The headline “Altcoin Market Cap Drops to $1.28 Trillion as AI Bubble Fears Fuel Sell-Off” captures more than just a number; it reflects a dramatic shift in sentiment across the broader crypto market. After months of speculative mania around AI-linked cryptocurrencies, altcoin prices are finally coming under heavy pressure. Tokens that were once praised as the future of decentralized artificial intelligence, data infrastructure, and Web3 automation are now at the center of a sharp correction.

For a long stretch, the altcoin market cap appeared unstoppable. Capital flowed into niche tokens promising AI-powered trading, autonomous agents, intelligent DeFi strategies, and blockchain-based machine learning platforms. Influencers, social media threads, and even some analysts pushed the narrative that AI plus crypto was a once-in-a-generation opportunity. As a result, valuations for many AI altcoins climbed far ahead of real-world usage, revenue, or proven technology.

Now, with the altcoin market cap falling to $1.28 trillion, the mood has changed. Traders are reassessing whether they overpaid for futuristic promises, and whether a genuine AI bubble has been forming within the digital asset space. The sell-off is forcing investors to differentiate between projects with real fundamentals and those riding on hype alone.

In this detailed analysis, we will examine what caused this sharp drop in altcoin valuations, how AI bubble fears developed, and what this means for the future of high-risk crypto assets. We will also explore how different groups of investors are reacting and what strategies might make sense in such a volatile environment.

How the Altcoin Market Cap Surged Before the Drop

The AI narrative takes over crypto

To understand why the altcoin market cap drops to $1.28 trillion, it helps to look back at the run-up that came before. The recent cycle saw the rise of a powerful story: that the intersection of artificial intelligence and blockchain would reshape everything from finance and gaming to healthcare and supply chains. This AI narrative quickly became one of the strongest themes in the altcoin market.

New and existing projects alike began branding themselves around concepts such as AI-powered DeFi, decentralized data marketplaces, on-chain machine learning, and autonomous AI agents. Some had genuine research and development behind them. Others simply added “AI” to their roadmap and marketing materials without substantial technical backing. Regardless of quality, many of these tokens saw their market caps balloon as speculators chased the next big thing.

The influx of capital was not limited to AI tokens alone. As AI hype spread, traders rotated profits into other altcoins, pushing the overall market cap higher. This created the impression of a broad-based altcoin supercycle, with AI acting as a central catalyst.

Liquidity, leverage, and speculative momentum

As prices rose, liquidity and leverage amplified the trend. Centralized and decentralized exchanges listed more AI-themed tokens, while derivatives markets began offering perpetual futures and options on top names. Traders who wanted to turbocharge their exposure used leverage to magnify both gains and potential losses.

This speculative momentum helped push the altcoin market cap to lofty levels. Small-cap and mid-cap coins, especially those with AI branding, experienced rapid price appreciation without a corresponding increase in user adoption or on-chain activity. For a time, it seemed as though as long as a token had “AI” attached to it, investors would line up to buy.

Yet underneath the surface, risk was quietly building. A growing number of crypto investors were holding highly correlated positions in the same AI narratives. Any serious disappointment—technical, regulatory, or macroeconomic—threatened to trigger a synchronized rush for the exits.

Why AI Bubble Fears Are Fueling the Sell-Off

The gap between AI promises and current reality

The phrase “AI bubble” is not unique to crypto. Traditional equity markets have also seen sharp rallies in companies linked to artificial intelligence, often pricing in years of future growth. In the altcoin market, however, this effect is magnified by volatility and the ease of launching tokens with very little infrastructure behind them.

As time passed, many AI-related altcoin projects struggled to deliver on their ambitious roadmaps. Real-world usage lagged behind marketing claims. MVPs and beta products took longer than expected, and some teams pivoted or went silent. On-chain data in many cases did not support the valuations that the market was assigning to these tokens.

When investors realized that much of the AI promise was still experimental and early-stage, doubts began to spread. The gap between the story and the data grew too large to ignore. Once a critical mass of traders concluded that prices had run too far ahead of fundamentals, AI bubble fears intensified and selling pressure mounted.

Profit-taking by early adopters and whales

Another major factor behind the sell-off is profit-taking by large holders. Early backers, venture funds, and whales who accumulated AI-focused altcoins at much lower levels began to secure their gains as valuations soared. As these large players sold into strength, they added steady downward pressure to the market. When the altcoin market cap dropped to $1.28 trillion, it reflected not only panic selling but also planned exits by sophisticated investors.

Retail traders who entered later, often chasing peak AI hype, were left holding bags as early entrants quietly reduced exposure or rotated into more established assets such as Bitcoin and Ethereum. This process of distribution is typical of speculative cycles. The presence of the AI narrative simply made it more extreme, as many investors underestimated how quickly sentiment could flip once early adopters decided to cash out.

