The Bitcoin price narrative is colliding with one of the most consequential derivatives events of the year: a $4.9 trillion options expiry across U.S. stocks, index futures, and ETFs. Crypto typically echoes the impulse from traditional markets during these “triple-witching” style expirations, and analysts say that alignment could steer BTC price action toward a decisive test of the widely discussed $110K target. Fresh commentary from market analysts notes that when such examples expire, equity volatility often spills into digital assets—especially when crypto options open interest is elevated and directional positioning is crowded.

The setup is simple to state but tricky to trade. On the one hand, the immediate effect of a huge cross-asset options expiry can be choppy price action as dealers rebalance, gamma unclenches, and “max-pain” dynamics tug at spot. On the other hand, the medium-term backdrop for Bitcoin price forecast models—spot ETF demand, halving-driven supply constraints, and still-elevated institutional participation in crypto derivatives—has kept bulls fixated on a retest and potential breakout above $110,000. Recent market readings suggest that options-centric volatility comes first, followed by a directional move once positioning resets.

Why this option’s expiry matters for Bitcoin right now

Today’s $4.9T options expiry is primarily a U.S. equities event, but its gravitational pull tends to ripple across risk assets. Market historians point out that December 2023 set the prior record near $4.9 trillion, and more recent “mega expiries” in 2024–2025 surpassed $5 trillion—notional marks that frequently coincided with sharp swings or brief consolidation phases in stocks. Crypto inherits that turbulence because the most significant crypto options venue activity and directional flows often correlate with the S&P 500 and tech-heavy risk trends. With dealers shedding hedges and re-delta-hedging into the close, BTC price can experience abrupt whipsaws before settling into a post-expiry path.

For Bitcoin specifically, same-day crypto derivatives expirations add an extra layer. Recent windows saw billions in BTC options rolling off at Deribit—$15 billion cleared in one 2025 quarterly, with open interest topping $40 billion at the time—showing how large and sticky the crypto options complex has become. Even when Bitcoin held steady near six figures through those expiries, the reset in positioning often preceded a push toward new ranges. That pattern is why traders are watching the Bitcoin price forecast path into and out of this week’s expiry cluster.

The $110K magnet: technician targets meet derivatives dynamics

So why the obsession with $110K? In recent months, research desks and options analysts sketched out a band between $105K and $115K where call concentrations, ETF dip-buying, and spot liquidity converge. During prior monthly expiries, bulls “won” the tape by defending six-figure support and pinning price near max-pain for puts, leaving room for an upside follow-through into $110K once the options overhang cleared. In June and late summer, commentary highlighted that similar mega-expiries produced either a month-long grind or brief downside flushes before a renewed uptrend—fuel for the notion that Bitcoin price could consolidate first, then challenge the $110K target.

The microstructure logic is straightforward. When large piles of contracts expire, the market sheds gamma and vanna exposures that have constrained spot. If spot BTC price is near a crowded strike, pinning pressure can keep it there into expiry; after the bell, that restraint eases. Should buyers step in—ETF inflows, macro relief, or simply risk-on sentiment—price can travel faster toward the next liquidity pocket, which for many models sits near or just above $110,000. Conversely, failure to reclaim key levels around $117K has also been flagged by traders as a short-term caution, implying a dip could come first.

Macro backdrop: the Fed, rates, and risk appetite

Macro still writes the prologue to every Bitcoin price forecast. While a recent U.S. rate cut did not immediately ignite a rally in digital assets, economists warn that markets may be underpricing the pace and magnitude of policy shifts ahead. If rate expectations pivot more dovish into Q4, the combination of lower real yields and risk-seeking flows could underpin a break toward $110K and beyond. In the near term, however, mixed reactions following the decision have left the BTC price oscillating around key psychological levels, with derivatives expiries amplifying the chop.

This tension—macro tailwinds versus positioning-driven noise—is why traders often treat options expiry days as event risk days, not trend days. Only after the hedging dust settles does the “truer” directional impulse emerge, usually in tandem with new data (jobs, inflation) or a catalyst like fresh ETF flow surprises.

