The cryptocurrency market continues to evolve rapidly, and investors worldwide are seeking reliable insights into bitcoin price prediction 2025 today. As Bitcoin maintains its position as the world’s leading digital asset, understanding current market dynamics and expert forecasts becomes crucial for making informed investment decisions.

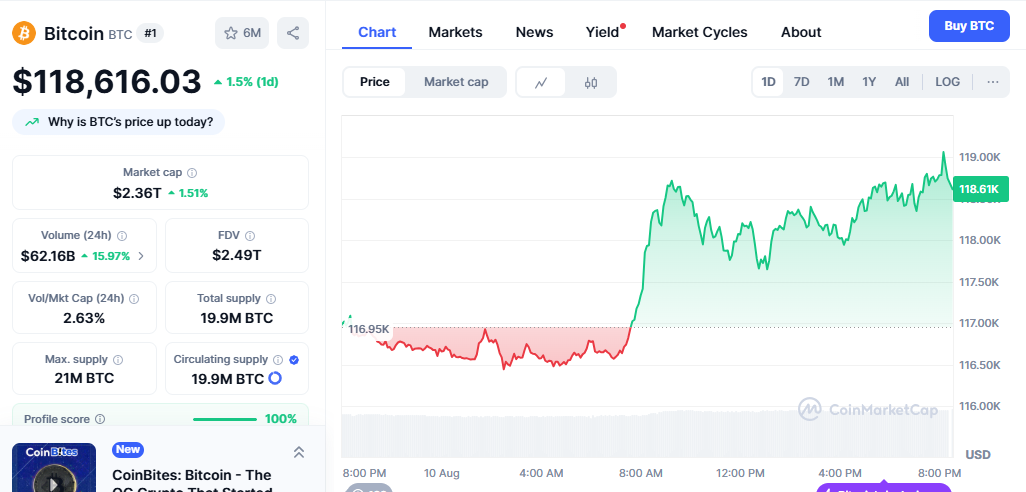

Bitcoin price prediction 2025 today shows remarkable optimism from leading analysts and financial institutions. With Bitcoin trading above $118,000 as of August 2025, the cryptocurrency has already surpassed many previous predictions. Current market conditions, including institutional adoption, regulatory clarity, and technological developments, suggest that Bitcoin’s journey in 2025 is far from over.

Leading cryptocurrency experts and financial institutions are providing updated forecasts that range from conservative growth projections to aggressive bullish targets. These BTC price predictions 2025 are based on comprehensive technical analysis, market sentiment indicators, and fundamental factors driving Bitcoin’s adoption globally.

Current Bitcoin Market Analysis and Today’s Performance

Real-Time Bitcoin Price Movement

Bitcoin’s performance in August 2025 has been particularly noteworthy, with the cryptocurrency reaching new all-time highs above $123,000 earlier this month. Bitcoin price analysis today reveals strong momentum driven by several key factors:

- Institutional Investment Flows: Major corporations continue adding Bitcoin to their balance sheets

- ETF Performance: Spot Bitcoin ETFs have attracted over $35 billion in inflows since January 2025

- Regulatory Environment: Increasingly favorable regulations in major markets

- Market Sentiment: Growing acceptance of Bitcoin as a store of value

The bitcoin market prediction 2025 landscape has shifted significantly compared to previous years. Traditional financial institutions that once viewed cryptocurrency with skepticism are now actively participating in the Bitcoin ecosystem.

Technical Indicators Supporting Price Growth

Current technical analysis supports bullish bitcoin price prediction 2025 today scenarios. Key indicators include:

Moving Averages: The 50-day and 200-day moving averages show strong upward trends, indicating sustained buying pressure.

Volume Analysis: Trading volume remains robust, suggesting healthy market participation and liquidity.

Support and Resistance Levels: Bitcoin has established strong support levels above $100,000, with resistance targets approaching $150,000.

Expert Bitcoin Price Predictions for 2025

Wall Street Analysts’ Forecasts

Leading financial institutions have released comprehensive bitcoin price prediction 2025 today reports that showcase varying degrees of optimism:

BlackRock’s Perspective: The world’s largest asset manager projects Bitcoin could reach between $500,000 and $700,000, though without specifying exact timeframes. Their analysis focuses on Bitcoin’s role as a treasury reserve asset.

ARK Invest’s Bullish Outlook: Cathie Wood maintains her aggressive stance, suggesting Bitcoin could reach $2.4 million by 2030, with intermediate targets supporting strong growth through 2025.

MicroStrategy’s Analysis: Michael Saylor continues advocating for Bitcoin as the apex monetary asset, suggesting institutional capital reallocations could drive prices past $1 million.

Cryptocurrency Industry Experts

Bitcoin price forecast 2025 from industry experts provides additional insights:

Technical Analysts: Many chartists point to Bitcoin’s historical four-year cycle patterns, though some suggest the traditional cycle may be evolving due to institutional participation.