Macro and Regulatory Backdrop: Why Sentiment Turned Cautious

Rising risk awareness in a fragile macro environment

The decline in the altcoin market cap is not happening in isolation from the broader financial world. Rising uncertainty about interest rates, inflation, and global growth impacts how much risk investors are willing to take. When traditional markets become volatile or risk-averse, speculative corners such as AI altcoins tend to suffer first.

Even if AI and crypto represent transformative technologies, large investors still categorize them as high-risk exposures. As risk appetite wanes, many prefer to de-risk by trimming positions in speculative assets. The result is a rotation away from niche tokens and toward more liquid, less volatile instruments. The sell-off in AI-driven altcoins therefore reflects both internal concerns about overvaluation and an external backdrop that discourages aggressive risk-taking.

Regulatory uncertainties around AI and crypto

Regulation adds another layer of complexity. Governments and regulators worldwide are paying closer attention to both artificial intelligence and cryptocurrencies. Concerns about data privacy, algorithmic transparency, manipulation, and systemic risk are driving new proposals and policy debates. For AI-based crypto projects, this creates a double exposure.

They must navigate not only evolving rules for digital assets but also potential constraints around data usage, AI model deployment, and cross-border data flows. This regulatory overhang can make traditional institutions hesitant to heavily allocate capital to AI altcoins, limiting sustainable demand. As policymakers signal potential crackdowns or tighter oversight, AI bubble fears can be reinforced, prompting traders to adopt a more cautious stance and further pressuring the altcoin market cap.

Technical Picture: Key Levels Behind the $1.28 Trillion Mark

Market cap as a sentiment barometer

The fact that the altcoin market cap drops to $1.28 trillion is important partly because of where it sits relative to previous cycles and consolidation zones. Market cap, while not a perfect measure, offers a macro-level view of how much capital is committed to the altcoin ecosystem. Breaking below a previously defended area often signals that a meaningful shift in sentiment has occurred.

Traders who once viewed dips as buying opportunities may now see them as warning signs. As a result, fewer participants are willing to “buy the dip” aggressively, making it easier for the market cap to fall further if selling continues. This is especially relevant when much of the prior rally was concentrated in a popular theme like AI. When that theme loses credibility, the selling can spill over into unrelated altcoins as investors reduce overall exposure.

