The decentralized finance ecosystem has entered a defining moment as Ethereum DeFi total value locked surges past the $99 billion milestone, reinforcing Ethereum’s position as the backbone of modern DeFi. While the crypto market often grabs attention with price swings, total value locked (TVL) tells a deeper story—one that reflects investor confidence, protocol utility, real liquidity, and the growing sophistication of on-chain financial products.

This breakthrough is not just another headline. Ethereum DeFi total value locked represents the combined value of assets deposited across lending platforms, decentralized exchanges, liquid staking protocols, yield aggregators, and other on-chain financial systems. When TVL rises sharply, it usually indicates that more users are actively participating in DeFi, depositing more assets, and trusting smart contracts with meaningful capital. Crossing $99 billion signals that Ethereum’s DeFi rails are not only surviving market cycles but also scaling toward mainstream financial relevance.

What makes this milestone especially important is the timing. DeFi has matured significantly since its early explosive growth period, evolving from experimental yield farms into an interconnected network of applications with risk management tools, deeper liquidity, stronger security audits, and improved user experiences. The current expansion of Ethereum DeFi total value locked suggests that capital is rotating back into on-chain finance for reasons beyond hype—such as improved layer-2 scaling, stronger institutional interest, liquid staking adoption, and the growing appeal of decentralized lending markets.

In this article, we’ll explore what’s pushing Ethereum’s DeFi TVL toward record territory, which sectors are leading the charge, how this impacts ETH, stablecoins, and the broader market, and what risks still remain. We’ll also examine what this milestone could mean for the future of Ethereum DeFi total value locked and whether the ecosystem can sustain growth in an increasingly competitive multi-chain world.

