The cryptocurrency market continues to evolve rapidly, and ETH price forecast analysis latest news has become increasingly crucial for investors seeking to understand Ethereum’s trajectory in 2025. As the second-largest cryptocurrency by market capitalization, Ethereum’s price movements significantly impact the entire digital asset ecosystem. Recent market developments, institutional adoption, and technological upgrades have created a complex landscape that requires careful analysis and expert insights.

Current ETH price forecast analysis latest news indicates a bullish sentiment among analysts, with many predicting substantial growth potential for Ethereum throughout 2025. The combination of regulatory clarity, increased institutional interest, and ongoing network improvements has positioned ETH as a prime candidate for significant price appreciation. Understanding these market dynamics is essential for making informed investment decisions in today’s volatile cryptocurrency environment.

This comprehensive analysis examines the latest expert predictions, market trends, and fundamental factors driving Ethereum’s price movements, providing readers with actionable insights based on the most recent ETH price forecast analysis latest news available.

Current Market Overview ETH Price Performance in 2025

Recent Price Movements and Market Sentiment

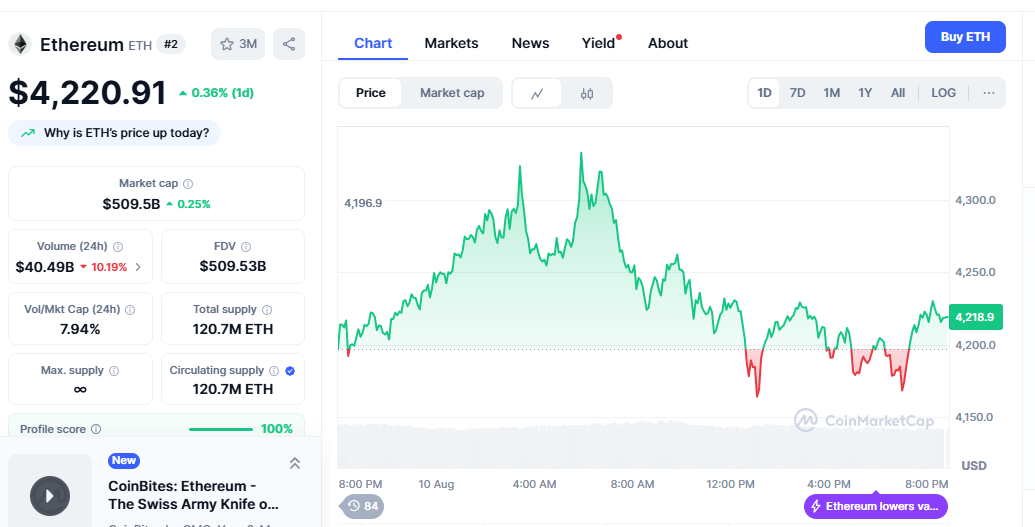

Ethereum has demonstrated remarkable resilience and growth potential in early 2025, with the ETH price forecast analysis latest news revealing several positive indicators. The cryptocurrency has experienced significant upward momentum, breaking through key resistance levels and establishing new yearly highs.

Market analysts report that ETH’s recent performance has been driven by multiple factors, including increased institutional adoption, improved network efficiency, and growing confidence in Ethereum’s long-term prospects. The latest ETH market analysis shows that trading volumes have surged, indicating strong investor interest and market participation.

Professional traders and institutional investors have been particularly bullish on Ethereum’s prospects, with many increasing their positions based on technical analysis and fundamental growth indicators. The ETH price trends 2025 suggest that this momentum could continue throughout the year, potentially leading to substantial gains for long-term holders.

Technical Analysis Insights

From a technical perspective, the ETH price forecast analysis latest news reveals several encouraging patterns. Key support and resistance levels have been established, providing a framework for understanding potential price movements. The Ethereum technical analysis indicates that the cryptocurrency has broken above significant resistance zones, suggesting continued upward potential.

Chart patterns show that ETH has formed bullish formations across multiple timeframes, supporting the positive sentiment reflected in recent cryptocurrency market predictions. Volume analysis confirms that the recent price increases have been accompanied by substantial trading activity, indicating genuine market interest rather than speculative bubbles.

Expert Predictions ETH Price Forecast Analysis Latest News

Short-Term Outlook (Q2-Q4 2025)

Leading cryptocurrency analysts have provided comprehensive insights in their ETH price forecast analysis latest news reports. Many experts predict that Ethereum could reach significant milestones in the coming months, with price targets ranging from conservative to highly optimistic scenarios.