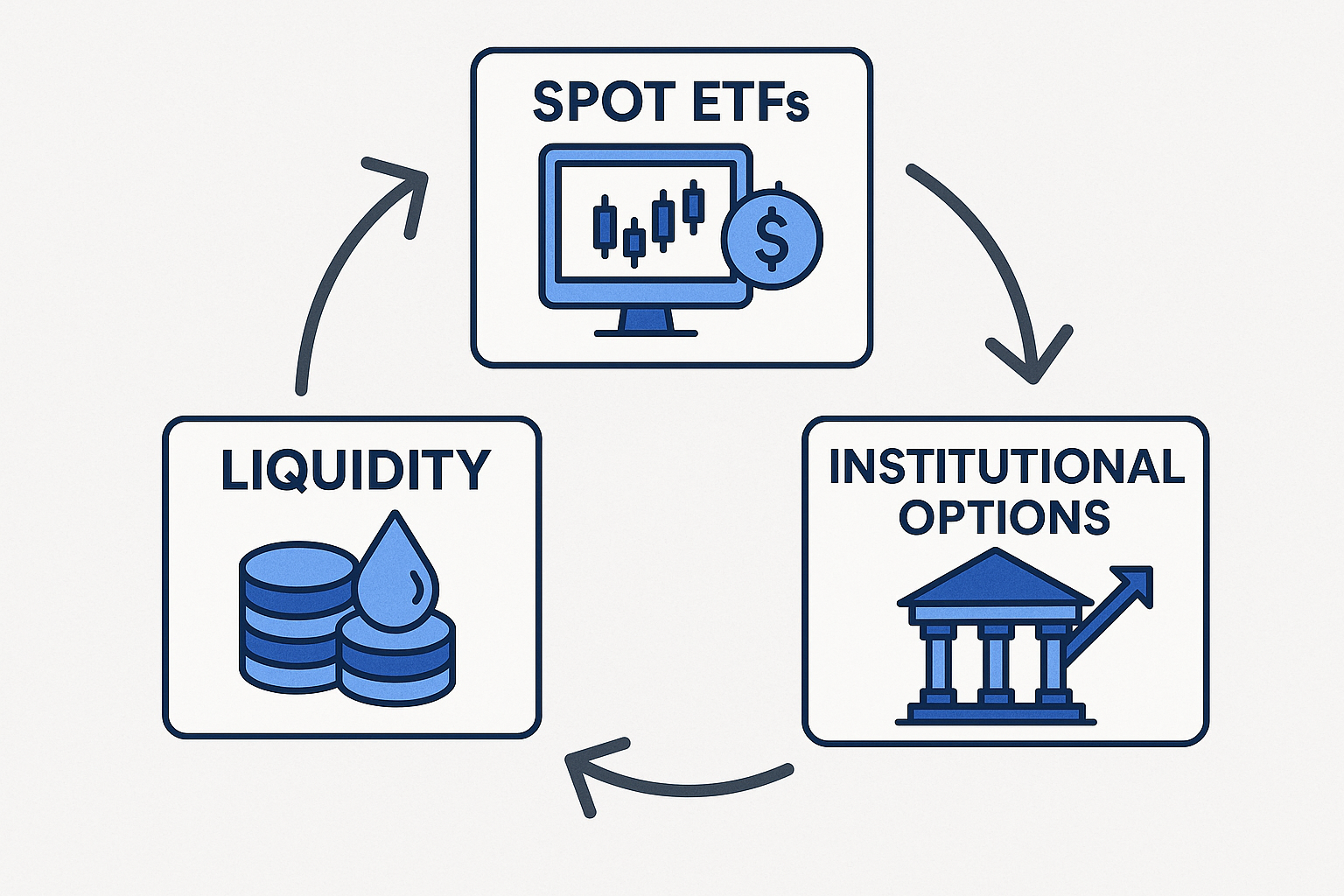

Spot ETFs, liquidity, and the institutional options flywheel

Another reason the Bitcoin price conversation keeps circling back to $110K is structural: spot Bitcoin ETFs have embedded a dollar-cost-averaging bid into the market. Even when daily flows wobble, institutions can accumulate on weakness, and options desks can sell volatility into those flows. That pairing has historically compressed realized volatility into expiries—until it doesn’t. When that compression breaks, post-expiry moves can be outsized. Coverage this year has emphasized episodes where ETF demand, combined with call-heavy positioning, has handed bulls the edge into monthly expiries, bolstering the BTC price case for six-figure holds and tests of the $110K target.

The ecosystem itself is maturing. Deribit’s dominance and potential strategic tie-ups with major U.S. exchanges have sharpened the options market’s institutional profile, signaling deeper liquidity and more sophisticated hedging. That depth can dampen blow-ups—but it also means Bitcoin price can travel quickly once the market collectively reprices risk after big expiries.

Key levels and “max-pain” zones to watch

In the near term, dealers and discretionary traders are mapping a cluster of strikes where max-pain aligns with recent spot pivots. Recent reads suggested max-pain around the low-to-mid-$110Ks for BTC options, with a put-to-call ratio a touch above one into one of the latest weekly expiries—conditions that often translate into churning ranges until the bell rings. Afterward, the tape either drifts toward the next call wall (which supports the $110K narrative) or, if sellers seize control, revisits the five-figure shelf that ETF buyers defended throughout the summer.