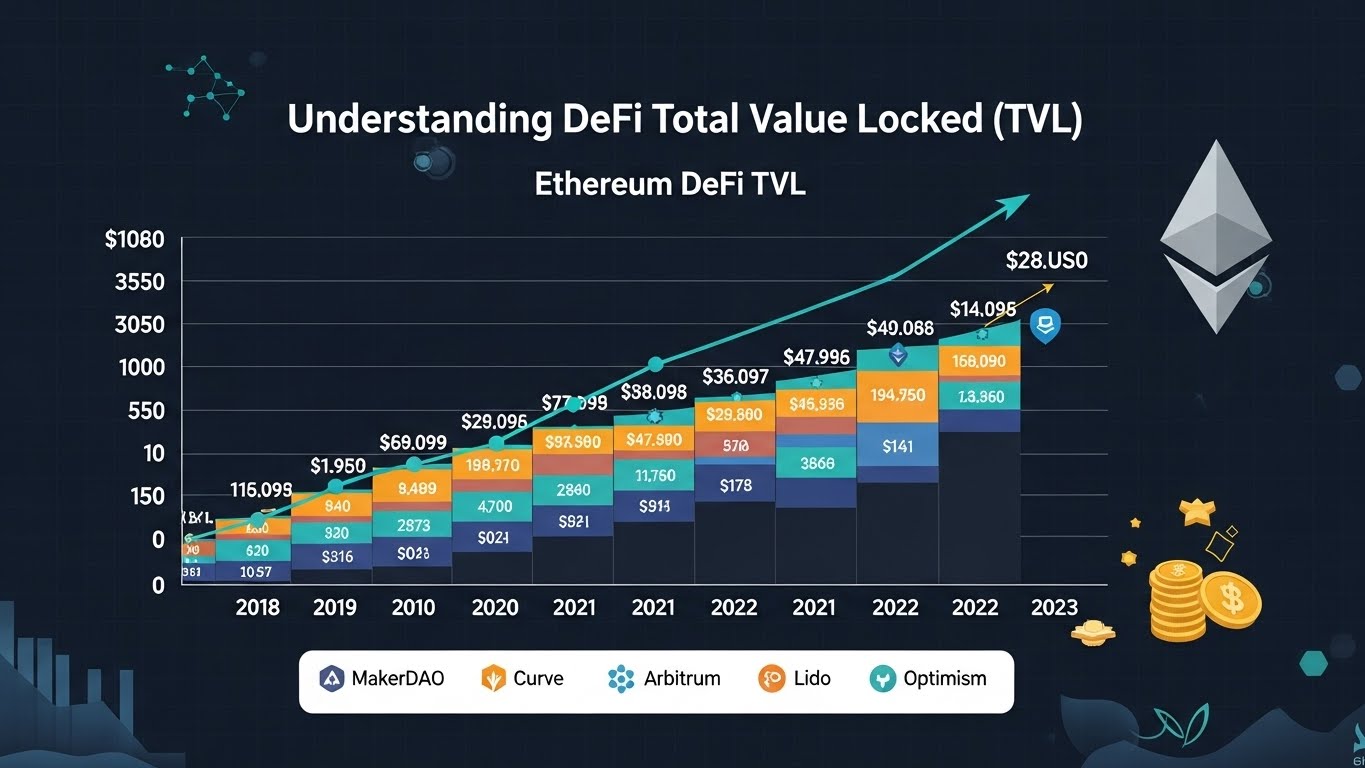

Understanding Ethereum DeFi Total Value Locked (TVL)

Before diving into the reasons behind the $99 billion achievement, it’s crucial to understand what Ethereum DeFi total value locked actually measures—and what it doesn’t. TVL generally refers to the total value of crypto assets deposited into DeFi smart contracts. These deposits may include ETH, stablecoins, wrapped tokens, staking derivatives, and governance tokens, depending on the protocol.

At a practical level, TVL reflects the amount of liquidity that is actively being used to power DeFi applications. Lending protocols use deposited assets as collateral for borrowing. Decentralized exchanges use locked liquidity to facilitate trading. Liquid staking systems lock ETH to secure Ethereum and issue tradable staking tokens in return. In all of these cases, the rise of Ethereum DeFi total value locked suggests increased demand for decentralized financial services.

However, TVL is not a perfect metric. It can increase simply because token prices rise, even if the number of users stays the same. It can also be inflated by “double counting,” where users deposit a token received from one protocol into another protocol, making the same value appear multiple times across platforms. Still, despite these limitations, Ethereum’s TVL remains one of the most widely used indicators of DeFi strength because it captures real capital commitments rather than short-term trading volume alone.

When Ethereum DeFi total value locked grows sustainably—accompanied by rising users, fees, and stable liquidity—it usually signals ecosystem health. That’s why crossing $99 billion is so meaningful: it implies a return of deep liquidity and confidence at scale.

Key Drivers Behind the $99B Ethereum DeFi TVL Breakout

Renewed Confidence in Ethereum as DeFi’s Settlement Layer

Ethereum has long been considered the most secure and battle-tested smart contract network. Despite the rise of alternative chains, institutional investors and experienced DeFi users often prefer Ethereum due to its long-term resilience, extensive developer community, and mature infrastructure. As capital grows more selective during market cycles, money tends to flow toward platforms with proven security and liquidity depth.

This renewed trust is a major driver behind the rise in Ethereum DeFi total value locked. Users are increasingly prioritizing protocol safety, audit history, and the likelihood of long-term survival. Ethereum’s dominance in blue-chip DeFi protocols helps reinforce that confidence, attracting liquidity that may have previously explored riskier ecosystems.

Liquid Staking Growth and the Expansion of Staking Derivatives

One of the biggest structural shifts in DeFi has been the rise of liquid staking. Instead of locking ETH for staking with no flexibility, users can stake ETH through liquid staking providers and receive a liquid token representing their staked position. These tokens can then be used throughout DeFi as collateral or yield-generating assets.

This dynamic plays a major role in boosting Ethereum DeFi total value locked, because staked ETH now becomes composable, moving through lending, liquidity pools, and yield strategies. The result is a multiplier effect: more ETH is staked while still remaining economically active across DeFi.

Layer-2 Scaling and Lower Transaction Costs

A major barrier for DeFi adoption has historically been Ethereum’s transaction fees. While Ethereum mainnet remains the most secure settlement environment, many users prefer faster and cheaper execution. With the expansion of layer-2 networks, DeFi participation has become more accessible without abandoning Ethereum’s security model.

As the user base grows through layer-2 adoption, the overall ecosystem strengthens, encouraging larger liquidity pools and deeper integration among protocols. This increases demand for deposits, directly supporting the rise of Ethereum DeFi total value locked across the broader Ethereum ecosystem.

