Quantum computing is often portrayed as Bitcoin’s ultimate existential threat. Headlines regularly warn that powerful quantum machines will crack cryptographic keys, drain wallets, and collapse the entire Bitcoin network overnight. These fears, while attention-grabbing, often ignore how Bitcoin actually works at a technical level. According to a detailed analysis by CoinShares, the real risk posed by quantum computers is far more limited than commonly believed. In fact, CoinShares states that quantum computers threaten only 10,200 Bitcoin in any scenario that could realistically cause sudden and meaningful market disruption.

This conclusion challenges the widespread belief that a large portion of Bitcoin’s total supply is imminently vulnerable. While quantum computing does introduce long-term cryptographic considerations, CoinShares emphasizes that Bitcoin’s structure, address formats, and usage patterns significantly constrain what an attacker could actually exploit. The threat is specific, measurable, and manageable rather than catastrophic.

This article explores why CoinShares believes quantum computers threaten only 10,200 Bitcoin, what makes certain coins more exposed than others, how close quantum technology really is to posing a danger, and what Bitcoin can do to prepare for a post-quantum future without panic or overreaction.

CoinShares 10,200 Bitcoin Estimate

The key to CoinShares’ conclusion lies in separating theoretical vulnerability from practical market impact. Many discussions around quantum computing assume that if Bitcoin’s cryptography can be broken in theory, then all Bitcoin is at risk in practice. CoinShares argues that this assumption is deeply flawed.

Bitcoin’s unspent transaction outputs are widely distributed across millions of addresses. Even among those that are technically more exposed to quantum attacks, most are fragmented into relatively small amounts. CoinShares estimates that although over one million Bitcoin may sit in older address formats, only about 10,200 BTC is concentrated in a way that could be stolen and liquidated quickly enough to destabilize markets.

Why Market Impact Matters More Than Raw Exposure

CoinShares does not claim that only 10,200 Bitcoin is vulnerable forever. Instead, it focuses on the amount of Bitcoin that could realistically be exploited in a short timeframe. Market disruption depends not just on vulnerability but also on speed, coordination, and liquidity. An attacker would need to steal large amounts of Bitcoin quickly and sell them rapidly to cause price shock.

Most potentially vulnerable coins are spread across thousands of addresses, many holding modest balances. Extracting value from them would be slow, visible, and likely countered by defensive measures long before becoming systemically dangerous.

