February 2026 arrives at a critical moment for the cryptocurrency market. After a volatile start to the year, investors are recalibrating expectations around Bitcoin dominance, Ethereum ecosystem growth, and the next potential altcoin rally. Historically, mid-Q1 has often been a transitional period where capital rotates from major assets into select high-conviction projects. That’s exactly why identifying the right altcoins to watch becomes so important right now.

Crypto markets in early 2026 are being shaped by three dominant forces: infrastructure development, cross-chain interoperability, and token supply dynamics. These themes are not short-lived trends; they represent structural shifts in how blockchain technology is evolving. Traders and long-term investors alike are narrowing their focus to projects that combine strong fundamentals with visible catalysts in the near term.

This article explores three carefully selected altcoins to watch in the third week of February 2026. Each project represents a different but influential narrative within the digital asset ecosystem: Layer-2 scaling, cross-chain interoperability, and supply-driven volatility. Rather than chasing hype, we’ll break down why these projects deserve attention, what catalysts could drive price movement, and what risks investors should consider. If you are building a strategic watchlist instead of reacting emotionally to market swings, these three altcoins to watch could help you stay ahead of the curve.

Market Conditions Shaping Altcoins in February 2026

Before diving into the three altcoins to watch, it’s important to understand the broader market context. The cryptocurrency market remains highly sensitive to macroeconomic data, regulatory commentary, and institutional flows. When Bitcoin experiences strong momentum or sharp corrections, altcoins typically amplify those movements.

At the same time, 2026 is showing increased maturity in blockchain infrastructure. Developers are prioritizing scalability, interoperability, and enterprise adoption. This means that the most relevant altcoins to watch are not just speculative tokens — they are projects positioned at the core of ecosystem growth.