The practical takeaway for traders is that options expiry can compress the order book near “sticky” strikes. Once that glue dissolves, price is freer to seek liquidity. If Bitcoin price is coiled beneath resistance, a post-expiry push through offers could trigger momentum toward $110K. If it’s rejected, the market may scan for demand pockets in the $102K–$108K region before attempting another leg.

Historical analogs: what prior mega-expiries signaled

Historical analogs don’t repeat perfectly, but they rhyme. Commentaries around March and June 2025 expiries noted downside and sideways periods, respectively, followed by renewed attempts to move higher after positioning resets. Each episode reinforced the lesson: the first move into options expiry isn’t always the “real” move; the cleaner signal often arrives once hedges are rolled, liquidity is replenished, and new catalysts arrive. Translating that into a Bitcoin price forecast, the base case is volatility into the event, then a directional decision—bulls need a close back above prior resistance bands to credibly press the $110K target.

Risk factors that could derail the $110K push

Even as many models focus on $110K, risks abound. A disorderly equities reaction to the $4.9T options expiry could sap risk appetite and pull BTC price lower in sympathy. A disappointing run of macro data, weaker-than-expected ETF inflows, or a liquidity air-pocket on major venues could turn a shallow dip into a deeper retracement. And while the options complex often stabilizes post-expiry, an elevated put-to-call ratio and heavy open interest below spot can accelerate losses if a downside break triggers dealer hedging. Recent daily and weekly snapshots warn of precisely that scenario around individual expiries, even when the medium-term path stayed constructive.

Strategy frame: navigating the expiry and its aftermath

For investors and traders, the most practical framework is to separate event-day tactics from trend-following plans:

Into expiry, recognize that options expiry flows can mechanically tug the Bitcoin price toward crowded strikes, creating mean-reversion pockets that fade quickly. Once the roll-off completes, refocus on the underlying trend signals: ETF flow direction, breadth in majors and altcoins, funding rates, and whether spot can hold prior resistance as support. Analysts calling for $110K emphasize that a durable move likely requires either a macro-friendly shift (e.g., clearer path to rate cuts) or a re-acceleration in ETF demand—both plausible, but neither guaranteed on the same day the derivatives clock runs out.

Bottom line: expiry first, direction second

The story this week is not whether Bitcoin price ticks every level intraday; it’s whether, after the $4.9T options expiry, the market has the freedom and sponsorship to press a sustained run toward the $110K target. The preconditions are in place: institutional depth, ETF scaffolding, and a macro setup that could become more supportive if policy turns decisively dovish. But the path is still likely to pass through a thicket of hedging-driven volatility. For now, traders should expect noise into the bell, then watch how spot behaves as the market steps into a cleaner tape. If bulls can establish higher lows and reclaim resistance on rising volume, the case for BTC price discovery above $110K strengthens considerably.

Conclusion

The convergence of a $4.9T options expiry and a crowded Bitcoin price forecast cluster around $110K sets the stage for an inflection. Expiry mechanics may dominate in the short run—pinning, whipsaws, quick fades—but the more important question is what happens once those constraints dissolve. With spot ETF flows, deepening derivatives liquidity, and the potential for macro tailwinds, an upside break remains on the table. Equally, failure to retake recent resistance could defer the $110K target and send BTC price back to test the summer’s high-volume support zones. In either case, the expiry is the prelude, not the finale. Watch how the market writes the next act once the clock runs out.

FAQs

Q: Why does a $4.9T options expiry in U.S. markets matter for Bitcoin?

Because such “mega expiries” often spike or reshuffle volatility in equities, and crypto tends to echo that risk impulse. Dealer hedging and gamma effects can wash into BTC price action, especially when crypto options open interest is high.

Q: What makes $110K so important in current Bitcoin price forecasts?

It’s where multiple factors converge: prior call concentrations, ETF-supported demand, and technical resistance. Clearing it on strong breadth would signal renewed price discovery.

Q: Could Bitcoin drop first before moving toward $110K?

Yes. Analysts flagged repeated failures to reclaim overhead levels and warned that large expiries can bring downside volatility or consolidation before a trend reasserts.

Q: How do max-pain and put-to-call ratios influence BTC on expiry day?

If max-pain clusters near spot and puts outweigh calls, pinning and choppy mean-reversion can dominate into the bell. After expiry, hedging constraints ease and direction can emerge.

Q: What should traders watch after the options roll-off?

ETF net flows, whether prior resistance becomes support, and the tone in U.S. macro data. A friendlier rates path and sustained inflows increase the probability of a push above $110K.

See More: Bitcoin Eyes $150K Amid US-China Tariff Deal and Market