On-Chain Analysts: Blockchain data shows decreasing exchange reserves and increasing long-term holder accumulation, supporting bullish price projections.

Market Strategists: Focus on macroeconomic factors, including potential Federal Reserve rate cuts and global liquidity trends.

Factors Driving Bitcoin Price in 2025

Institutional Adoption Acceleration

The bitcoin investment outlook 2025 is heavily influenced by institutional adoption trends:

Corporate Treasury Holdings: Over 60 companies have added more than $11 billion worth of Bitcoin to their treasuries in 2025. This trend shows no signs of slowing as more corporations seek inflation hedges.

Banking Sector Integration: Traditional banks are increasingly offering Bitcoin custody services and investment products to their clients.

Pension Fund Allocation: Several pension funds have announced plans to allocate portions of their portfolios to Bitcoin, representing trillions in potential future demand.

Regulatory Developments

Bitcoin regulation news 2025 has been predominantly positive, supporting price growth:

United States: The Trump administration’s crypto-friendly policies have provided regulatory clarity and reduced uncertainty.

European Union: The Markets in Crypto-Assets (MiCA) regulation has created a comprehensive framework for cryptocurrency operations.

Asia-Pacific: Countries like Japan and Singapore continue developing progressive cryptocurrency regulations.

Technological Improvements

Bitcoin technology updates 2025 contribute to long-term value propositions:

Lightning Network Growth: Layer-2 scaling solutions continue expanding, improving Bitcoin’s utility for daily transactions.

Mining Efficiency: Improvements in mining technology and renewable energy adoption address environmental concerns.

Security Enhancements: Ongoing development work strengthens Bitcoin’s security and functionality.

Bitcoin Price Prediction 2025 Today Detailed Analysis

Short-Term Price Targets (Q3-Q4 2025)

Bitcoin price prediction 2025 today for the remainder of the year includes several scenarios:

Conservative Estimate: $130,000 – $150,000

- Based on current trend continuation

- Assumes moderate institutional adoption

- Factors in potential market corrections

Moderate Bullish Scenario: $150,000 – $200,000

- Incorporates accelerated ETF inflows

- Assumes Federal Reserve rate cuts

- Includes increased corporate adoption

Aggressive Bull Case: $200,000 – $250,000

- Requires major institutional announcements

- Depends on favorable regulatory developments

- Assumes continued momentum from current levels

Long-Term Implications for 2025

The cryptocurrency market forecast 2025 suggests Bitcoin will likely maintain its dominant position while potentially reaching new adoption milestones:

Market Capitalization Growth: Bitcoin’s market cap could approach $5-6 trillion under bullish scenarios.

Global Reserve Asset: Increasing recognition as a legitimate store of value and potential reserve asset.

Mainstream Integration: Continued integration into traditional financial systems and payment networks.

Market Sentiment and Investor Behavior

Current Market Psychology

Bitcoin market sentiment 2025 reflects several important trends:

Institutional Confidence: Large institutions demonstrate increasing confidence through sustained accumulation strategies.

Retail Participation: Individual investors show more sophisticated understanding of Bitcoin’s long-term value proposition.

Global Adoption: International recognition continues growing, with some countries exploring Bitcoin as legal tender.

Risk Factors and Considerations

While bitcoin price prediction 2025 today appears optimistic, several risk factors warrant consideration:

Market Volatility: Bitcoin remains subject to significant price swings that could affect short-term performance.

Regulatory Changes: Unexpected regulatory developments could impact market sentiment and price direction.

Macroeconomic Factors: Global economic conditions, including inflation rates and monetary policy changes, influence Bitcoin’s performance.

Competition: Other cryptocurrencies and digital assets may compete for market share and investor attention.

Global Economic Impact on Bitcoin Price

Macroeconomic Environment

The bitcoin economic analysis 2025 reveals several macroeconomic factors supporting price growth:

Inflation Hedge Demand: As traditional currencies face devaluation pressures, Bitcoin’s fixed supply makes it attractive as an inflation hedge.

Interest Rate Environment: Potential Federal Reserve rate cuts could drive investors toward alternative assets like Bitcoin.

Global Liquidity: Increasing global money supply often correlates with Bitcoin price appreciation.

Geopolitical Considerations

Bitcoin geopolitical impact 2025 includes several relevant factors:

Currency Debasement: Countries experiencing currency instability increasingly turn to Bitcoin as a store of value.

Sanctions and Trade: Bitcoin’s borderless nature makes it attractive during international trade tensions.

Financial System Concerns: Growing distrust in traditional financial systems supports Bitcoin adoption.

Investment Strategies Based on Price Predictions

Portfolio Allocation Recommendations

Based on current bitcoin price prediction 2025 today, investment professionals suggest various allocation strategies:

Conservative Approach: 1-5% portfolio allocation for risk-averse investors seeking exposure to digital assets.