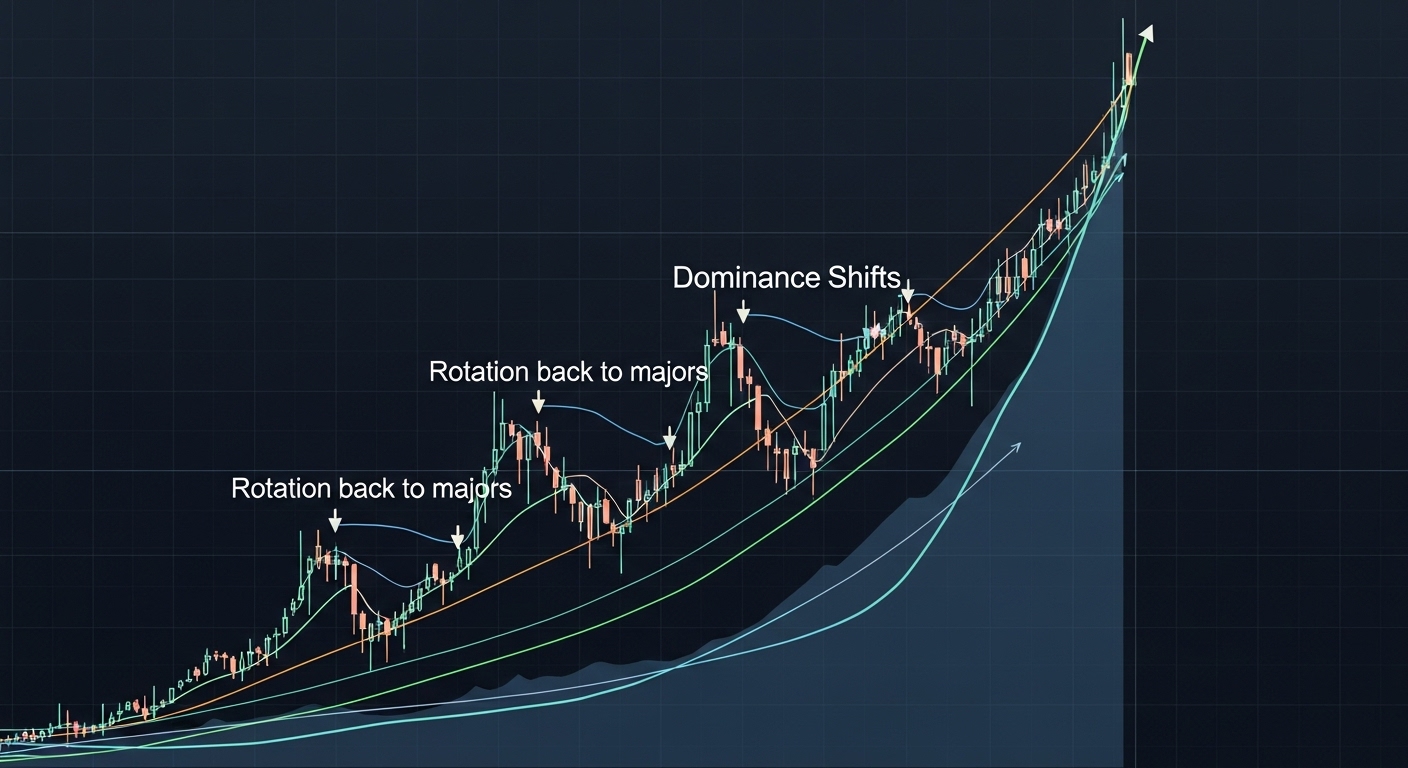

Chart structures, dominance shifts, and rotation back to majors

Technical analysts also pay attention to the relationship between altcoins and Bitcoin, often in the form of Bitcoin dominance charts. When the altcoin market is strong, dominance tends to fall as capital rotates into smaller coins. When risk appetite wanes, dominance often rises as money flows back into BTC and large-cap assets. The recent drop in altcoin valuations and total market cap aligns with a rotation back toward perceived safety.

Many traders are consolidating into major cryptocurrencies, stablecoins, or even exiting the market while volatility is high. This dynamic puts additional strain on altcoin prices, as fewer buyers are willing to step in and absorb selling. The move to $1.28 trillion is therefore more than a random number; it signals that the altcoin sector is in a corrective phase, driven by a mixture of AI-related anxiety, technical breakdowns, and capital rotation.

How Different Investor Groups Are Reacting to the Altcoin Sell-Off

Short-term traders: volatility hunting and fast exits

Short-term traders, including scalpers and day traders, tend to view situations like this through the lens of volatility. For them, the fact that the altcoin market cap drops to $1.28 trillion is less about long-term fundamentals and more about near-term price swings. Many have reduced their exposure to illiquid, thinly traded AI tokens and focused on more liquid pairs where they can enter and exit quickly.

Some aggressive traders are attempting to fade extreme moves by shorting overheated coins or buying sharp intraday dips. However, this strategy carries significant risk, as liquidity can dry up rapidly in stressed markets. Those who are not disciplined with risk management may find that the same volatility they seek for profit can result in outsized losses.

Long-term believers: separating signal from noise

Long-term investors who still believe in the structural potential of altcoins and AI are reacting differently. Rather than abandoning the sector entirely, many are using this correction to evaluate which projects have real technology, strong teams, and sustainable roadmaps. The key question they ask is whether a token is more than just an AI label.

For these crypto investors, the sell-off is an opportunity to separate signal from noise. Projects that continue building, shipping updates, and attracting genuine users may emerge stronger once the AI bubble narrative fades. Those that were primarily fueled by hype may never recover their prior valuations. Instead of chasing the latest memetic AI narrative, long-term participants are focusing on fundamentals such as tokenomics, product-market fit, developer activity, and ecosystem growth.

Institutional participants: reassessing exposure and mandates

Institutional investors, including funds and family offices, often have strict risk controls and mandates. The recent decline in the altcoin market cap and the turbulence in AI tokens are likely prompting these players to reassess their allocations. Some may temporarily reduce exposure to high-beta altcoins until conditions stabilize or regulatory clarity improves.

Others might use the downturn to quietly accumulate positions in more established projects at discounted prices, especially if they believe in the long-term convergence of AI and blockchain. However, institutions generally move cautiously and slowly, meaning they are unlikely to “rescue” the market in the middle of a panic-driven sell-off.

Is This the End of the AI Altcoin Narrative?

Narrative cycles in crypto: boom, disappointment, and rebirth

Crypto markets are driven by recurring narrative cycles. In past years, themes such as ICOs, DeFi, NFTs, play-to-earn gaming, and metaverse tokens each had their moments in the spotlight. They attracted enormous attention, saw rapid price expansion, and then endured crushing corrections when expectations exceeded reality.

The current AI altcoin narrative fits this pattern. The fact that AI bubble fears now fuel a sell-off does not necessarily mean the underlying idea is invalid. It means that the market front-ran the timeline for adoption and overpaid for tokens that had not yet proven real-world value.

