Crypto news, Bitcoin has slipped back toward the psychologically heavy $87,000 zone after failing to hold recent highs, reigniting the same question traders ask during every sharp pullback: is this just volatility, or is it a real bear market signal?

Price-wise, the market is clearly nervous. Bitcoin is trading around the high-$80Ks, after printing an intraday low in the mid-$86Ks, underscoring how quickly liquidity can sweep the order book when sentiment flips. But this isn’t only about a number on a chart. In crypto news cycles, $87K matters because it combines psychology (round number magnet), structure (a commonly watched area), and positioning (where leveraged traders often get punished).

At the same time, context matters. A move into the $87K range can mean very different things depending on what’s driving it. Is it risk-off macro pressure? ETF flow dynamics? A cascade of liquidations? Or simply a reset after a crowded long trade? The truth is that Bitcoin rarely moves for one reason—especially when headlines, leverage, and liquidity are all interacting in real time.

This crypto news article breaks down what the dip to $87K may (and may not) be signaling. We’ll look at technical structure, sentiment, and macro catalysts; explain how traders interpret a pullback like this; and outline realistic scenarios that can help you think clearly when the chart feels loud.

The market snapshot: what “Bitcoin slips back to $87K” really means

In crypto news, the phrase “Bitcoin slips back to $87K” can sound like a simple step down. In practice, it’s often a volatility event. When price loses a key area, the next minutes or hours can bring fast moves driven by automated risk systems, forced selling, and thinner liquidity than most people expect from a trillion-dollar asset.

Recent reporting described Bitcoin pulling back below roughly $87.5K and “giving up” early-year gains, reflecting a broader shift toward caution as macro headlines hit risk assets. Another report highlighted how moves below widely watched thresholds can trigger liquidations and fast selloffs, amplifying the drop beyond what spot selling alone might cause.

From a market-structure perspective, this is why crypto news watchers treat the $87K zone like a decision point. If price reclaims and holds above it, the dip may end up looking like a shakeout. If price repeatedly fails at that level and sellers defend it, the market starts to behave like a downtrend.

In other words, $87K is less a “destination” and more a stress test: a place where the market reveals whether it still has bull-market demand or whether rallies are being sold.

Is this a bear market signal or a normal pullback?

The honest answer—especially in crypto news—is that it depends on follow-through. One dip does not define a bear market. But certain characteristics, when they cluster together, can turn “healthy correction” into “trend damage.”

How traders define a bear market signal

A true bear market signal typically shows up as a pattern, not a moment. Traders usually look for:

Sustained lower highs and lower lows, repeated failed rebounds, and fading volume on rallies. They also watch whether previously reliable support levels flip into resistance. When that happens, the market narrative changes from “buying dips” to “selling rips.”

This is why crypto news headlines can feel dramatic while the chart is still undecided. The signal isn’t the wick below $87K. The signal is what Bitcoin does after it slips—does it bounce and build, or bounce and fail?

When a pullback can be bullish

Paradoxically, some of the strongest bull markets include violent pullbacks. Bitcoin can fall hard, reset leverage, cool overheating sentiment, and then trend higher once weak hands are cleared.

So in crypto news terms, the constructive interpretation of $87K is: the market flushed excess leverage, found willing buyers, and is now rebuilding a base.

When a pullback turns bearish

The bearish interpretation is: demand is drying up, rallies are being distributed into, and every bounce becomes a chance for trapped buyers to exit.

A “bear signal” strengthens if Bitcoin can’t reclaim prior breakdown levels, and if broader conditions (rates, dollar strength, geopolitics, equities) remain risk-off.

Why Bitcoin dropped: catalysts that commonly push BTC into the $87K zone

Every crypto news drawdown looks unique, but the mechanics repeat. Here are the most common forces behind a slip into a major level like $87K, and why they matter.

Risk-off macro mood and headline shock

Bitcoin still trades like a high-volatility risk asset during stress events. When markets suddenly prefer safety, capital often moves toward cash-like instruments, the U.S. dollar, or gold, while high-beta exposures get trimmed. Some reporting around the recent move linked the drop to a broader risk-off shift and geopolitical tension, which can hit crypto sentiment quickly.

