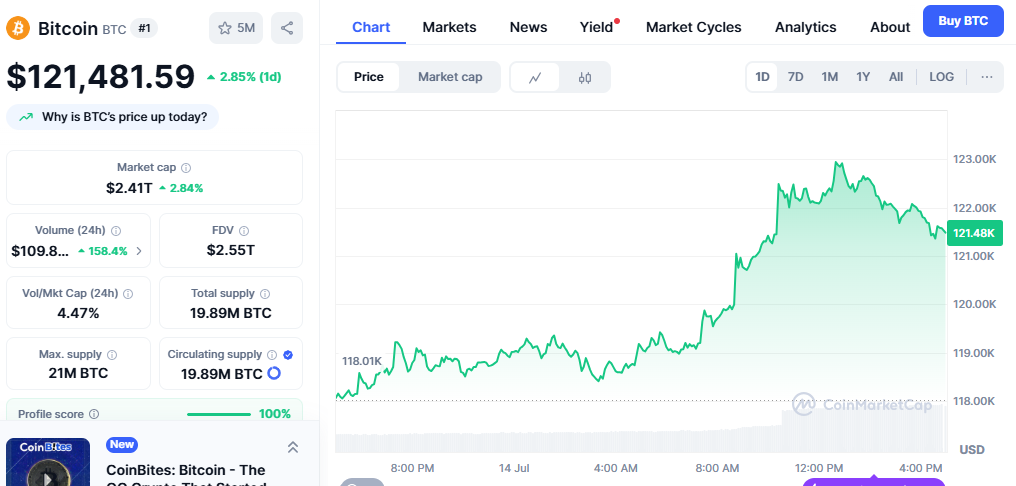

In today’s rapidly evolving cryptocurrency landscape, staying informed with the best bitcoin investment news analysis has become crucial for both seasoned investors and newcomers alike. With Bitcoin reaching new all-time highs and institutional adoption accelerating, the need for comprehensive, data-driven investment analysis has never been more critical. This guide provides you with expert insights, market trends, and strategic guidance to help you navigate the complex world of Bitcoin investing. Whether you’re looking to understand market movements, evaluate investment strategies, or stay ahead of regulatory changes, our analysis delivers the actionable intelligence you need to make informed decisions in the volatile crypto market.

Why Bitcoin Investment News Analysis Matters for Your Portfolio

Understanding market dynamics through professional analysis can be the difference between profitable investments and costly mistakes. The cryptocurrency market operates 24/7, with news events capable of triggering significant price movements within minutes. Professional analysts combine technical indicators, fundamental analysis, and market sentiment to provide comprehensive investment guidance.

Recent institutional adoption by companies like MicroStrategy, Tesla, and major financial institutions has fundamentally changed Bitcoin’s investment landscape. These developments require careful analysis to understand their long-term implications for individual investors.

Key Components of Professional Bitcoin Investment Analysis

Market Trend Analysis

Professional Bitcoin analysis examines multiple timeframes to identify both short-term trading opportunities and long-term investment trends. This includes analyzing price patterns, volume indicators, and market cycles that historically influence Bitcoin’s performance.

Technical analysts use various indicators such as moving averages, RSI (Relative Strength Index), and support/resistance levels to forecast potential price movements. These tools help investors time their entries and exits more effectively.

Fundamental Analysis Factors

Beyond technical indicators, fundamental analysis examines factors that drive Bitcoin’s intrinsic value:

- Adoption rates by institutions and retail investors

- Regulatory developments across major markets

- Network metrics, including hash rate and transaction volume

- Macroeconomic factors such as inflation and monetary policy

- Supply dynamics, including Bitcoin halving events

Risk Assessment and Portfolio Allocation

Professional analysis always includes risk management strategies. This involves determining appropriate position sizes, diversification strategies, and exit plans based on individual risk tolerance and investment goals.

Current Market Insights: What Experts Are Saying

Institutional Investment Trends

Major financial institutions continue to allocate significant portions of their portfolios to Bitcoin. Recent analysis shows that institutional demand remains robust, with spot Bitcoin ETFs recording substantial inflows throughout 2025.

Regulatory Landscape Updates

The evolving regulatory environment significantly impacts Bitcoin investment strategies. Recent developments in the United States and Europe suggest a more favorable regulatory framework, which could drive further institutional adoption.

Price Prediction Models

Professional analysts utilize various models to forecast Bitcoin’s potential price movements:

- Stock-to-Flow models that consider Bitcoin’s scarcity

- On-chain analysis examining wallet movements and holder behavior

- Correlation analysis with traditional assets and macroeconomic indicators

Best Bitcoin Investment News Analysis: Top Sources and Strategies

Reliable News Sources

To access the most accurate and timely Bitcoin investment analysis, consider following these types of sources:

- Established cryptocurrency news platforms with verified track records

- Professional trading firms that publish regular market analysis

- Blockchain analytics companies provide on-chain data insights

- Regulatory bodies for official policy updates

Outbound Link Suggestion: Link to CoinDesk’s Bitcoin analysis section for additional professional insights.

Investment Strategy Development

Successful Bitcoin investing requires a well-defined strategy based on:

- Investment timeline (short-term vs. long-term)

- Risk tolerance and capital allocation

- Market conditions and entry/exit points

- Diversification within and outside cryptocurrency

Internal Link Anchor Text Suggestion: “Learn more about cryptocurrency portfolio diversification strategies”

Advanced Analysis Techniques for Bitcoin Investors

On-Chain Analytics

Modern Bitcoin analysis increasingly relies on blockchain data to understand market dynamics. Key metrics include:

- HODL waves showing long-term vs. short-term holder behavior

- Exchange flows indicating buying or selling pressure

- Mining profitability and network security metrics

- Whale movements and large transaction analysis

Sentiment Analysis

Market sentiment plays a crucial role in Bitcoin’s price movements. Professional analysts monitor:

- Social media sentiment across platforms

- Fear and Greed Index measurements

- Options market positioning

- Futures market data and funding rates

Risk Management in Bitcoin Investment

Position Sizing Strategies

Professional analysis emphasizes proper position sizing to manage risk effectively. Common approaches include:

- Fixed percentage allocation (typically 1-10% of total portfolio)

- Dollar-cost averaging to reduce timing risk

- Volatility-adjusted sizing based on market conditions

Stop-Loss and Take-Profit Strategies

Implementing systematic exit strategies helps protect profits and limit losses:

- Technical stop-losses based on support levels

- Time-based exits for predetermined holding periods

- Profit-taking ladders to capitalize on price appreciation

Future Outlook: Bitcoin Investment Trends to Watch

Emerging Market Developments

Several trends are shaping Bitcoin’s investment landscape:

- Central Bank Digital Currencies (CBDCs) and their impact on Bitcoin adoption

- Lightning Network development is improving Bitcoin’s utility

- Environmental sustainability initiatives in Bitcoin mining

- Integration with traditional finance through ETFs and institutional products

Technology Advancements

Ongoing technological improvements continue to enhance Bitcoin’s investment appeal:

- Scalability solutions reducing transaction costs

- Security enhancements protecting investor assets

- User experience improvements are making Bitcoin more accessible

Conclusion

Staying informed with the best bitcoin investment news analysis is essential for navigating today’s complex cryptocurrency market successfully. By combining professional insights with your own research and risk management strategies, you can make more informed investment decisions in this dynamic asset class.

Remember that Bitcoin investment carries significant risks, and past performance doesn’t guarantee future results. Always consult with financial professionals and only invest what you can afford to lose.