Stablecoin Liquidity and Stronger On-Chain Money Markets

Stablecoins act as the lifeblood of DeFi by providing predictable value and liquidity. When stablecoin supply expands on Ethereum, it typically boosts lending and trading activity, increasing collateral deposits and liquidity pool depth.

As DeFi lending platforms become more advanced with improved interest rate models, better collateral frameworks, and cross-protocol integrations, they attract more stablecoin deposits. That naturally supports growth in Ethereum DeFi total value locked, especially when borrowing demand rises from traders, market makers, and on-chain businesses.

Which DeFi Sectors Are Fueling Ethereum’s TVL Growth?

Decentralized Lending Protocols

Lending platforms are consistently among the largest contributors to Ethereum DeFi total value locked because they require large collateral deposits to support borrowing. When market sentiment improves, borrowing demand tends to increase—either for leverage, liquidity, or trading strategies—leading to more collateral flowing into lending protocols.

DeFi lending has also matured into a robust market with better liquidation systems, risk parameters, and governance structures than earlier cycles. That improved stability makes it easier for large depositors to allocate capital confidently, which can significantly increase Ethereum’s TVL in a short period.

Decentralized Exchanges and Liquidity Pools

Automated market makers (AMMs) remain essential infrastructure for DeFi. Liquidity providers deposit tokens into pools to earn fees, while traders use those pools for swaps. When trading volume rises, liquidity providers often deposit more capital to capture yield opportunities, increasing TVL.

The growth of Ethereum DeFi total value locked in this sector often reflects stronger demand for Ethereum-based liquidity, improved capital efficiency mechanisms, and expanding derivatives or stablecoin pools. DEX ecosystems also thrive as more tokens launch and more trading pairs emerge, creating new incentives to lock value into liquidity pools.

Liquid Staking and Restaking Ecosystems

Liquid staking has become a core pillar of Ethereum DeFi, and its influence on TVL is enormous. Restaking models also expand this concept by enabling staked ETH (or staking derivatives) to provide additional security services, potentially generating extra yield.

As these systems grow, they tend to lock massive amounts of ETH, which contributes directly to Ethereum DeFi total value locked. The fact that staked positions can still be used as DeFi collateral makes this sector uniquely powerful in driving TVL increases.

