the token. The more excitement Hyperliquid generates, the more HYPE benefits. But it’s still a risky asset. Derivatives trading is linked to high leverage, and sharp market drops can trigger fast reversals. Even with strong momentum, HYPE can fall just as quickly as it rises, especially during volatile periods.

WLFI: A Political-Backed Token With a Big Story

WLFI, the governance token of World Liberty Financial, is one of the most unusual tokens rising right now. Its surge is tied to a strong and highly visible narrative: the token is connected to the Trump family and has branding built around national identity, stablecoins, and financial independence.

WLFI originally launched as a non-transferable governance token, but when trading opened to the public, interest exploded. A politically themed token naturally attracts attention, and attention is often the engine behind large price moves in crypto. Supporters believe WLFI could become a major player in the stablecoin and DeFi space, especially with the marketing power of a high-profile political brand. Critics argue that its value is based more on hype and association than on real utility so far.

This dual nature makes WLFI volatile and unpredictable. It can surge on positive headlines, endorsements, or social media activity. But it can also drop sharply if interest cools or if regulatory pressure increases. WLFI is a clear example of how powerful narrative-driven trading can be, especially when Bitcoin slows down and traders start looking for big stories.

ENA: Fueling a New Type of Synthetic Dollar in DeFi

ENA powers Ethena, a protocol designed to create a stable, yield-generating synthetic dollar for crypto users. Its main product aims to give traders and DeFi users a stable way to store value while earning attractive yields. Many see it as a potential evolution of stablecoins. ENA stands out because it blends stability with yield. Users can hold a dollar-like asset and earn rewards, which is appealing in a market where yield opportunities are sometimes hard to find. This has pushed ENA into the spotlight, especially among DeFi investors.

The token’s rise has also been fueled by strong community interest, high liquidity, and regular news events such as upgrades and token unlocks. ENA’s model depends on hedging and derivatives, which makes it both innovative and complex. When the market is calm and predictable, the system works smoothly. When volatility spikes, the risks increase. Even with these challenges, ENA has one of the strongest narratives in DeFi today. It represents a new approach to stable assets and yield generation, and that vision has helped drive its recent gains as Bitcoin cools.

