The Bitcoin price is writing a new chapter in 2025. After punching to fresh records above $125,000 in early October and then retracing on macro jitters, the market’s message remains remarkably consistent: a critical mass of traders still expects a run beyond $130,000 before year-end. Spot levels have been choppy in mid-October near the low-$110Ks as global risk assets wobble, yet the conviction behind bullish positioning—particularly in the options market and ETF flows—suggests the rally isn’t over.

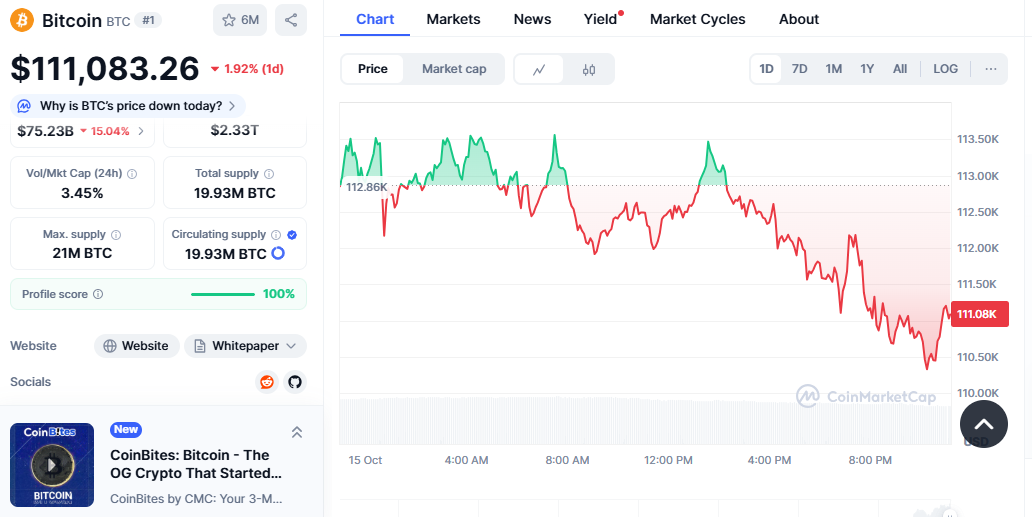

At the same time, a cluster of real-world risks—from rate uncertainty and regulatory crosswinds to miner stress—could complicate the final stretch. Recent price action shows both forces at work: Bitcoin set a new all-time high above $125,000 on October 5, then slipped back toward $111,000 amid geopolitical tremors and a broader risk-off tone.

In this in-depth outlook, we unpack why traders are still positioning for BTC to clear $130K, what might catalyze that move, and which risks could derail it. We’ll explore the role of spot Bitcoin ETFs, crypto derivatives, on-chain metrics, and the wider macro environment, then map plausible price paths into Q4. The goal is to help you read the market’s signals without getting lost in the noise—so your strategy remains calm, informed, and adaptable.

Why traders still expect Bitcoin to top $130,000 in 2025

A credible thesis for new highs rests on three pillars: fresh demand through spot Bitcoin ETFs, an options backdrop skewed toward upside tails, and a macro mix that’s slowly turning less hostile to risk assets.

New demand pipes ETFs opened the institutional floodgates.

Since the U.S. approved 11 spot Bitcoin ETFs in January 2024, institutional inflows have transformed the market structure. The ETF wrapper gives pensions, RIAs, and corporates an easy, compliant way to accumulate digital gold. Over 2025, these funds repeatedly printed large-scale net creations, culminating in record single-day and weekly inflows in early October as prices pushed to all-time highs—evidence of persistent demand that many traders expect to resume on dips.

To be clear, flows are not a one-way escalator. Several windows this year saw ETF outflows during risk-off episodes, reminding everyone that passive wrappers can also amplify downside. But the bigger picture remains that ETFs have broadened the investor base and deepened liquidity, making sustained price advances more feasible when macro winds cooperate.

Options positioning shows traders reaching for upside.

On Deribit, the world’s largest crypto options venue, dealers and macro funds have repeatedly chased out-of-the-money call options with strikes that cluster between $120K and $130K, and even far above in some expiries. Through mid-year and into Q3, market commentary highlighted growing interest in $130K calls as traders positioned for renewed bullish volatility. That upside skew and call demand are classic signatures of a market bracing for a fresh leg higher should resistance give way.