In crypto news, macro isn’t a background story anymore—it’s often the main driver of the day.

Leverage unwinds and liquidation cascades

A dip to $87K can be exaggerated by derivatives positioning. If too many traders are long with tight liquidation thresholds, a small decline can trigger forced selling, which pushes price lower, which triggers more forced selling. That’s how the market can slide thousands of dollars fast without “new” fundamental information.

This is why seasoned crypto news readers watch open interest, funding rates, and liquidation data alongside the spot chart.

Spot Bitcoin ETF flows and “institutional temperature”

ETF flow data has become one of the most discussed crypto news indicators because it can reflect institutional risk appetite. When ETFs see meaningful outflows, it doesn’t automatically mean “institutions are bearish,” but it can signal that marginal demand is cooling.

Recent coverage noted notable early-year outflows, which can add to short-term pressure when combined with weak risk sentiment. In a fragile tape, outflows can matter less for their absolute size and more for how traders interpret them: confirmation that buyers are stepping back.

Technical analysis: what the $87K level represents on the chart

In crypto news, technical analysis is often mocked—until price hits an obvious level and the whole market reacts like it was scripted. The reason is simple: charts reflect human behavior, and humans cluster decisions around the same numbers.

Support, resistance, and the psychology of round numbers

$87,000 is a psychological marker as much as a technical one. Round numbers attract attention, limit orders, and stop placement. When Bitcoin slips to $87K, it’s not only about “value”—it’s about where traders chose to place risk.

If Bitcoin holds above that zone and starts printing higher lows, the market may treat it as a defended support level. If it breaks, rebounds, and then fails beneath it, the level can flip into resistance—often a classic bear market signal in technical terms.

Trend structure: what matters more than one candle

A single wick into $87K can be noise. Structure is the signal.

In practical crypto news trading language, many participants look for a reclaim: Bitcoin pushes above the breakdown point, holds it for multiple sessions, and begins building a base. Without that, bounces can become short-lived relief rallies.

Volatility compression versus trend breakdown

Sometimes Bitcoin moves sideways, then breaks down into $87K as part of a volatility expansion. Other times, it grinds down in a controlled trend. The first scenario can reverse quickly; the second often implies distribution and weaker demand.

So the key crypto news question is not “Did it touch $87K?” It’s “Did the market accept prices below $87K?”