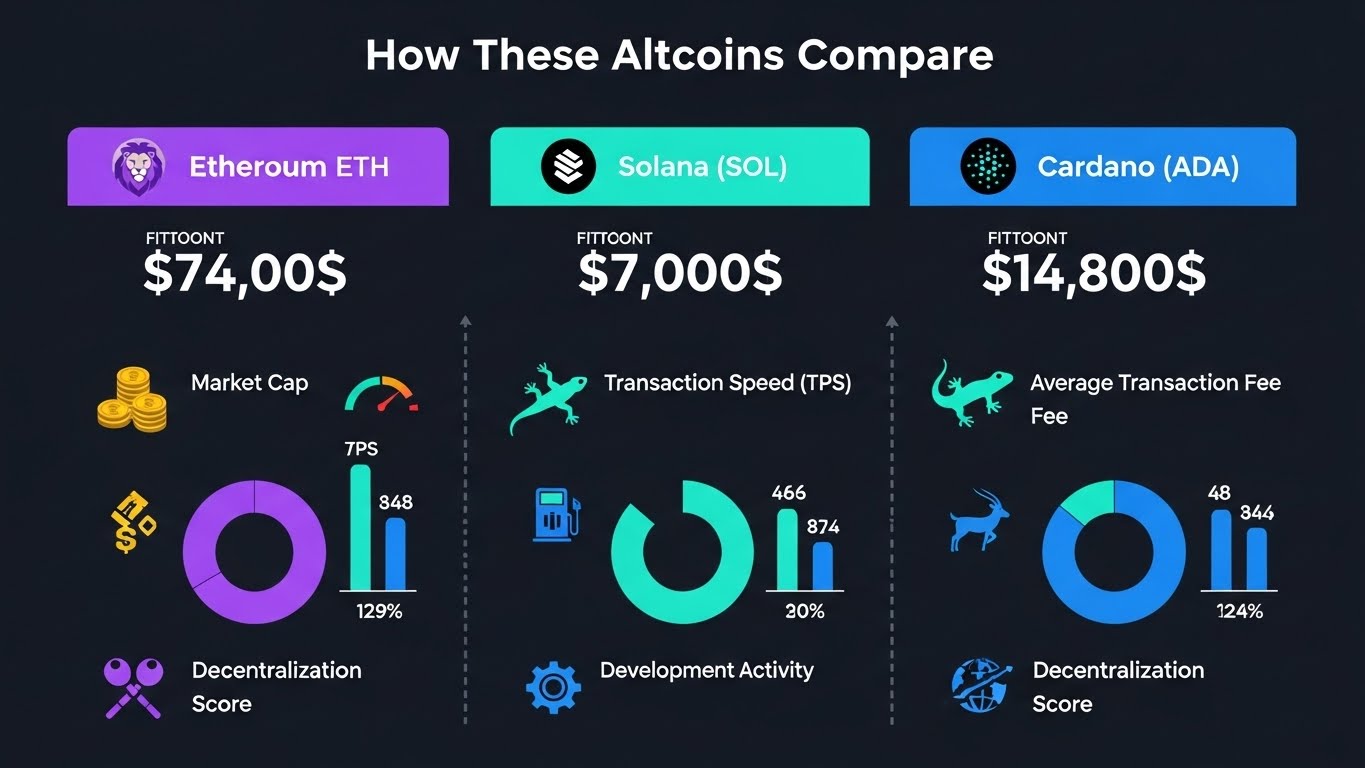

How These Altcoins Compare

HYPE, WLFI, and ENA have all seen major interest, but their strengths come from very different areas. HYPE is powered by real usage on a growing derivatives exchange. WLFI is driven mostly by narrative and political association. ENA sits at the intersection of stablecoins, yield, and DeFi innovation. Their differences help explain why traders are rotating into them.

HYPE appeals to traders who believe in decentralized futures markets. WLFI appeals to those who follow political trends and brand-driven tokens. ENA appeals to DeFi users who want yield and a new kind of dollar-based product. Even though they are rising for different reasons, they share one key trait: they all benefit from Bitcoin’s slowdown. When Bitcoin gets quiet, traders look elsewhere, and these altcoins offer strong enough stories to attract that attention.

What This Means for the Crypto Market

The rise of HYPE, WLFI, and ENA shows that the crypto market is entering another stage of risk-taking. Altcoins tend to outperform during these periods because traders want faster gains and are willing to take on more volatility. This doesn’t mean Bitcoin is weak. In fact, Bitcoin often cools before starting another strong move. But during those pauses, the rest of the market becomes more active.

The surge in these altcoins suggests traders feel confident enough to explore new opportunities, even if they come with higher risk. It also signals that the market is becoming more narrative-driven again. Stories, themes, and community excitement are playing a bigger role. That can create opportunities, but also brings dangers when hype outweighs substance.

The Risks Behind the Rally

Even though these altcoins are rising fast, they also carry significant risks. HYPE depends heavily on trading volume and leverage. WLFI carries political risk and possible regulatory challenges. ENA relies on complex financial models that can face stress in volatile markets. Another important factor is token unlocks.

When large amounts of tokens become available for trading, the price can drop sharply. Unlocks, whale sell-offs, and liquidity changes are all things that can quickly reverse a rally. Because of these risks, it’s important for traders not to rely solely on hype or social media trends. Understanding each project’s design, purpose, and long-term potential is essential.

How Traders Can Approach This Trend

Seeing altcoins rise will always attract attention, but smart traders stay balanced. The goal is not to chase every sharp move, but to understand why a token is rising and what could affect it next. HYPE, WLFI, and ENA can be part of a diversified portfolio, but they should be treated as higher-risk assets. Many long-term investors keep Bitcoin or Ethereum as their main holdings and add smaller amounts of speculative altcoins when the market conditions are right. The most important thing is to know the narrative, know the risks, and keep position sizes under control. Crypto rewards patience as much as excitement.

Conclusion

Altcoins HYPE, WLFI, and ENA are soaring as Bitcoin cools, and their rise reflects a growing appetite for risk across the market. Traders are looking for fresh opportunities, strong stories, and new types of innovation. HYPE offers growth in decentralized trading. WLFI brings political branding and bold messaging. ENA pushes the boundaries of stable assets and yield in DeFi.

These tokens are rising for different reasons, but they share the same momentum coming from Bitcoin’s slowdown. Understanding why these altcoins are moving helps traders make smarter choices, stay aware of the risks, and stay prepared for the next shift in sentiment.

FAQs

Q: Why are HYPE, WLFI, and ENA rising now?

They are rising because Bitcoin has slowed down, and traders are rotating into altcoins with strong momentum and attention. Each of these tokens has a story that appeals to different groups of traders.

Q: Is HYPE’s growth based on real usage?

Yes, HYPE is tied to Hyperliquid, a fast-growing decentralized derivatives exchange. Its rising user activity and trading volume have helped push the token higher.

Q: What makes WLFI different from other altcoins?

WLFI stands out because of its political association and national branding. This creates strong narratives that attract attention, but it also brings higher uncertainty and controversy.

Q: Is ENA a stablecoin?

ENA is not a stablecoin itself. It powers Ethena, a protocol that creates a synthetic, yield-bearing dollar-like asset for DeFi users. ENA benefits when demand for that synthetic dollar grows.

Q: Should I rotate from Bitcoin into these altcoins?

That depends on your risk tolerance. These altcoins offer higher potential upside but also higher volatility. Many traders keep Bitcoin as a core holding and use altcoins like HYPE, WLFI, and ENA for smaller, more speculative positions.

See More: Top 5 Altcoin Market Movers KAS Rebounds, SUI, BONK, XRP