Macro backdrop is turning from headwind to a possible tailwind

October’s turbulence reminded everyone that Bitcoin is still a high-beta macro asset; the pullback below $111K coincided with trade-war headlines and a risk-off swoon across markets. Yet improving odds of Fed easing into year-end have helped stabilize sentiment, with investors interpreting Chair Powell’s recent tone as incrementally dovish. Lower policy rates tend to support risk assets by reducing the relative appeal of cash and bonds—conditions that historically improve the crypto bid.

The structure of this rally is why $130K matters

Technical significance near prior highs

The breakout above the summer highs to print a new all-time high in early October signaled a trend that’s alive and well. The zone just above $125K now serves as a psychological waypoint; a decisive weekly close back above it would validate an “impulse-then-consolidation-then-impulse” structure that technicians often associate with bull market continuation. Traders eye $130,000 as both a round-number magnet and the next logical extension if momentum returns.

ETF flow-price feedback loop

Each break to new highs has tended to attract incremental ETF creationscreatingte a reflexive loop: higher prices drive media attention, whicin turn h drives allocator interestleading togs more creations—pushing prices again. The early October surge that carried Bitcoin to records coincided with blockbuster ETF intake, reinforcing this flywheel narrative.

The pillars of demand in 2025

Institutional adoption through low-friction access

For many traditional allocators, ETF shares are the first truly operationally simple way to obtain BTC exposure. They fit existing custody and compliance processes, and they trade on familiar venues alongside equities and bond ETFs. This isn’t just convenient; it psychologically reframes Bitcoin from an exotic instrument to a portfolio building block. SEC approval in January 2024 was the turning point.

Derivatives as accelerants

When traders load into calls or unwind put hedges, dealers can be forced to chase the underlying higher to stay delta neutral. In practice, that means concentrated call-buying at the $120K–$130K range can add kindling to upside moves if spot rips, especially around options expiries that squeeze liquidity. We’ve already seen episodes this year when upside tails thickened as prices pushed through resistance.

The risks that could keep Bitcoin below $130K

Macro shocks, dollar strength, and liquidity holes

The same macro that can fuel a melt-up can efficiently deliver a gut-check. In October, Bitcoin sagged alongside stocks as geopolitical tensions rose and liquidity fled to safe havens. If stress lingers—such as a stronger U.S. dollar, higher real yields, and risk-off in equities—the Bitcoin price could remain capped beneath prior highs, with rallies fading before $130K.

ETF outflows cut both ways

The ETF wrapper enables large, rapid flows. That’s supportive on the way up—but those same pipes can siphon liquidity on the way down when allocators de-risk or rebalance. We’ve already seen short bursts of record outflows this year, particularly when macro headlines turned sour or when traders locked in gains. If such episodes coincide with thin weekend liquidity, drawdowns can steepen.

Post-halving miner stress and hash economics

The 2024 halving cut block rewards to 3.125 BTC, compressing miner revenue and pushing weaker operators toward consolidation. While protocol scarcity is a long-term tailwind, the short-term reality is tighter miner cash flows, which can lead to increased selling to fund operations during price dips. That supply overhang is another reason rallies can stall before a clean run past $130K.

Key drivers to watch into year-end

Federal Reserve signaling and the rates complex

Markets now handicap a meaningful chance of further easing by year-end. Softer labor data or a dovish pivot on balance-sheet runoff would typically lower term premia and bolster risk appetite—fertile ground for crypto. Conversely, any surprise rekindling of inflation or hawkish rhetoric would likely cap Bitcoin below the prior high for an extended period.

ETF flow cadence and primary-market creations

Monitor daily creations/redemptions across the leading spot Bitcoin funds. Surges in creations after mild pullbacks have repeatedly preceded upside extensions this year. Steady inflows alongside rising prices would be a strong tell that allocators are averaging in rather than aggressively top-ticking.

Options market skew and open interest

If 25-delta call skew turns decisively positive and open interest builds at strikes above $125K, that’s a sign that traders are paying up for upside again. High-delta call rolling and short-dated gamma pinning around key levels can also set the stage for abrupt range breaks. Reports through mid-year highlighted building interest in the $130K area; a renewed push there would support the bull case.