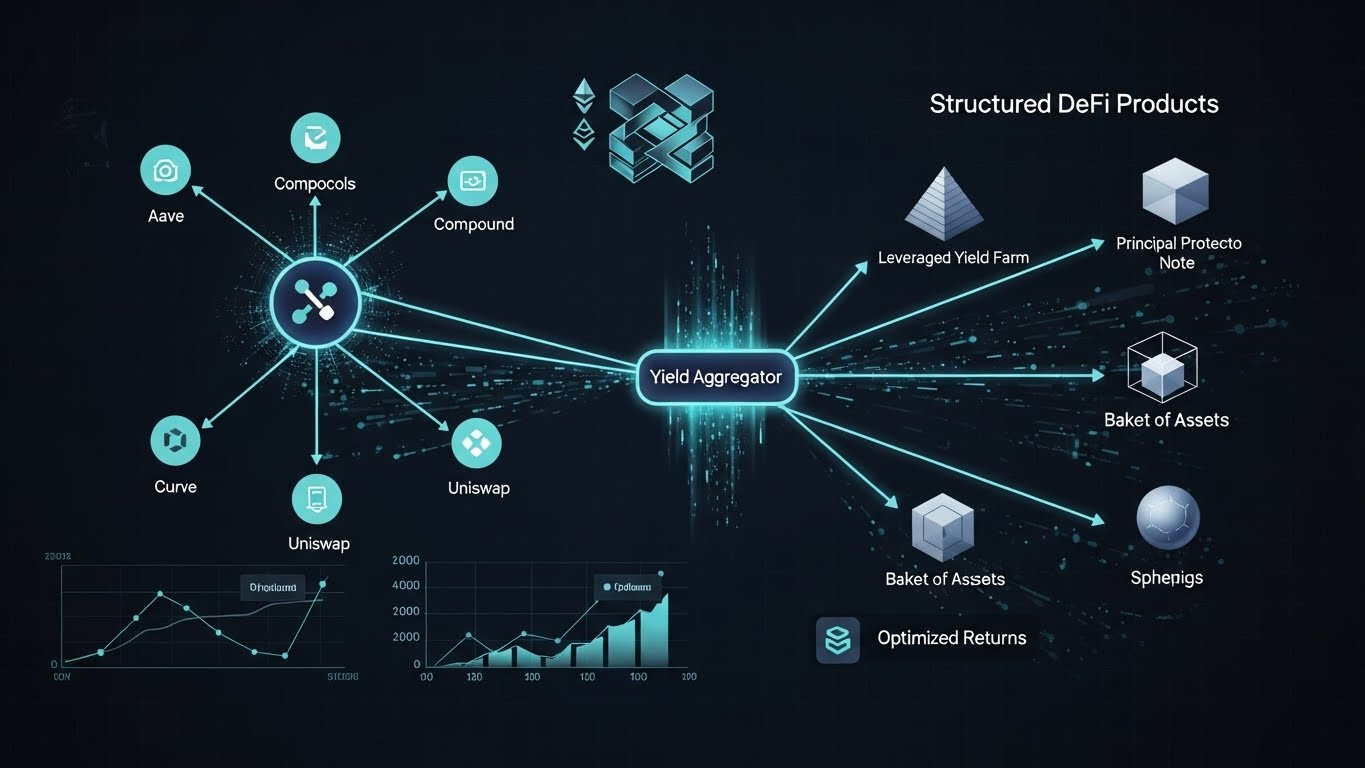

Yield Aggregators and Structured DeFi Products

As DeFi becomes more sophisticated, users increasingly look for automated strategies that optimize yield. Yield aggregators simplify complex strategies by routing funds across lending, liquidity, and incentive programs.

These platforms can boost Ethereum DeFi total value locked because they attract users who might not manually manage DeFi positions but still want exposure to on-chain yield. Structured products—such as options vaults or fixed-yield mechanisms—also contribute to TVL by locking assets for defined periods.

What This $99B Milestone Means for ETH and the Crypto Market

Ethereum’s Economic Flywheel Strengthens

When Ethereum DeFi total value locked climbs, Ethereum’s network activity and economic relevance typically increase. More deposits often lead to more transactions, more smart contract interactions, and potentially higher fee generation (especially on mainnet settlement). In turn, that can support ETH’s long-term value proposition as the asset that powers and secures the ecosystem.

Ethereum’s role as DeFi’s settlement layer becomes more pronounced when TVL expands, particularly if growth is driven by organic adoption rather than short-term incentives. In that environment, ETH benefits from being the primary collateral asset, gas token, and staking base.

Stronger Market Liquidity and Lower Slippage

Higher TVL generally means deeper liquidity. This benefits traders, protocols, and the overall market because better liquidity reduces slippage and improves pricing efficiency. A rising Ethereum DeFi total value locked often signals that markets are becoming more liquid, making Ethereum-based DeFi more attractive to both retail users and professional capital.

This is especially important for large trades, stablecoin conversions, and institutional participation. Deep liquidity is one of the primary reasons Ethereum DeFi continues to dominate, even when alternative chains attempt to compete.

A Signal That DeFi Is Entering a More Mature Phase

The DeFi market has historically been cyclical, often driven by speculative yield and hype. But sustained growth in Ethereum DeFi total value locked suggests that DeFi usage is expanding beyond speculation. The presence of better risk tools, improved auditing practices, and more reliable stablecoin infrastructure points to maturation.

This doesn’t mean risk disappears. But it does mean the ecosystem is likely becoming more resilient, making it harder for new competitors to unseat Ethereum’s DeFi leadership purely through incentives.

Risks and Challenges That Still Matter Despite Rising TVL

Smart Contract Vulnerabilities and Exploit Risk

Even with audits and improvements, DeFi protocols remain exposed to smart contract vulnerabilities. Rising Ethereum DeFi total value locked means more capital is at stake, making DeFi an even more attractive target for attackers. Exploits can quickly reduce TVL, damage confidence, and trigger cascading liquidations.

Security is improving across the ecosystem, but as complexity grows, so does the attack surface. That is why protocol design, code quality, bug bounty programs, and conservative risk management remain critical.