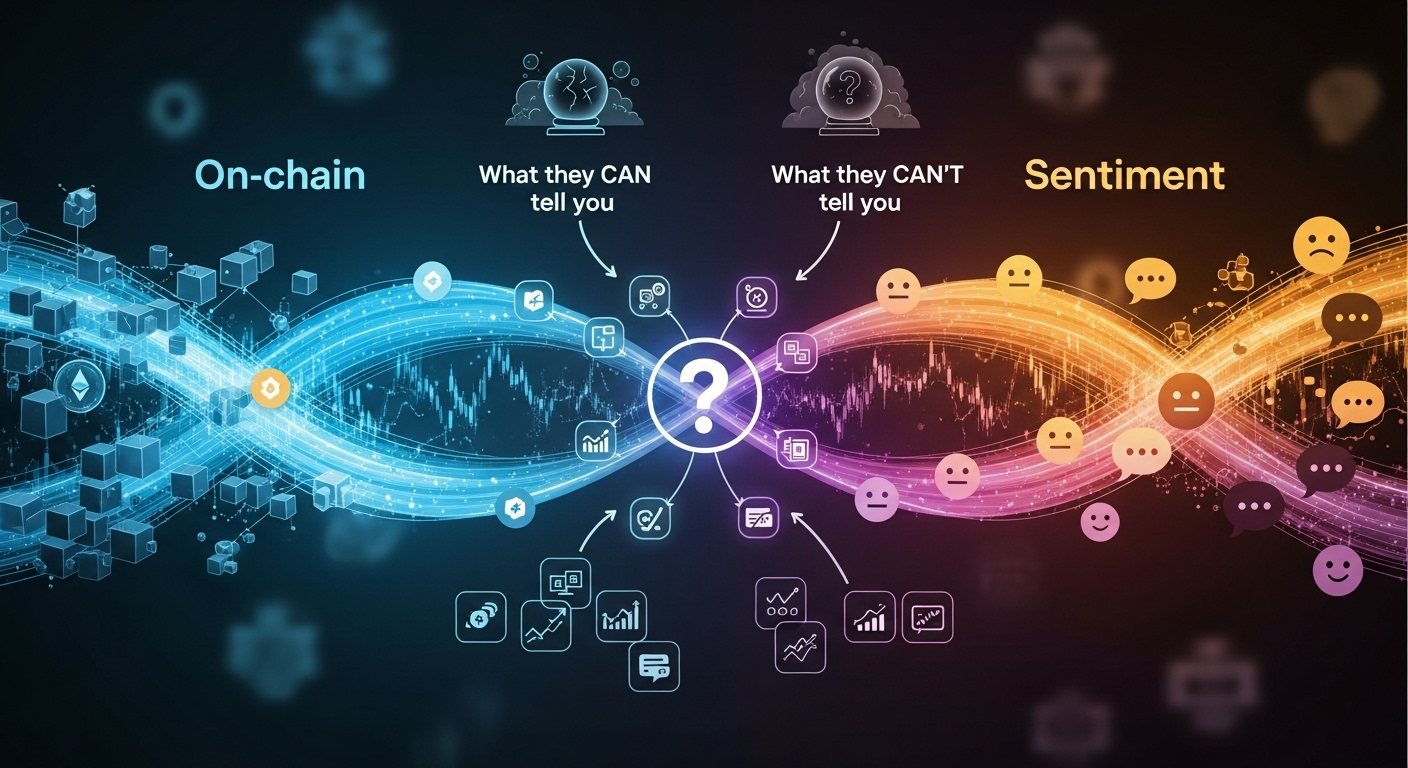

On-chain and sentiment signals: what they can (and can’t) tell you

On-chain metrics are a staple of crypto news, but they’re often misunderstood. They can provide context about holder behavior and network flows, yet they rarely produce clean “buy” or “sell” answers on a short timeline.

Long-term holders versus short-term panic

One useful lens is whether long-term holders appear to be distributing aggressively or whether the selling is mostly short-term traders rotating out. In many selloffs, the loudest selling comes from leveraged participants and short-term holders reacting emotionally.

When Bitcoin slips to $87K, a key question becomes: is this capitulation, or is it a temporary leverage reset?

Sentiment indicators and the contrarian trap

Sentiment gauges can help frame risk, but they’re not a magic bottom finder. In crypto news, extreme fear can precede strong bounces, but fear can also persist for weeks in a real downtrend.

So rather than treating sentiment as a timing tool, it’s often better used as a context tool: if sentiment is washed out and price stabilizes at $87K, odds of a bounce improve. If sentiment is washed out and price keeps making new lows, the market may be transitioning into a deeper bearish phase.

Macro drivers to watch next: rates, liquidity, and policy narratives

If you follow crypto news closely, you’ve probably noticed Bitcoin’s sensitivity to global liquidity and policy expectations. Even when crypto has strong internal narratives, macro conditions can overpower them in the short run.

Interest rates and the cost of risk

Higher rates tend to reduce the attractiveness of speculative risk because the “risk-free” alternative becomes more appealing. When capital can earn decent yield elsewhere, it’s harder for Bitcoin to attract fresh marginal buyers during uncertainty.

If rates remain restrictive or if markets reprice future cuts, it can keep pressure on BTC—making the $87K retest feel heavier.

Dollar strength and cross-asset correlations

Bitcoin often shows changing correlation regimes with equities, tech, and the dollar. In risk-off moments, correlation can spike, making crypto trade more like a leveraged expression of broader sentiment.

That’s why crypto news investors track not only BTC charts, but also equity volatility and dollar moves.

Regulation headlines and institutional posture

Regulation and institutional adoption don’t move price every day, but they shape the backdrop that decides whether dips are bought confidently or defensively. If the market perceives improving clarity and steady institutional engagement, $87K can attract buyers. If uncertainty rises, buyers can hesitate.

Scenarios: what could happen next after Bitcoin slips back to $87K

Because crypto news can feel chaotic, scenario thinking helps. No one needs a perfect prediction—you need a map.