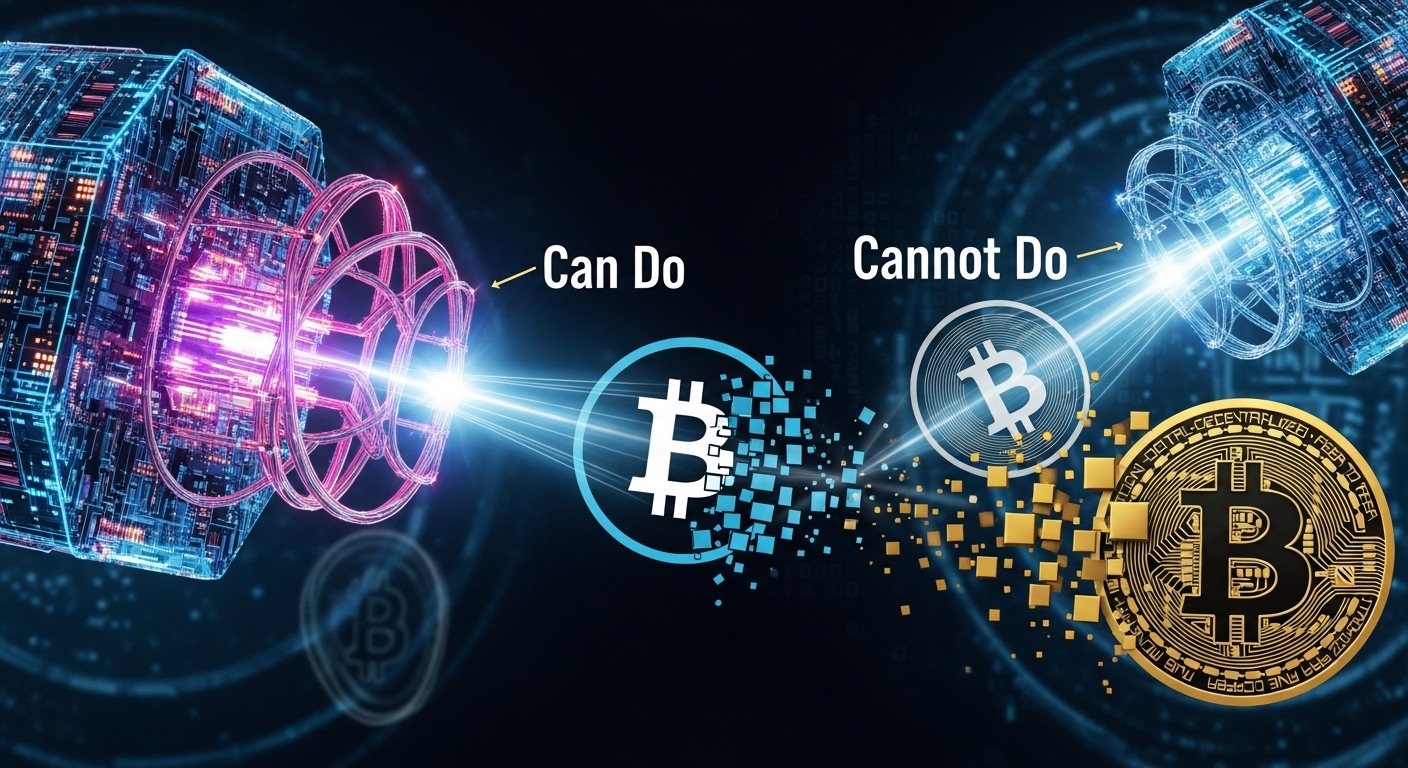

What Quantum Computers Can and Cannot Do to Bitcoin

Quantum computing changes how certain mathematical problems are solved, but it does not grant unlimited power over Bitcoin. CoinShares highlights that many fears stem from misunderstanding which cryptographic components are actually affected.

Quantum Threats to Digital Signatures

Bitcoin relies on elliptic curve cryptography to authorize transactions. A sufficiently powerful quantum computer running Shor’s algorithm could theoretically derive private keys from exposed public keys. This would allow an attacker to forge transaction signatures and spend coins they do not own. However, this threat only applies when public keys are visible on the blockchain long enough for such calculations to occur. That distinction dramatically limits the real-world attack surface.

Hashing and Mining Remain Largely Secure

Bitcoin’s hashing functions are used for mining and for obscuring public keys in many address types. Quantum algorithms can reduce the effective strength of hash functions, but not to a degree that makes brute-force attacks practical with foreseeable technology. Mining difficulty adjusts automatically, meaning quantum-assisted mining would not break Bitcoin’s consensus rules.

What Quantum Computers Cannot Break

Quantum computers cannot alter Bitcoin’s 21 million supply cap, create coins from nothing, or bypass consensus rules. Bitcoin’s monetary policy and transaction validation remain intact even in a quantum future. The concern is theft from certain address types, not systemic failure.

Why Some Bitcoin Addresses Are More Exposed Than Others

Not all Bitcoin addresses are created equal when it comes to quantum risk. The level of exposure depends largely on whether the public key is visible on-chain.

Modern Address Types and Public Key Protection

Most commonly used Bitcoin address formats hide the public key behind a cryptographic hash. The public key is only revealed when coins are spent. This limits the time window during which a quantum attacker could attempt to derive the private key, making attacks significantly harder.

Legacy Pay-to-Public-Key Outputs

The primary long-term exposure identified by CoinShares comes from early Bitcoin outputs that directly embed public keys on the blockchain. These legacy outputs were common in Bitcoin’s earliest years and still hold a noticeable amount of Bitcoin. While these outputs represent a non-trivial portion of supply, CoinShares stresses that only a small fraction is concentrated enough to pose immediate market risk. This is where the 10,200 Bitcoin figure becomes relevant.

Address Reuse and Overstated Risk Estimates

Some claims suggest that up to 25% of Bitcoin is quantum-vulnerable due to address reuse. CoinShares argues these estimates conflate avoidable practices with structural vulnerabilities. Address reuse can be mitigated through better wallet behavior and software updates, giving the ecosystem ample time to adapt.