Liquidity Fragmentation Across Multiple Chains

While Ethereum leads, DeFi liquidity is spread across multiple chains and layer-2 networks. Fragmentation can reduce capital efficiency, increase bridging risks, and complicate user experience. Although layer-2 solutions often strengthen Ethereum’s ecosystem, they also introduce challenges around interoperability and liquidity routing.

If users face friction, it can limit growth in Ethereum DeFi total value locked, especially if newer chains offer smoother onboarding. Long-term success depends on better cross-layer integration and secure bridging infrastructure.

Regulatory Pressure and Compliance Shifts

DeFi continues to attract regulatory attention globally. Increased scrutiny around stablecoins, privacy tools, and financial services may impact protocol operations, front-end access, or user participation in certain jurisdictions.

Even though DeFi protocols are decentralized by design, regulatory impacts can still shape where liquidity flows. This remains a major external variable that could influence the trajectory of Ethereum DeFi total value locked in future cycles.

What Happens Next After Ethereum DeFi TVL Hits $99B?

The Push Toward $100B and Beyond

Crossing $99 billion naturally raises the question: is $100 billion next? Psychological milestones matter in markets because they amplify attention and attract more capital. If Ethereum DeFi total value locked moves decisively above $100 billion, it could reinforce market confidence and draw additional liquidity from sidelined investors.

However, sustaining growth matters more than reaching a round number. Healthy TVL expansion is supported by rising user activity, stable yields, real demand for borrowing, and consistent protocol revenues.

More Institutional Capital May Follow

Institutional participation in DeFi is still early, but it is growing. Professional capital tends to prioritize liquidity, transparency, and market depth—all areas where Ethereum DeFi leads. As protocols mature, compliance tools expand, and risk frameworks improve, more institutions may explore DeFi as a financial layer.

If that happens, Ethereum DeFi total value locked could grow not only through retail adoption but through large, strategic capital allocations that stabilize liquidity across cycles.

Innovation Will Shift Toward Real Utility

The next phase of DeFi likely focuses on practical use cases such as on-chain credit, decentralized identity for risk scoring, tokenized real-world assets, and more efficient derivatives markets. These innovations could bring long-term utility and sustained capital inflows, strengthening Ethereum DeFi total value locked even in less speculative environments.

Conclusion

The moment Ethereum DeFi total value locked shatters the $99 billion milestone is more than a number—it’s a sign of renewed trust, stronger infrastructure, and rising utility across decentralized finance. From lending and DEX liquidity to liquid staking and advanced yield strategies, Ethereum remains the dominant environment where DeFi capital feels most secure and most productive.

Yet, growth comes with responsibility. Security risks, liquidity fragmentation, and regulatory uncertainty remain real challenges. Still, Ethereum’s progress suggests that DeFi is evolving into a more durable and innovative financial ecosystem—one that could continue expanding well beyond this milestone if adoption remains steady and development continues to mature.

Whether the next target is $100 billion or a new all-time high, one thing is clear: Ethereum DeFi total value locked is becoming one of the most powerful indicators of crypto’s transition from speculation into functional, decentralized financial infrastructure.

FAQs

Q: What does Ethereum DeFi total value locked mean?

Ethereum DeFi total value locked refers to the total value of crypto assets deposited in Ethereum-based DeFi protocols, including lending markets, DEX liquidity pools, and staking systems.

Q: Why is the $99 billion milestone significant?

Crossing $99 billion shows major confidence in Ethereum DeFi, reflecting deeper liquidity, stronger user participation, and growing adoption of decentralized finance products.

Q: Does higher TVL mean DeFi is safer?

Not necessarily. While rising Ethereum DeFi total value locked can indicate trust and maturity, risks like smart contract bugs and exploits still exist. Safety depends on protocol design and security practices.

Q: Which protocols contribute most to Ethereum DeFi TVL?

Ethereum TVL is largely driven by decentralized lending, DEX liquidity pools, and liquid staking protocols, where users deposit significant amounts of ETH and stablecoins.

Q: Can Ethereum DeFi TVL keep growing beyond $100B?

Yes, it can. Continued growth may come from broader adoption, institutional capital, improved layer-2 experiences, and expanding use cases such as tokenized assets and advanced on-chain credit systems.