Blockchain investment advisors suggest that ETH could test new all-time highs before the end of 2025, citing improved market conditions and increasing institutional adoption. The Ethereum price predictions 2025 from reputable analysts indicate potential price ranges between $5,000 and $8,000, depending on market conditions and adoption rates.

Short-term ETH market sentiment remains predominantly positive, with technical indicators supporting continued growth. However, experts emphasize the importance of monitoring market volatility and external factors that could influence price movements.

Long-Term Projections (2026-2030)

The ETH price forecast analysis latest news for long-term projections presents even more optimistic scenarios. Industry experts believe that Ethereum’s fundamental value proposition positions it for substantial growth over the next five years.

Cryptocurrency investment strategies increasingly include significant Ethereum allocations, reflecting confidence in the platform’s long-term viability. Analysts project that ETH could reach price levels between $10,000 and $15,000 by 2030, based on network growth, adoption metrics, and technological improvements.

These Ethereum future predictions are supported by the platform’s expanding ecosystem, including decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and smart contract implementations across various industries.

Fundamental Analysis Driving Forces Behind ETH Growth

Network Upgrades and Technological Improvements

The ETH price forecast analysis latest news consistently highlights the importance of network upgrades in driving price appreciation. Ethereum’s transition to proof-of-stake and ongoing scalability improvements have significantly enhanced the platform’s efficiency and sustainability.

Ethereum 2.0 developments continue to improve transaction throughput while reducing energy consumption, making the network more attractive to institutional investors and environmentally conscious users. These blockchain technology updates directly impact ETH’s value proposition and long-term growth potential.

Layer 2 scaling solutions have gained significant traction, enabling faster and cheaper transactions while maintaining security. The ETH network improvements have resulted in increased user adoption and higher transaction volumes, supporting positive price momentum.

Institutional Adoption and Investment Trends

Recent ETH price forecast analysis latest news emphasizes the growing institutional interest in Ethereum. Major corporations, investment funds, and financial institutions have begun allocating significant resources to ETH, recognizing its potential as a store of value and technological platform.

Institutional crypto adoption has accelerated throughout 2025, with several publicly traded companies adding Ethereum to their treasury reserves. This trend reflects growing confidence in ETH’s long-term value proposition and its role in the digital economy.

Corporate Ethereum investments have provided substantial market support, creating a more stable price floor and reducing volatility. The entrance of traditional financial institutions into the Ethereum ecosystem has legitimized the cryptocurrency and attracted additional mainstream investment.

Market Factors Influencing ETH Price Movements

Regulatory Environment and Legal Clarity

The ETH price forecast analysis latest news frequently addresses the impact of regulatory developments on Ethereum’s price trajectory. Recent regulatory clarity in major markets has removed significant uncertainty, allowing investors to make more informed decisions.

Cryptocurrency regulations 2025 have generally favored established platforms like Ethereum, providing clearer guidelines for institutional participation. The ETH legal status updates have been predominantly positive, supporting continued growth and adoption.

Regulatory approval of Ethereum-based financial products, including ETFs and derivatives, has expanded accessibility for traditional investors. These crypto regulatory news developments have contributed to increased trading volumes and price stability.

Global Economic Conditions and Market Dynamics

Macroeconomic factors play a crucial role in shaping the ETH price forecast analysis latest news. Current global economic conditions, including inflation rates, monetary policies, and geopolitical events, influence cryptocurrency markets significantly.

Digital asset market trends show that Ethereum often benefits from economic uncertainty, as investors seek alternative stores of value. The crypto market analysis 2025 indicates that ETH has developed characteristics of a risk-on asset while maintaining some safe-haven properties.

Interest rate policies and central bank decisions continue to impact cryptocurrency markets, with lower rates generally supporting higher valuations for digital assets. The Ethereum market dynamics reflect these broader economic influences while maintaining unique growth drivers.

Investment Strategies Based on ETH Price Forecasts

Risk Management and Portfolio Allocation

Professional investors incorporating ETH price forecast analysis latest news into their strategies emphasize the importance of proper risk management. Diversified cryptocurrency portfolios typically include significant Ethereum allocations while maintaining exposure to other digital assets.

Ethereum investment strategies range from conservative dollar-cost averaging approaches to more aggressive growth-oriented positions. The ETH portfolio management techniques recommended by experts focus on long-term value creation rather than short-term speculation.

Risk assessment frameworks consider Ethereum’s volatility characteristics while acknowledging its growth potential. Cryptocurrency investment advice consistently emphasizes the importance of thorough research and understanding market dynamics before making investment decisions.

Trading Opportunities and Market Timing

The ETH price forecast analysis latest news provides valuable insights for both short-term traders and long-term investors. Technical analysis reveals potential entry and exit points based on historical price patterns and market indicators.