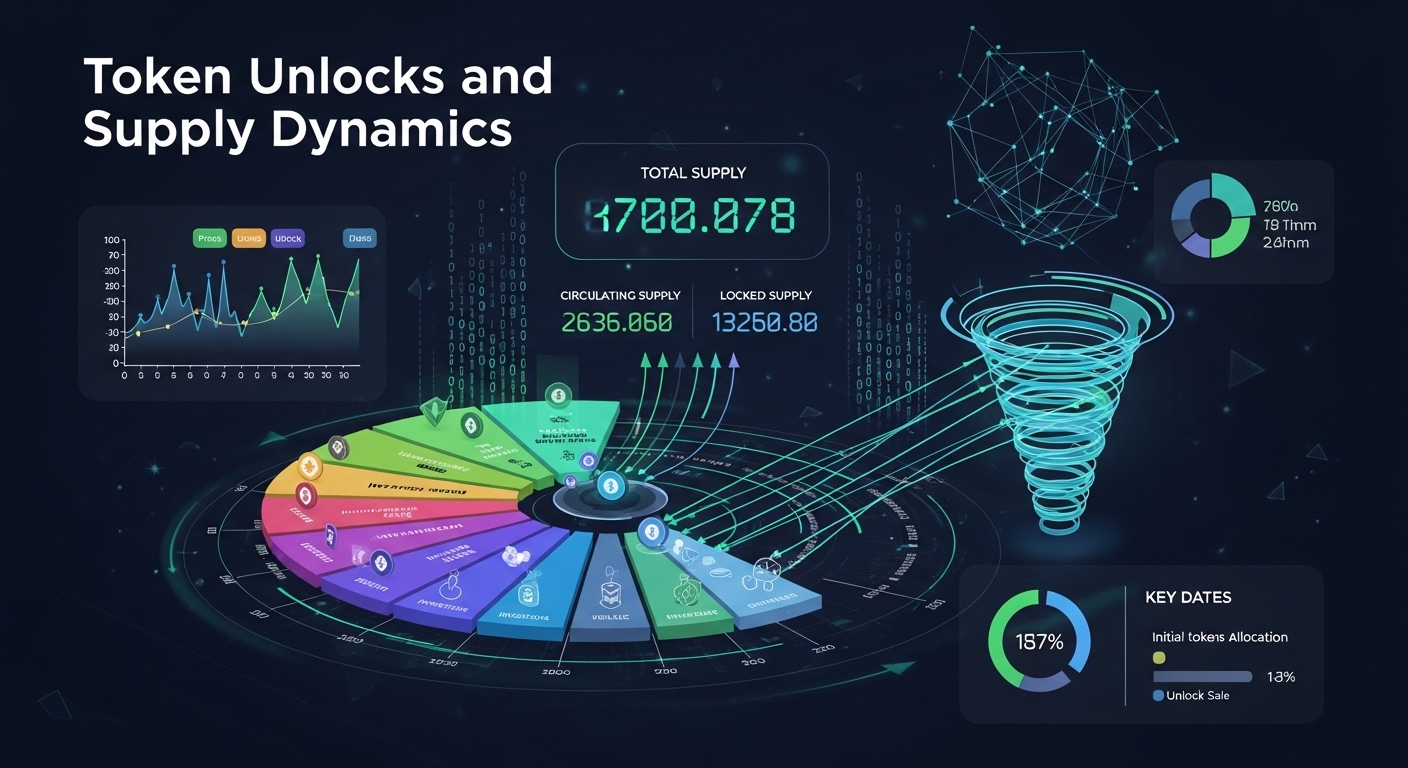

Another major factor influencing altcoins to watch this week is token supply. Vesting schedules and unlock events can introduce volatility, particularly when large amounts of previously locked tokens enter circulation. Smart traders pay close attention to these events because they can significantly impact short-term price behavior. With that context in mind, let’s explore the three altcoins to watch in the third week of February 2026.

Arbitrum (ARB): A Layer-2 Altcoin to Watch

The Growing Importance of Layer-2 Scaling

Arbitrum continues to stand out as one of the most important Layer-2 scaling solutions built on Ethereum. As transaction activity grows across decentralized finance (DeFi), NFTs, and tokenized assets, Ethereum’s base layer can face congestion. This is where Layer-2 networks like Arbitrum become essential.

Among the altcoins to watch this week, ARB deserves attention because the broader market narrative still strongly favors scalability. Lower transaction fees, faster confirmations, and improved developer tools are all attractive features that support ecosystem expansion. As Ethereum continues evolving, Layer-2 solutions are no longer optional — they are foundational. This structural demand is one reason ARB remains one of the top altcoins to watch in February 2026.

Ecosystem Growth and Developer Activity

One of the strongest indicators of long-term success in crypto is developer activity. Arbitrum has cultivated a thriving ecosystem of decentralized applications, including DeFi platforms, gaming projects, and liquidity protocols. When evaluating altcoins to watch, it’s important to look beyond price charts.

On-chain activity, total value locked (TVL), and governance participation all provide insight into whether a project is gaining traction. ARB benefits from continuous ecosystem development, which helps reinforce its relevance. If market sentiment shifts toward infrastructure plays, ARB could see renewed interest quickly. That’s what makes it one of the most strategically positioned altcoins to watch this week.

Risks to Consider

Despite its strengths, ARB is not immune to volatility. Layer-2 tokens often move in correlation with Ethereum. If ETH experiences a sharp downturn, ARB may follow. Additionally, competition in the Layer-2 sector remains intense. Optimism, zk-rollups, and other scaling technologies are all competing for market share. Investors tracking altcoins to watch should monitor ecosystem adoption carefully.

Chainlink (LINK): An Interoperability Altcoin to Watch

Why Cross-Chain Infrastructure Matters

Chainlink has evolved far beyond its original role as a decentralized oracle network. In 2026, the project is increasingly associated with cross-chain interoperability, secure messaging, and institutional-grade blockchain infrastructure. Interoperability is becoming a core requirement for the future of crypto. Blockchains are no longer operating in isolation.

Assets, data, and smart contract instructions need to move securely across networks. This is why LINK remains one of the most compelling altcoins to watch in the third week of February 2026. As decentralized applications expand across multiple chains, the demand for secure cross-chain communication grows. Projects that facilitate this process often gain strategic importance within the ecosystem.

Institutional Narrative and Real-World Assets

Another reason LINK stands out among altcoins to watch is its alignment with the real-world asset (RWA) narrative. Tokenized bonds, equities, and commodities require reliable oracle systems and secure cross-chain infrastructure. Institutional interest in blockchain technology continues to develop in 2026. When traditional financial entities explore tokenization, they prioritize security and reliability. Chainlink’s infrastructure positions it as a potential backbone for these integrations. This dual exposure to DeFi and institutional adoption strengthens LINK’s case as one of the top altcoins to watch this week.