Moderate Strategy: 5-15% allocation for investors comfortable with moderate volatility and long-term growth potential.

Aggressive Positioning: 15-25% allocation for investors with high risk tolerance and strong conviction in Bitcoin’s future.

Dollar-Cost Averaging Benefits

Bitcoin investment strategy 2025 often emphasizes dollar-cost averaging benefits:

Volatility Mitigation: Regular purchases help smooth out price volatility over time.

Emotional Discipline: Systematic investing reduces the impact of emotional decision-making.

Long-Term Accumulation: Consistent purchasing builds positions during various market conditions.

Technical Analysis for 2025 Bitcoin Price

Chart Patterns and Indicators

Bitcoin technical analysis 2025 reveals several bullish patterns:

Ascending Triangle Formation: Long-term charts show ascending triangle patterns suggesting continued upward momentum.

Volume Confirmation: Increasing volume during price advances confirms the strength of bullish movements.

Momentum Indicators: RSI and MACD indicators suggest Bitcoin maintains strong upward momentum without being severely overbought.

Fibonacci Retracement Levels

Technical analysts use Fibonacci retracements to identify potential bitcoin price targets 2025:

Key Resistance Levels: $150,000, $180,000, and $220,000 represent significant Fibonacci extension targets.

Support Zones: $100,000 and $85,000 serve as major support levels in case of market corrections.

Golden Ratio Projections: Long-term Fibonacci projections suggest targets extending well beyond current price levels.

Bitcoin Mining and Network Fundamentals

Hash Rate and Network Security

Bitcoin network analysis 2025 shows continued strengthening:

Hash Rate Growth: Bitcoin’s hash rate continues reaching new all-time highs, indicating robust network security.

Mining Distribution: Geographic distribution of mining operations becomes more balanced, reducing centralization risks.

Energy Efficiency: Improvements in mining efficiency and renewable energy adoption address environmental concerns.

Transaction Volume and Adoption

Bitcoin adoption metrics 2025 demonstrate growing utilization:

On-Chain Activity: Transaction volumes and active addresses show consistent growth patterns.

Lightning Network Usage: Layer-2 adoption continues expanding, enabling more efficient small transactions.

Institutional Usage: Large-scale institutional transactions represent an increasing percentage of network activity.

Alternative Scenarios and Risk Assessment

Bear Case Scenarios

While bitcoin price prediction 2025 today leans bullish, potential downside scenarios include:

Regulatory Crackdown: Unexpected harsh regulations could temporarily suppress prices.

Economic Recession: Severe economic downturns might reduce risk asset demand, including Bitcoin.

Technical Issues: Unforeseen technical problems or security vulnerabilities could impact confidence.

Black Swan Events

Bitcoin risk analysis 2025 must consider low-probability, high-impact events:

Quantum Computing Threats: Advances in quantum computing could theoretically threaten Bitcoin’s cryptographic security.

Government Bans: Coordinated government actions against cryptocurrency could create significant headwinds.

Market Manipulation: Large-scale manipulation by major holders could create extreme volatility.

Future Developments and Catalysts

Upcoming Technological Improvements

Bitcoin development roadmap 2025 includes several important upgrades:

Protocol Enhancements: Continued development work focuses on scalability, privacy, and functionality improvements.

Layer-2 Solutions: Expansion of Lightning Network and other scaling solutions enhances Bitcoin’s utility.

Smart Contract Integration: Developments like Taproot enable more sophisticated smart contract functionality.

Institutional Infrastructure

Bitcoin infrastructure 2025 continues expanding:

Custody Solutions: Enhanced institutional-grade custody services reduce barriers to large-scale adoption.

Trading Platforms: Improved trading infrastructure provides better liquidity and price discovery.

Financial Products: New financial instruments and derivatives expand investment options for institutions.

Conclusion and Investment Outlook

The bitcoin price prediction 2025 today landscape presents compelling opportunities for informed investors. With Bitcoin trading above $118,000 and showing strong momentum, expert analysis suggests significant upside potential remains for the remainder of 2025.

Key factors supporting bullish bitcoin price prediction 2025 today include continued institutional adoption, favorable regulatory developments, and improving technological infrastructure. While risks exist, the overall trajectory appears positive for Bitcoin’s long-term growth.

Current bitcoin price forecast 2025 ranges from conservative targets around $150,000 to aggressive projections exceeding $250,000 by year-end. Investors should carefully consider their risk tolerance and investment timeframes when positioning for these potential opportunities.

For those seeking exposure to Bitcoin’s growth potential, now may be an opportune time to research and consider appropriate allocation strategies. Stay informed about bitcoin price prediction 2025 today updates and market developments to make educated investment decisions.

Ready to capitalize on Bitcoin’s 2025 potential? Research current market conditions, consult with financial advisors, and consider your investment strategy based on the latest bitcoin price prediction 2025 today analysis.