ETH trading strategies benefit from understanding market cycles and sentiment indicators. Professional traders utilize various analytical tools to identify optimal trading opportunities while managing downside risks.

Market timing considerations include monitoring news events, technical breakouts, and fundamental developments that could trigger significant price movements. Ethereum market opportunities often emerge during periods of high volatility and market uncertainty.

Technology and Innovation Impact on ETH Valuation

DeFi Ecosystem Growth and Smart Contract Adoption

The expanding decentralized finance ecosystem significantly influences ETH price forecast analysis latest news. As more DeFi protocols launch and gain adoption, demand for ETH increases due to its role as collateral and transaction medium.

DeFi market growth has created substantial utility value for Ethereum, supporting higher valuations through increased network usage. The smart contract adoption across various industries demonstrates Ethereum’s versatility and long-term potential.

Innovation in DeFi protocols continues to drive ETH ecosystem development, creating new use cases and revenue streams. These blockchain innovation trends contribute to Ethereum’s fundamental value proposition and support positive price forecasts.

NFT Market and Web3 Development

Non-fungible token markets and Web3 development significantly impact Ethereum’s price dynamics. The ETH price forecast analysis latest news often highlights the correlation between NFT activity and ETH demand.

Web3 technology trends position Ethereum as a foundational layer for next-generation internet applications. The NFT market analysis shows continued growth in digital collectibles and utility tokens built on Ethereum.

Enterprise adoption of Web3 technologies creates sustained demand for ETH, supporting long-term price appreciation. Blockchain use cases continue expanding across industries, reinforcing Ethereum’s position as a leading smart contract platform.

Challenges and Risk Factors

Competition and Alternative Platforms

While the ETH price forecast analysis latest news remains generally positive, analysts acknowledge competitive pressures from alternative blockchain platforms. Ethereum competitors continue developing innovative solutions that could capture market share.

Blockchain platform comparison reveals that Ethereum maintains advantages in network effects, developer adoption, and institutional recognition. However, crypto market competition requires continuous innovation and improvement to maintain leadership positions.

Scalability improvements and cost reductions remain critical for Ethereum’s long-term success. ETH scalability solutions address these challenges while maintaining security and decentralization principles.

Market Volatility and External Risks

Cryptocurrency markets remain inherently volatile, and ETH price forecast analysis latest news must account for potential downside scenarios. Market corrections and external shocks can significantly impact short-term price movements.

Cryptocurrency market risks include regulatory changes, security breaches, and macroeconomic instability. ETH volatility analysis helps investors understand potential price ranges and prepare for various market conditions.

Risk mitigation strategies focus on diversification, proper position sizing, and staying informed about market developments. Crypto investment risks require careful consideration and ongoing monitoring of market conditions.

Future Outlook and Market Predictions

Emerging Trends and Growth Catalysts

The ETH price forecast analysis latest news identifies several emerging trends that could drive future growth. Institutional adoption, technological improvements, and expanding use cases create multiple growth catalysts for Ethereum.

Cryptocurrency trends 2025 include increased integration with traditional financial systems and growing acceptance as a legitimate asset class. ETH growth catalysts encompass both technological and market-driven factors that support long-term appreciation.

Innovation in areas such as artificial intelligence, gaming, and supply chain management creates new opportunities for Ethereum-based solutions. Blockchain future trends suggest continued expansion of smart contract applications across various industries.

Market Maturation and Stability Factors

As cryptocurrency markets mature, ETH price forecast analysis latest news indicates increasing stability and reduced volatility over time. Market infrastructure improvements and regulatory clarity contribute to more predictable price movements.

Crypto market maturity brings institutional-grade custody solutions, insurance products, and sophisticated trading tools. Ethereum market evolution reflects broader cryptocurrency market development and mainstream acceptance.

Professional investment products and services make Ethereum more accessible to traditional investors, supporting sustained demand and price appreciation. Digital asset integration with existing financial systems facilitates broader adoption and market growth.

Conclusion

The comprehensive ETH price forecast analysis latest news presents a compelling case for Ethereum’s continued growth and market leadership. Multiple factors, including technological improvements, institutional adoption, and expanding use cases, support positive long-term projections for ETH.

Successful navigation of the Ethereum market requires staying informed about the latest developments, understanding fundamental drivers, and implementing appropriate risk management strategies. The ETH price forecast analysis latest news provides valuable insights for making informed investment decisions in this dynamic market environment.

Whether you’re a seasoned cryptocurrency investor or new to digital assets, staying updated with reliable ETH price forecast analysis latest news is essential for success. Monitor market developments, follow expert analysis, and consider professional advice when making significant investment decisions in the evolving Ethereum ecosystem.