Scenario 1: The $87K bounce holds and Bitcoin rebuilds

In this scenario, Bitcoin dips into the $87K zone, finds demand, and reclaims nearby resistance levels. Volatility cools, and spot buying gradually returns. ETF flows stabilize, and the market narrative shifts from “bear signal” to “shakeout.”

This outcome often features choppy action first, because rebuilding trust takes time.

Scenario 2: Relief rally, then failure (classic bull trap)

Here, Bitcoin bounces sharply—often driven by short covering—then runs into heavy sell pressure. The market can look “saved” briefly, but the rebound fails, confirming the level flip. In crypto news language, this is where a dip starts acting like a broader downtrend.

Scenario 3: Breakdown and deeper drawdown

If $87K fails cleanly and price accepts below it, the market may search for the next major demand pocket. This can happen quickly if leverage is high and liquidity is thin.

Even then, it doesn’t guarantee a multi-year bear market, but it does increase the odds of a prolonged correction phase.

What this means for altcoins and the broader crypto market

Whenever crypto news turns bearish on Bitcoin, altcoins typically feel it more. That’s because many alts are higher beta and rely on risk appetite. If Bitcoin can’t hold key levels, capital tends to consolidate into perceived safety within crypto—often BTC itself, stablecoins, or large-cap majors.

If Bitcoin stabilizes after slipping to $87K, some altcoins may recover sharply. If Bitcoin trends down, altcoin strength usually becomes selective, narrative-driven, and less forgiving.

How to approach the market during this kind of crypto news volatility

During high-volatility crypto news weeks, the biggest edge is often psychological. When price is whipping around major levels like $87K, the market punishes impulsive decisions.

A practical approach is to define what would change your mind. If you’re bullish, what reclaim would confirm it? If you’re cautious, what breakdown would prove the market is weaker than expected? The goal isn’t to predict every candle—it’s to avoid getting emotionally dragged by them.

And regardless of your stance, respect the idea that Bitcoin can stay volatile longer than most people can stay patient.

Conclusion

This crypto news moment—Bitcoin slipping back to $87K—doesn’t automatically confirm a bear market, but it does raise the stakes. The $87K zone matters because it’s where psychology, structure, and positioning collide. Whether it becomes a bear market signal depends less on the dip itself and more on what happens next: does Bitcoin reclaim and hold key levels, or does it fail repeatedly and confirm a trend shift?

Right now, the market is balancing macro uncertainty, leverage dynamics, and evolving institutional flow narratives. If you want the cleanest read, watch acceptance: how Bitcoin behaves around $87K over multiple sessions, not minutes. In crypto news, the loudest candles get the headlines—but the follow-through writes the story.

FAQs

Q: Is Bitcoin at $87K automatically a bear market signal?

Not by itself. In crypto news, a single drop to $87K is a data point, not a verdict. A stronger bear market signal usually requires follow-through: repeated failures to reclaim key levels and a sustained pattern of lower highs and lower lows.

Q: Why does the $87K level matter so much?

$87K combines a psychological round-number effect with a widely watched market-structure area. When Bitcoin slips to $87K, it often becomes a battlefield where buyers try to defend support and sellers try to flip it into resistance.

Q: Can ETF outflows push Bitcoin lower from here?

ETF flows can influence short-term sentiment and marginal demand. Recent coverage highlighted meaningful outflows early in 2026, which can add pressure if risk appetite is already weak. (Yahoo Finance) Still, flows are one factor among many in crypto news—they matter most when they align with broader risk-off momentum.

Q: What should I watch to tell if the dip is just a shakeout?

In crypto news terms, look for stabilization and a reclaim: Bitcoin holds above $87K, prints higher lows, and breaks back above nearby resistance with improving market breadth. If bounces fail quickly and sellers keep control, the pullback may be turning into trend damage.

Q: Do altcoins usually recover if Bitcoin bounces from $87K?

Often, yes—but not always evenly. If Bitcoin stabilizes after slipping to $87K, risk appetite can return and lift majors and selected narratives. If Bitcoin remains weak, altcoins typically underperform and volatility increases across the board.