Potential Downside Risks

Even strong infrastructure projects can face short-term volatility. If speculative capital rotates into high-beta meme coins or smaller cap tokens, LINK may temporarily underperform. Additionally, broader crypto market corrections can impact even fundamentally strong assets. Investors building a list of altcoins to watch should remain mindful of overall market momentum before making decisions.

Sui (SUI): A High-Volatility Altcoin to Watch

Token Unlocks and Supply Dynamics

Sui has become one of the more closely monitored altcoins to watch due to token unlock schedules. When previously locked tokens enter circulation, supply increases. This can create short-term selling pressure depending on market conditions. The third week of February 2026 coincides with heightened attention around supply-related events across several ecosystems. For SUI specifically, traders are watching closely to see how the market absorbs any new liquidity.

Supply events do not automatically mean price declines. Sometimes markets price in unlocks early, and if selling pressure is lighter than expected, relief rallies can occur. This uncertainty is precisely what makes SUI one of the most interesting altcoins to watch right now.

Ecosystem and Technology Strength

Beyond supply concerns, Sui represents a technically ambitious blockchain project focused on scalability and performance. Its architecture is designed for high throughput and low latency, appealing to developers building gaming and DeFi applications. When assessing altcoins to watch, it’s important to balance short-term volatility with long-term potential. SUI’s technology foundation gives it staying power beyond just unlock narratives.

Volatility Considerations

SUI can experience amplified price swings compared to larger-cap altcoins. This makes it attractive for active traders but potentially risky for conservative investors. Anyone tracking altcoins to watch in February 2026 should understand that volatility cuts both ways. Large price moves can create opportunity, but they also increase risk.

How to Evaluate Altcoins to Watch Strategically

Building a list of altcoins to watch should involve more than social media trends. A disciplined approach includes monitoring:

- Market sentiment and Bitcoin dominance

- On-chain metrics and developer activity

- Upcoming catalysts such as upgrades or unlocks

- Liquidity conditions and trading volume

The third week of February 2026 is not just about speculation — it’s about identifying projects positioned within larger structural themes like Layer-2 growth, interoperability infrastructure, and token supply management. Investors who combine narrative awareness with risk management tend to perform better than those reacting emotionally to price spikes.

Conclusion

The third week of February 2026 presents a dynamic landscape for crypto investors. While market volatility remains elevated, opportunities often emerge during periods of uncertainty. Arbitrum (ARB) stands out as a Layer-2 scaling leader benefiting from Ethereum ecosystem growth. Chainlink (LINK) continues to solidify its role in cross-chain interoperability and institutional blockchain adoption. Sui (SUI) offers high-volatility potential driven by token supply dynamics and ecosystem expansion.

These three altcoins to watch each represent a distinct narrative shaping crypto markets in 2026. Whether you are a short-term trader or a long-term investor, maintaining a focused watchlist and understanding both catalysts and risks is essential. As always, research thoroughly, manage risk responsibly, and remember that volatility is a defining characteristic of the cryptocurrency market.

FAQs

Q: Why are these considered the top altcoins to watch this week?

They align with dominant 2026 narratives: scaling infrastructure, interoperability, and supply-driven volatility. Each has identifiable catalysts in the near term.

Q: Are altcoins to watch suitable for beginners?

They can be, but beginners should start with small positions and prioritize understanding market cycles and risk management before trading volatile assets.

Q: How do token unlocks affect altcoins?

Unlocks increase circulating supply. If demand does not absorb the new supply, prices can drop. However, markets sometimes price in these events early.

Q: What role does Bitcoin play in altcoin performance?

Bitcoin dominance often influences altcoin movements. When BTC stabilizes or consolidates, capital may rotate into altcoins.

Q: How often should investors update their altcoins to watch list?

In fast-moving markets like crypto, reviewing your watchlist weekly is a smart practice, especially during volatile periods like February 2026.

Also More: Bitcoin Whales Sell 170K as Hong Kong Boosts Leverage