Pathways to $130K and beyond scenarios

Base case range-then-break

In the base case, Bitcoin oscillates between roughly $108K and $125K as macro dust settles, with spot testing offers just under the prior high. A follow-through catalyst—an upside surprise in ETF creations, dovish Fed commentary, or a substantial risk rally—sparks a breakout close above the October peak and a measured march through $130,000. Technical momentum and options-linked buying carry price into the mid-$130Ks before year-end.

Dip-and-rip volatility clears weak hands.

Alternatively, another macro shock presses Bitcoin into the high-$90Ks/low-$100Ks, triggering liquidations and miner hedging. But if ETF inflows stabilize and the Fed tone eases, a sharp reversal follows as sidelined capital buys the dip. This path is messier but ends with the same destination: a late Q4 sprint that finally takes Bitcoin price through $130K.

Bearish risk grinding consolidation

If growth cools but inflation proves sticky, the Fed stays cautious, the dollar firms, and equities chop sideways. In that environment, ETF flows could turn intermitten,t and options demand stays muted, leaving Bitcoin capped beneath the prior high and ending the year in a broad consolidation. This is the scenario in which $130K remains out of reach until a clearer macro inflection arrives.

How traders are positioning now

Spot accumulation with disciplined risk

Many allocators continue dollar-cost averaging via ETFs to accumulate on pullbacks toward key moving averages. The thesis is straightforward: as long as adoption curves and institutional participation expand, dips are opportunities—provided position sizes respect volatility.

Options overlays to define risk

Bullish traders frequently combine a call spread (buying a $125K–$135K structure) with protective puts beneath $105K–$110K to cap downside while preserving upside convexity. When implied volatility dips toward cycle lows, call spreads offer attractive asymmetry. When vol rises into events, some prefer sell-puts-to-finance-calls structures—only if they’re comfortable potentially buying spot lower.

Rotation within crypto beta

When Bitcoin pauses, some funds rotate into large-cap alts for relative performance, then rotate back to BTC during breakouts. This approach carries basis risk; in macro drawdowns, alts typically underperform. The core idea is to stay anchored to Bitcoin dominance while harvesting tactical opportunities.

What would invalidate the bull case?

A sustained breakdown in ETF flows, a hawkish repricing of the rate path, or a regulatory shock that crimps liquidity could all reset expectations. A multi-week failure to reclaim prior highs despite benign macro would also warn that the impulse is aging. Traders watch for divergences—like softening on-chain activity or rising exchange reserves—as early warnings that supply is outpacing demand.

The bottom line conviction with humility

The market’s mosaic points to a simple, if uncomfortable, truth: Traders still expect the Bitcoin price to challenge and clear $130,000 in 2025, but they also know the path won’t be linear. Structural demand from spot ETFs, persistent options interest near the $130K band, and a gradually improving macro tone argue for higher highs. Yet the very same mechanisms that fuel upside—fast ETF flows, leverage, and reflexivity—can amplify shocks on the downside. If you align your time horizon with your risk management and watch the three big dials (Fed, ETF creations, options skew), you’ll be better prepared for whichever path Bitcoin takes next.

FAQs

Q Will Bitcoin really reach $130,000 this year?

It’s plausible but not guaranteed. ETF inflows, options demand, and a friendlier rates backdrop support the case, while macro shocks and ETF outflows could delay or cap the move. Traders are positioned for the attempt, especially around year-end catalysts.

Q What events could push the Bitcoin price through $130K?

A decisive weekly close above the recent all-time high, accompanied by strong ETF creations and positive macro surprises (like clearer Fed easing signals), would likely draw momentum buyers and force options hedging that accelerates upside.

Q What are the most significant risks to the bull case?

Renewed risk-off from geopolitics, a hawkish Fed repricing, sharp ETF outflows, or stress among miners post-halving could all weigh on price and keep Bitcoin stuck below its highs longer than bulls expect.

Q How important are the spot Bitcoin ETFs?

They’re a structural game-changer. By allowing broad, regulated access to BTC, they deepen liquidity and pull in long-horizon capital, which is one reason the market hit fresh highs in October. But they can also accelerate drawdowns when outflows hit.

Q What price level should long-term investors watch?

Rather than fixating on a single number, focus on trend and participation: can Bitcoin reclaim and hold above the prior ATH with rising ETF creations and healthy options demand? If yes, the probability of sticking a move over $130,000 rises meaningfully.

Also More: Bitcoin News $11B Whale Moves $360M After 2 Months