How Close Are We to a Real Quantum Attack?

One of the most important points in the CoinShares analysis is timeline realism. Theoretical capability does not equal imminent danger.

Breaking Bitcoin’s elliptic curve cryptography within practical time limits would require millions of fault-tolerant qubits. Current quantum machines operate at vastly smaller scales and lack the stability required for such attacks. The engineering challenges involved are enormous and unlikely to be resolved suddenly.

Physical Qubits vs Logical Qubits

Raw qubit counts are misleading. Useful quantum computation requires error-corrected logical qubits, which demand massive overhead in physical qubits and infrastructure. Scaling from today’s systems to cryptographically dangerous machines would require breakthroughs across hardware, materials science, and error correction.

Why Early Preparation Still Matters

Even though the threat is not imminent, cryptographic transitions take time. Planning early allows Bitcoin to upgrade methodically rather than react in crisis mode. CoinShares frames quantum risk as a long-term engineering challenge, not an emergency.

What a Quantum-Resistant Bitcoin Could Look Like

Preparing Bitcoin for a post-quantum world does not require radical redesign. The solution lies in upgrading signature schemes.

Post-Quantum Cryptography Is Already Advancing

Globally, cryptographers are developing and standardizing quantum-resistant algorithms. These advances provide Bitcoin developers with a growing toolkit of well-studied options that could eventually replace or supplement existing signature systems.

Bitcoin Can Upgrade Without Breaking Consensus

Bitcoin has successfully upgraded before through carefully coordinated changes. Introducing quantum-resistant address types would allow users to migrate funds gradually, preserving backward compatibility and minimizing disruption.

Social Coordination Is the Real Challenge

The hardest part of any cryptographic transition is not technical feasibility but adoption. Wallet providers, exchanges, institutions, and individual users must all move in concert. This is why early discussion and conservative implementation matter.

Why Extreme Measures Are Unnecessary

Some proposals advocate burning vulnerable coins or forcing migrations through aggressive protocol changes. CoinShares warns that such approaches risk undermining Bitcoin’s core principles, including neutrality and property rights.

Not all dormant coins are lost, and history has shown that long-inactive addresses can move unexpectedly. Allowing voluntary migration with sufficient warning preserves trust while maintaining network stability.

Practical Implications for Bitcoin Holders

For most Bitcoin users, the takeaway is reassuring. Modern wallet practices already align with quantum-resistant behavior. Avoiding address reuse, keeping software updated, and being prepared to migrate to new address formats in the future are sensible precautions.

For institutions, quantum risk should be weighed alongside more immediate concerns such as custody security, regulatory compliance, and operational resilience. CoinShares views quantum computing as a manageable, long-term consideration rather than a near-term existential threat.

Conclusion

Quantum computing is advancing, and Bitcoin will eventually need to adapt. However, CoinShares’ analysis makes it clear that the popular narrative of an imminent Bitcoin collapse is overstated. While some legacy outputs are theoretically vulnerable, only 10,200 Bitcoin is positioned in a way that could cause sudden and meaningful market disruption.

Bitcoin has time. With careful planning, responsible upgrades, and informed discussion, the network can transition to quantum-resistant cryptography without panic. The real risk is not quantum computers themselves, but misunderstanding the nature of the threat.

FAQs

Q: Does quantum computing threaten all Bitcoin?

No. Quantum computing primarily threatens certain legacy address types with exposed public keys. Most Bitcoin uses address formats that significantly reduce exposure.

Q: Why does CoinShares focus on 10,200 Bitcoin?

Because this amount represents the subset of Bitcoin that could realistically be stolen and sold quickly enough to disrupt markets, not the total theoretical exposure.

Q: Can quantum computers change Bitcoin’s supply limit?

No. Quantum computers cannot alter Bitcoin’s fixed supply cap or consensus rules.

Q: Is a quantum attack on Bitcoin imminent?

No. Current quantum technology is far from the scale required to break Bitcoin’s cryptography in real time.

Q: How can Bitcoin become quantum-resistant?

By gradually adopting post-quantum cryptographic signature schemes and allowing users to migrate funds over time through carefully designed protocol upgrades.