Over time, as technology matures, some AI-related blockchain projects could still carve out meaningful roles in data markets, automation, or decentralized computation. The current correction may eventually be seen as a necessary phase where speculation is flushed out and only durable innovations remain.

Cooling hype can create room for real builders

One of the surprising benefits of a narrative collapse is that it often clears space for genuine builders and innovators. When hype dominates, teams feel pressure to prioritize token marketing over product development. During a downturn, however, the spotlight shifts toward those who keep shipping, regardless of price.

As the altcoin market cap declines and speculative attention wanes, AI-focused projects with real substance may have a better chance to stand out based on merit rather than mere branding. Investors who take a patient, research-driven approach may find that this quieter phase offers some of the best risk-reward opportunities, even if it feels uncomfortable in the moment.

Strategies for Navigating an Altcoin Market in Correction

Risk management before return maximization

In an environment where the altcoin market cap drops to $1.28 trillion, the priority for most investors should be risk management. That means understanding how much capital is at risk in speculative AI tokens, how concentrated their portfolio is, and whether they can withstand further drawdowns without being forced to sell at the worst time.

Prudent strategies include reducing leverage, diversifying across different sectors and time horizons, and avoiding overexposure to illiquid small caps that can be difficult to exit under pressure. Allocating a core portion of a portfolio to more established assets while reserving only a controlled share for high-risk AI altcoins can help strike a balance between opportunity and protection.

Focusing on fundamentals and time horizons

Another key strategy is to align investments with realistic time horizons and fundamental analysis. Short-term traders may focus on technical patterns and news flow, but long-term investors should base decisions on deeper research. That includes evaluating a project’s whitepaper, team experience, token utility, governance model, and competitive landscape.

Those who believe in the long-term potential of AI and blockchain may choose to accumulate during periods of fear, but only in projects that demonstrate real progress and transparency. This approach requires patience and the ability to withstand volatility without reacting emotionally to every price swing.

Conclusion

The headline “Altcoin Market Cap Drops to $1.28 Trillion as AI Bubble Fears Fuel Sell-Off” marks an important moment for the crypto ecosystem. It is a sharp reminder that even the most compelling narratives—like the marriage of AI and blockchain—cannot suspend the laws of market gravity. When valuations run too far ahead of fundamentals, and when hype outpaces real adoption, corrections are not only possible; they are likely. Yet this downturn is not a final verdict on altcoins or on the long-term promise of combining artificial intelligence with decentralized networks. Instead, it is an inflection point. It forces the market to distinguish between genuine innovation and speculative branding, between sustainable ecosystems and quick-money schemes.

For investors and traders, the sell-off offers painful but valuable lessons. It underscores the importance of risk management, skepticism toward overused buzzwords, and the need to think in cycles rather than straight lines. Those who can learn from this period, adapt their strategies, and remain focused on fundamentals are more likely to survive—and potentially thrive—when the next narrative wave arrives. The altcoin market cap may be down, but the story of digital assets, AI integration, and decentralized technologies is still being written. The question is not whether narratives will return, but whether participants will be better prepared when they do.

FAQs

Q: Why did the altcoin market cap drop to $1.28 trillion?

The altcoin market cap dropped to $1.28 trillion due to a combination of profit-taking, AI bubble concerns, macroeconomic uncertainty, and regulatory overhang. Many AI-themed altcoins saw valuations far exceed real usage, and once sentiment shifted, selling pressure spread across the broader altcoin sector.

Q: Are AI altcoins dead after this sell-off?

No, AI altcoins are not necessarily dead, but the AI narrative has been severely challenged. Projects with weak fundamentals or purely hype-driven marketing may struggle to recover, while those with real technology, active development, and clear use cases could survive and grow over time, especially once the market stabilizes.

Q: How do AI bubble fears affect non-AI altcoins?

Even non-AI altcoins can be impacted because investors often treat altcoins as a single risk bucket. When confidence in a dominant theme like AI fades, many traders choose to reduce overall exposure. This broad de-risking can lead to sell-offs across a wide range of tokens, not just those directly linked to AI.

Q: Is now a good time to buy altcoins after the drop?

Whether it is a good time to buy depends on your risk tolerance, time horizon, and research. Some investors see corrections as opportunities to accumulate strong projects at lower prices, while others prefer to wait for clearer signs of stabilization. It is crucial to avoid blindly buying dips and instead focus on altcoins with solid fundamentals and transparent teams.

Q: How can I protect myself from future narrative-driven bubbles?

To protect yourself from future narrative-driven bubbles, diversify your portfolio, limit leverage, and avoid overconcentration in any single theme such as AI, DeFi, or gaming. Combine narrative awareness with on-chain data, fundamental research, and macro analysis. Most importantly, set clear risk limits and stick to them, even when the market feels euphoric.